The right prop trading firms in the USA can transform your trading journey from managing small accounts to accessing serious capital, regardless of your experience level.

Top prop firms today open doors to incredible opportunities.

You can manage up to $600,000 in trading capital and earn 100% profit splits on your first $25,000.

The options have never been better – from futures prop firms with instant payouts to platforms that give you access to over 12,000 stocks and ETFs.

We looked closely at and tested the best prop firms USA to create this curated list.

Our review focused on capital access, profit splits, trading conditions, and a firm’s reliability for US traders.

Here are eight prop trading firms that stand behind their promises in 2025.

MyFundedFX: Best All-Round Prop Firm for Forex, Indices, Commodities, and Crypto

MyFundedFX is a proprietary trading firm based in Houston, Texas.

It allows traders to access funded accounts and trade various instruments, including Forex, indices, commodities, and cryptocurrencies.

With a flexible evaluation process and competitive profit splits, MyFundedFX has become a preferred choice for many traders globally.

Trading Rules and Requirements

MyFundedFX presents traders with three evaluation programs designed to suit different trading styles and risk tolerances:

- One-Step Challenge: Achieve a 10% profit target with a 6% trailing maximum drawdown and a 4% daily drawdown limit.

- Two-Step Challenge:

- Phase 1: Reach an 8% profit target.

- Phase 2: Achieve a 5% profit target.

Drawdown Limits: 5% daily and 8% maximum drawdown in both phases.

- Three-Step Challenge: Each phase requires a 6% profit target, with a 4% daily drawdown limit and 8% maximum drawdown.

No Time Limits – A standout feature is that traders can complete evaluations at their own pace, reducing the pressure to rush trades.

Flexible Trading Styles – MyFundedFX allows scalping, swing trading, hedging, and holding positions overnight and over weekends, enabling traders to apply their preferred strategies.

Profit Split Structure

The profit distribution model is highly competitive:

| Profit Range | Trader’s Share |

|---|---|

| Base Rate | 80% |

| Upgraded Rate | 90% (with 20% extra fee on challenge cost) |

| First $25,000 (once funded) | 100% |

Traders can request payouts every 5 to 14 days, with bank transfers and cryptocurrency options available, ensuring fast and convenient withdrawals.

Scaling Opportunities

MyFundedFX offers impressive scaling opportunities, with account sizes ranging from $5,000 to $200,000 and the potential to scale up to $1 million based on consistent performance.

Additionally, traders can manage multiple accounts simultaneously, allowing for strategy diversification and increased profit potential.

The firm’s emphasis on long-term growth and flexibility and the absence of time pressure during evaluations make it an ideal choice for traders aiming to scale their trading careers.

Overall, MyFundedFX stands out for its trader-focused approach.

It combines lenient rules, a rewarding profit split structure, and scalability, making it a top choice for traders seeking reliable funding and growth potential.

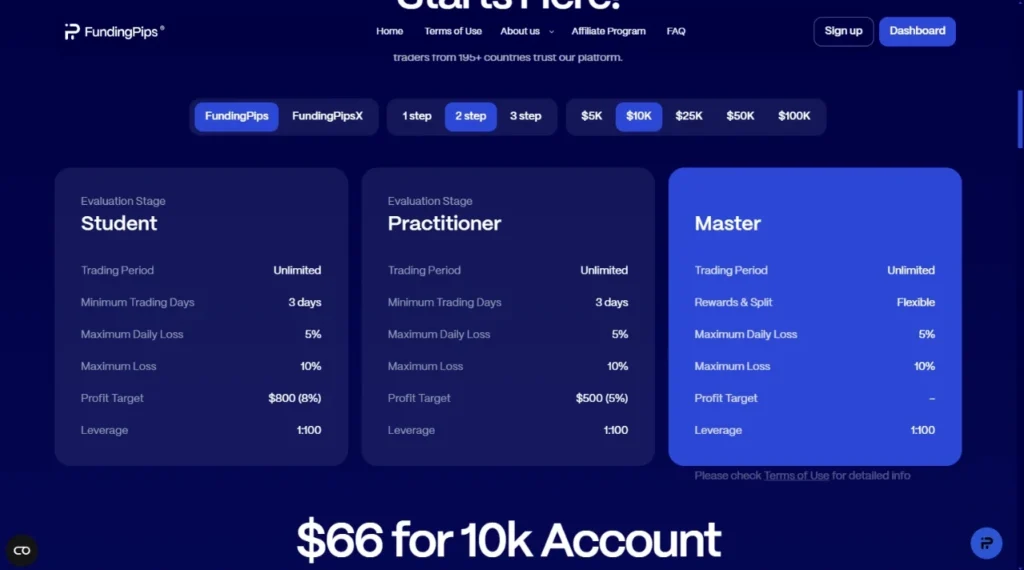

Funding Pips: Best Prop Firm for Customizable Challenges and High Profit Splits

Funding Pips is a US-based proprietary trading firm providing traders access to funded accounts upon completing an evaluation process.

Known for its flexible evaluation options and profit split potential, it is a growing choice among traders seeking funding.

Trading Rules and Requirements

Funding Pips offers three evaluation models to accommodate different trading styles and risk preferences:

- One-Step Evaluation: This requires a 12% profit target, a 4% daily loss limit, and a 6% maximum drawdown.

- Two-Step Evaluation: Phase 1 requires an 8% profit target, and Phase 2 requires a 5% profit target. Both phases enforce a 5% daily loss limit and a 10% maximum drawdown.

- Three-Step Evaluation: Each phase mandates a 5% profit target, a 4% daily loss limit, and a 6% maximum drawdown.

A key advantage is that there are no time limits for completing any phase, allowing traders to progress at their own pace.

The firm supports all trading styles, including scalping, swing, and day trading, and permits holding positions overnight and over weekends.

Profit Split Structure

The profit distribution model comes with competitive terms:

| Profit Range | Trader’s Share |

|---|---|

| Base Rate | 80% |

| Performance-Based Increase | Up to 90% |

Payout requests are processed biweekly, and traders can receive their earnings through multiple payment methods, including bank transfers and cryptocurrency.

Scaling Opportunities

Funding Pips allows traders to scale their accounts based on consistent profitability.

As traders demonstrate strong performance, their account size can grow, unlocking larger capital allocations and increasing earning potential.

This structure encourages disciplined risk management while rewarding traders for consistency.

Additionally, Funding Pips supports the management of multiple accounts, enabling traders to diversify strategies and manage different portfolios simultaneously.

This flexibility aligns well with the firm’s trader-first philosophy, empowering skilled individuals to maximize their potential.

Funding Pips is a robust choice for traders seeking a proprietary trading firm with clear rules, a high-profit split structure, and ample scaling opportunities.

Its flexible evaluation process and trader-friendly conditions make it especially appealing to those pursuing long-term growth in the trading world.

Apex Trader Funding: Best Futures Prop Firm for US Traders

Apex Trader Funding, a two-year-old futures funding evaluation firm based in Austin, Texas, has become an industry leader.

The company serves a global community spanning over 150 countries and focuses on trading futures.

Apex Trader Funding Platform Features

The platform excels with its detailed trading infrastructure. Traders can access NinjaTrader and TradingView platforms, which were integrated at no extra cost, with immediate data inclusion.

The platform lets you trade 23 hours a day, from 6 PM ET to 4:59 PM ET, including holidays and during news events.

Trading Rules and Requirements

A simple one-step approach guides the evaluation process.

Traders must hit their profit target within seven trading days before reaching the maximum drawdown.

The platform then uses a trailing threshold system that removes daily drawdown concerns.

Trading rules create a balanced risk management system:

- Maximum 5:1 risk-to-reward ratio for all trades

- 30% negative P&L rule on open trades

- Consistent contract sizing requirements

Profit Split Structure

The profit distribution model comes with attractive terms:

| Profit Range | Trader’s Share |

|---|---|

| First $25,000 | 100% |

| Beyond $25,000 | 90% |

Traders can ask for payouts every eight trading days when at least five of those days show a minimum profit of $50.

Payout approvals take about 2 business days, and fund transfers follow within 3-4 business days.

Scaling Opportunities

A strategic scaling program promotes disciplined growth.

Traders use half of their maximum contracts until they reach the trailing threshold.

For instance, a $50,000 account that allows 10 contracts has traders begin with five contracts until the account balance grows beyond $52,600.

The platform also gives you the flexibility to manage multiple accounts—you can run up to 20 accounts at once.

This feature, along with the ability to reset evaluation accounts unlimited times for $80 per reset, creates many opportunities for growth and risk management.

MyFundedFutures: Top Choice for Undercapitalized Traders

“At MyFundedFutures (MFFU), we pride ourselves on offering a diverse range of evaluations tailored to meet the unique needs and aspirations of every trader.” — MyFundedFutures, Prop trading firm

MyFundedFutures stands out in the prop trading world with its low-cost funded accounts and flexible trading conditions.

The US-based prop firm led by CEO Matthew Leech provides account sizes from $50,000 to $150,000.

Account Types and Pricing

The platform offers three distinct account categories:

| Account Type | Monthly Fee | Profit Target | Max Drawdown |

|---|---|---|---|

| Starter Plus | $267 | $6,000 | $3,000 |

| Expert | $344 | $8,000 | $3,000 |

| Milestone | $555 (one-time) | $6,000 | $3,000 |

Expert accounts are perfect for seasoned traders and offer added flexibility.

They have no consistency rules or activation fees, and traders can run up to ten funded accounts simultaneously.

MyFundedFutures Evaluation Process

The platform uses a simple one-step verification process.

Traders can finish their evaluation in just one day since there’s no minimum trading day requirement. Each account size has its own profit target:

- $3,000 for $50,000 accounts

- $6,000 for $100,000 accounts

- $9,000 for $150,000 accounts

Successful traders get access to simulated funds and can take out their profits every two weeks.

Risk Management Rules

The firm takes a different approach to risk management.

Instead of daily loss limits, it uses a maximum trailing End of Day (EOD) drawdown.

After hitting the drawdown percentage plus $100 in profit, the drawdown locks at the original balance plus $100.

Contract size limits scale with account size. Expert accounts allow:

- 5 contracts for $50,000 accounts

- 10 contracts for $100,000 accounts

- 15 contracts for $150,000 accounts

Profits from a single trading day must not exceed 40% of the total overall profit.

Traders can use several platforms, with NinjaTrader, Tradovate, and TradingView being the main options.

Trade the Pool: Leading Stock Trading Prop Firm

The platform gives traders access to over 12,000 stocks and ETFs, making it an excellent choice for those seeking substantial capital.

Trade the Pool’s Unique Features

The platform stands out with its single-phase evaluation model instead of traditional multi-step processes.

Traders need to complete 50 trades within 30 days to qualify for funding.

The evaluation accounts mirror actual market conditions with up-to-the-minute data feed from NASDAQ, NYSE, and CBOE.

Available Trading Instruments

Traders can access more than 12,000 stocks and ETFs on U.S. markets.

The platform supports penny stock trading and pre/after market hours operations.

A 100-day trading period allows both day trading and overnight position holding.

Profit Sharing Model

The platform has three funding programs with different profit splits:

| Program Type | Profit Split | Daily Loss Limit |

|---|---|---|

| Super BP | 60/40 | $700 |

| Extra BP | 70/30 | $1,300 |

| Ultimate BP | 80/20 | $2,000 |

Traders can take out profits every 14 days.

They must maintain three profitable days with 0.5% profit on buying power.

Technology Stack and Tools

The platform runs on TraderEvolution, a professional trading platform that comes with:

- Scalping windows for quick trades

- Advanced market depth analysis

- Super DOM functionality

- Integrated scanners

Educational Resources

Trade The Pool helps traders grow through solid educational support.

Members get:

- Free access to premium tools like Trade Ideas or TrendSpider

- Detailed trading guides and documentation

- Video format FAQs and stock terminology tutorials

- Active Discord community for peer learning

Risk management is at the core of the platform’s approach.

Traders cannot exceed 30% of their daily loss allowance per trade.

This means traders with a $700 daily loss limit can trade up to $210 per click, which ensures disciplined position sizing.

Day Traders: Fastest Payouts for US Traders

We focused on speed and efficiency when Day Traders changed the prop trading world through its founders’ technology development experience with major futures funding companies.

The platform uses an Automated Payout System that processes withdrawals within seconds.

Account Options and Costs

A Pattern Day Trader (PDT) rule requires traders to maintain a minimum balance of $25,000.

Traders need to keep their risk at 1% of their account balance per trade.

The platform’s fee structure has:

| Fee Type | Amount |

|---|---|

| Account Management | $500/month |

| Platform Access | $100/month |

| Market Data | $50-$200/month |

Trading Platform Features

The trading infrastructure runs 23 hours daily, from 6 PM ET to 4:59 PM ET, and has complete capabilities. The platform stands out with:

- Trade execution at 0.0107-second speed

- Deep internal liquidity for quick position management

- Advanced charting features with live market data

Payout Structure and Speed

Day Traders sets itself apart with its game-changing payment structure.

Independent traders earn between $39,500 and $269,500 annually, and prop traders make $47,600 to $151,364. The platform provides:

- Automated approval system for instant payout processing

- Bi-weekly withdrawal options

- Profit splits ranging from 50% to 90% based on performance

Risk Parameters

The platform enforces strict risk management protocols. Traders must follow:

- Maximum position sizing of 2% per trade

- Stop-loss orders for capital protection

- Daily loss limits and overall exposure restrictions

- Margin trading requirements with careful leverage management

The platform balances quick profit access with responsible trading practices.

The core team and automated systems work together to process payouts quickly, even during high market volatility.

For Traders: Best for Beginner US Traders

For Traders is an evaluation and education firm built for beginners.

Through its simulated trading platform, traders can manage up to $300,000 in virtual capital.

Evaluation Process Overview

A well-laid-out two-step challenge evaluation process guides traders.

The first phase needs traders to achieve a minimum of three profitable days with at least 0.5% profit each day.

Successful traders move to the second phase, which has similar profit requirements but different leverage ratios.

Trading Conditions

For Traders gives flexible trading parameters in multiple assets:

| Trading Stage | Forex Leverage | Indices Leverage | Commodities Leverage |

|---|---|---|---|

| Challenge Phases | 1:125 | 1:20 | 1:40 |

| Master Account | 1:40 | 1:10 | 1:10 |

Traders can choose from three distinct trading platforms:

- cTrader

- TradeLocker

- DXtrade

The firm has strict risk management rules.

Traders need to show consistent performance through safe trading.

No single or multiple trades on the same symbol can exceed 70% of the profit target.

Support and Education

For Traders stands out with its educational support through:

- Free video courses

- Complete e-books

- Trading tutorials

A 24/5 customer support team helps traders quickly with any questions. The platform builds a strong community through:

- Trader meetups

- Trading tournaments

- Community events

Successful traders earn an 80% profit split.

Weekend trading and news event participation are allowed with adjusted leverage requirements to control risk.

Trading accounts stay active when there’s meaningful trading activity within 30 days.

BrightFunded: Best for Mult

BrightFunded operates from the Netherlands and lets traders manage capital up to $400,000.

The company stands out with its trading platform and wide selection of trading instruments.

Available Markets and Instruments

Traders can access more than 150 trading instruments through BrightFunded. The platform shines with its cryptocurrency selection of over 35 pairs. These include popular coins like Bitcoin and Ethereum and newer assets like Arbitrum and Injective. Traders can build diverse portfolios with:

- Major, minor, and exotic forex pairs with leverage up to 1:100

- Global indices with 1:20 leverage

- Commodities, including metals and agricultural product,s with 1:40 leverage

Platform Features

BrightFunded’s trading platform works on both desktop and mobile devices. This sets it apart from companies that use MT4 or MT5. The platform offers these key features:

| Feature | Benefit |

|---|---|

| Live Data Feed | Accurate market information |

| Custom Interface | Tailored trading experience |

| Multi-device Support | Trading flexibility |

Profit Split and Scaling

The platform has a smart way to help traders grow. After four months of trading, accounts can grow by 30% of their original size.

Traders need to meet these goals:

- Show profit in two out of four months

- Make at least 10% total profit

- Complete two successful payouts

The profit split starts at 80/20 and can reach 100/0 after the third scale-up. Traders can get their money every 14 days, with weekly withdrawals available as an add-on feature.

Trade2Earn Loyalty Program

Trade2Earn rewards both winning and losing trades. Traders earn BrightFunded Tokens based on their trading volume. These tokens can get you:

- Free evaluation accounts

- Better profit splits up to 90%

- Lower profit targets

- Higher drawdown limits

US Trader Requirements

US traders must follow these rules:

- Daily losses cannot exceed 5% of the starting balance

- The total drawdown limit is 10%

- Must trade for at least five days during evaluation

- Need 8% profit for the Challenge phase and 5% for Verification

However, traders face no limits on maximum trading days and can use various payment methods, including crypto and bank transfers.

Most payouts are processed within 4 hours.

FXIFY: Ideal for Experienced US Traders

FXIFY burst onto the scene in 2023 and quickly became a leading prop trading firm.

The company builds on FXPIG’s 10-year brokerage expertise.

Traders can access large capital pools while they retain control of their trading style.

Account Features and Limits

Traders can start with capital allocations up to $400,000 and scale up to $4 million.

FXIFY has three evaluation programs:

| Program Type | Features | Profit Target |

|---|---|---|

| One-Phase | 10% target | 6% max loss |

| Two-Phase | 10% & 5% targets | 10% max loss |

| Three-Phase | 5% per phase | 5% max loss |

We tested the platform and found that traders need to complete at least five trading days during the evaluation.

There are no maximum time limits.

The platform supports algorithmic trading, martingale strategies, and grid trading.

Trading Platform Options

FXIFY’s strategic collaborations with top trading platforms give you access to:

- MetaTrader 4 and MetaTrader 5 for non-US traders

- DXtrade platform specifically for US-based traders

The strong infrastructure connects to over 20 bank and non-bank liquidity providers.

This ensures raw spread trading from 0.0 pips.

Traders can trade forex, indices, precious metals, and cryptocurrencies without commission.

Risk Management Tools

The platform’s complete risk management framework includes:

- Maximum daily drawdown between 3% and 5%

- Total drawdown limits ranging from 5% to 10%

- Leverage options up to 50:1 through add-on features

FXIFY’s trading dashboard is a game-changer with its advanced analytics. The system tracks live metrics for:

- Performance tracking

- Trading behavior analysis

- Pattern recognition

- Consistency monitoring

Profit Distribution

Profit-sharing starts at an 80% base rate and can reach 90%. The platform’s payout system stands out with these benefits:

- First withdrawal available after your first profitable trade

- No minimum withdrawal requirements

- Bi-weekly payout options through add-ons

- Processing time of 12-48 hours

The scaling program rewards your consistent performance. Your account size grows by 25% when you:

- Stay profitable for two out of three months

- Reach 10% average returns in this period

With consistent performance, your account balance can double every three months.

The Rise payment system processes payments in over 90 local currencies and over 100 cryptocurrencies.

Comparison Table

| Prop Firm | Specialization | Max Account Size | Profit Split | Evaluation Process | Payout Frequency | Notable Features |

|---|---|---|---|---|---|---|

| MyFundedFX | Forex, Indices, Commodities, Crypto | $1,000,000 | 80%-90% (100% on first $25,000) | 1-Step, 2-Step, 3-Step Challenges (No time limits) | Every 5-14 days | No time limit, holds overnight/weekend, scaling to $1M |

| Funding Pips | Forex, Indices, Commodities, Crypto | $400,000 | 80%-90% | 1-Step, 2-Step, 3-Step Evaluations (No time limits) | Biweekly | Flexible evaluation models, scaling, holds overnight/weekend |

| Apex Trader Funding | Futures Trading | Not mentioned | 100% first $25K, 90% beyond | One-step, 7 days | Every 8 trading days | Up-to-the-minute data included, 23-hour trading |

| MyFundedFutures | Low-cost Entry | $150,000 | Not mentioned | One-step, no minimum days | Bi-weekly | Supports 10 funded accounts at once |

| Trade the Pool | Stock Trading | Not mentioned | 60-80% | Single-phase, 50 trades in 30 days | Every 14 days | Access to 12,000+ stocks/ETFs |

| Day Traders | Quick Payouts | $25,000 minimum | 50-90% | Not mentioned | Instant automated payouts | 0.0107-second execution speed |

| For Traders | Beginner Trading | $300,000 | 80% | Two-step challenge | Not mentioned | Detailed educational resources |

| BrightFunded | Multi-Asset Trading | $400,000 | 80-100% | Not mentioned | Every 14 days | 150+ trading instruments |

| FXIFY | Experienced Trading | $400,000 (up to $4M with scaling) | 80-90% | One/Two/Three-phase options | Bi-weekly | Raw spread trading from 0.0 pips |

✅ Which is Best for You?

| Choose Futures Prop Firms if: | Choose Forex/CFDs Prop Firms if: |

|---|---|

| You prefer scalping/day trading in highly liquid markets. | You want flexibility (swing trading, holding overnight). |

| You value low evaluation fees and tight spreads. | You prefer MT4/MT5 platforms and higher leverage. |

| You can handle trailing drawdowns and fast-paced markets. | You like varied assets (indices, crypto, commodities). |

| You are comfortable with futures platforms like NinjaTrader. | You don’t want trailing drawdown pressure. |

Conclusion

The right prop trading firm can greatly impact your trading experience.

Each platform we’ve reviewed has its own strengths.

Apex Trader Funding excels in futures trading.

Trade the Pool gives broad stock market access.

FXIFY works best for experienced traders who want substantial capital.

Smart traders look beyond profit splits or account sizes.

They need to think about what they need and how they trade.

These Eight firms have shown they’re reliable. They make consistent payouts and create conditions that help traders succeed.

The prop trading world keeps changing.

Firms now compete with better terms than ever before.

You could start with MyFundedFutures’ low-cost entry or aim for BrightFunded’s $400,000 accounts.

These platforms give you a real shot at growing your trading career.

Ultimately, your success depends on picking a prop firm that fits your trading goals, risk comfort, and skill level.

Before you decide, take your time to assess each option’s rules, requirements, and support systems.

FAQs

Which prop trading firm offers the fastest payouts for US traders?

Day Traders stands out with its Automated Payout System, processing withdrawals within seconds. They offer instant automated payouts, making them one of the fastest in the industry for US traders.

What is the best prop trading firm for futures trading?

Apex Trader Funding is considered the best futures prop firm for US traders. They offer real-time data inclusion at no additional cost and support trading 23 hours a day, including holidays and during news events.

Which prop firm is most suitable for beginner traders in the US?

For Traders is designed with beginners in mind. They offer comprehensive educational resources, including free video courses, e-books, and trading tutorials. Their structured two-step challenge evaluation process also helps new traders develop their skills.

What is the maximum account size offered by these prop trading firms?

BrightFunded and FXIFY both offer initial capital allocations up to $400,000. FXIFY even provides scaling potential reaching $4 million for successful traders.

How do profit splits typically work in these prop trading firms?

Profit splits vary among firms but generally range from 60% to 100% for traders. For example, Apex Trader Funding offers 100% on the first $25,000 and 90% beyond that, while BrightFunded’s profit split starts at 80/20 and can reach 100/0 from the third scale-up onwards.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025