Resilience is the cornerstone of any successful venture, and trading is no exception. This attribute is an individual’s ability to swiftly recover from adverse situations and maintain a balanced mental state.

In trading, being resilient means facing losses, mistakes, or wrong decisions without succumbing to negative emotions, and maintaining the ability to operate with confidence and objectivity.

In this article, we will explore the importance of resilience in Forex trading and provide strategies for developing an unshakable trading mindset.

What is Trading Resilience?

Trading resilience refers to the capacity of a trader to endure and swiftly bounce back from unfavorable situations.

It is the mental toughness that enables a trader to keep their emotions in check, make rational decisions, and continue operating even amidst losses or setbacks.

Trading resilience is not something you are born with, but a skill that can be developed and strengthened over time and experience.

Like any other skill in trading, it requires practice, self-awareness, and a proactive attitude toward learning and personal growth.

The Importance of Resilience in Forex Trading

Trading, by its very nature, is teeming with highs and lows. Even the most seasoned traders face losses and challenging times.

The pressure to make quick decisions, the uncertainty of market conditions, and the risk of significant financial losses can lead to stress, anxiety, and self-doubt.

Emotions such as fear, greed, and overconfidence creep in and influence trading decisions, leading to impulsive or irrational behavior.

However, what sets successful traders apart from those who surrender is their ability to handle these situations with emotional resilience.

Making Objective Decisions

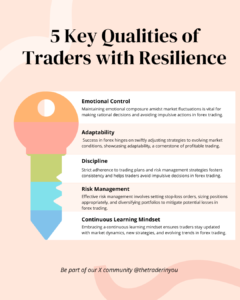

Fear or greed can cloud judgment and lead to impulsive decisions. Trading resilience helps maintain objectivity and base decisions on data and analysis rather than emotional reactions.

Handling Losses

No trader is immune to losses. The key is how they are managed. Resilience allows viewing losses as learning opportunities, not personal failures.

Maintaining Confidence

Confidence is a crucial ingredient in trading. Emotional resilience helps maintain confidence in the strategy and abilities, even after facing setbacks.

The Need for Resilience in Trading

The financial market is, more often than not, unpredictable. It’s not always possible to predict what will happen in the future. Even the best traders and investors are not accurate 100% of the time. Thus, no matter how good you are, there will be some winter periods. Hence, resilience will help you become a better trader even during adversity.

Adapting to Market Conditions

Being resilient can help you adapt to different market conditions. If you are good at making money in trending markets, resilience can help you navigate ranging markets.

Managing Expectations

While you want to make money, you must manage your expectations well. In most cases, you will have high expectations when starting your trading career. However, in most cases, your expectations will not be met because of how the market works.

Building Resilience in Trading

Building trading resilience takes time and practice. However, there are several strategies you can employ to strengthen your resilience and improve your trading performance.

Risk Management

One of the most crucial elements in building resilience is risk management, which involves reducing risks while maximizing returns.

Some key risk management strategies that one can use include not risking too much money per trade, always having a stop-loss in all your trades, not over-trading, and having a take-profit to stop your trades when it hits its profit target level.

Developing a Robust Trading Strategy

Another essential step towards building resilience in trading is to have a well-tested trading strategy that suits your style and preference. Some popular trading strategies include scalping, trend-following, swing trading, and copy-trading.

Cultivate Patience and Discipline

Patience and discipline are fundamental attributes of resilient traders. The market can be unpredictable, and impulsive decision-making can lead to poor outcomes.

Resilient traders understand the importance of waiting for high-probability setups and sticking to their trading plans, even in the face of short-term setbacks.

By cultivating patience and discipline, traders can maintain emotional stability and make better-informed decisions.

Continuous Learning

Finally, continual learning plays a pivotal role in building resilience in trading. This involves updating yourself with the latest market trends, trading strategies, and trading tools.

As the financial market is dynamic, continuous learning will help you adapt to the ever-changing market conditions and enhance your trading performance.

Practice Self-Awareness

Developing self-awareness (mindfulness) is crucial for building emotional resilience. Traders need to understand their own emotions, triggers, and patterns of behavior.

Being mindful can help traders learn to regulate themselves more effectively and make better decisions under pressure.

Develop a Routine

Establishing a structured routine can help traders maintain discipline and emotional stability.

A well-defined routine can provide stability and control in an otherwise unpredictable environment.

It can include regular exercise, mindfulness, and adequate rest to promote mental and emotional well-being.

Building a Supportive Trading Community

Trading can be a solitary profession, but seeking support from fellow traders or mentors can be invaluable for developing emotional resilience.

Connecting with like-minded individuals who have faced similar challenges can provide emotional support and valuable insights.

Additionally, seeking feedback from trusted sources can help traders identify areas for improvement and gain a fresh perspective on their trading strategies.

Connecting with other Traders and Mentors

Connecting with other traders and mentors can provide valuable social support and guidance. You can join trading groups or forums, attend trading seminars or workshops, and seek mentorship from experienced traders.

Participating in trading groups and forums

Participating in trading groups and forums can provide opportunities to share experiences, exchange ideas, and learn from other traders. You can also receive feedback on their strategies and techniques and build valuable relationships with other traders.

Learning from the experiences of successful traders

Learning from the experiences of successful traders can provide inspiration and motivation for building resilience in Forex trading. You can study the habits and strategies of successful traders and apply these principles to your trading.

Learning from Setbacks and Growing as a Trader

Failure is a natural part of the trading journey. Resilient traders understand that losses and mistakes are inevitable and view them as opportunities for growth.

Instead of dwelling on failures, they focus on learning from them and adapting their strategies accordingly.

Analyzing past failures and setbacks can help traders identify areas for improvement and develop a plan for growth and development.

Traders can use this information to refine their strategies, improve risk management practices, and build a more resilient trading mindset.

With this mindset, you can develop a plan for growth and improvement. You can set specific goals, create a timeline for achieving them, and track their progress.

Reframing failures as opportunities is a key component of building resilience in Forex trading.

By viewing failures as opportunities for improvement and development, you can maintain a positive outlook and continue to improve your performance over time.

Conclusion

Building resilience is essential for success in Forex trading. Traders who develop a growth mindset, manage their emotions effectively, and utilize technology and social support can maintain an unshakable trading mindset in the face of setbacks and market volatility.

Trading resilience is an essential skill that every trader should aim to develop. It can make the difference between success and failure in the unpredictable trading world.

So, keep practicing, learning, and enhancing your resilience, and the path to trading success will be yours to tread.