The Forex market sees a staggering $6.6 trillion in daily transactions.

You read that right – it is the largest, most liquid financial market worldwide.

But success doesn’t come easy.

Statistics show that 71% of retail traders lose money trading CFDs.

A smarter way to trade exists, whether you’re starting with forex scalping strategy or want to improve your current approach.

Picture yourself making 5 to 10 pips profit per trade and executing over 100 trades daily.

Successful scalping traders focus on quick, small profits instead of waiting for big market moves.

Want to learn a proven forex scalping strategy that works?

Let’s take a closer look at the steps, tools, and techniques you need to start scalping profitably.

What is Forex Scalping Trading

Forex scalping is a unique trading style where traders profit from small price movements by quickly opening and closing positions.

Scalpers hold their positions for seconds to minutes and execute multiple trades in a single session.

Key differences from regular trading

Forex scalping differs from conventional trading methods in several key ways:

- Trading Duration: Regular traders hold positions for days or weeks, while scalpers complete trades within seconds to minutes

- Position Management: Scalpers target 5-10 pips per trade and focus on high-frequency trades instead of waiting for bigger market moves

- Trade Volume: Scalpers make dozens to hundreds of trades daily, while traditional traders make fewer, calculated moves

- Market Analysis: We focused on technical analysis and immediate market data rather than fundamental analysis

Why Traders choose Scalping

Traders pick forex scalping because smaller price movements happen more often than larger ones.

This strategy has several advantages for certain types of traders.

The forex market’s high liquidity makes it perfect for scalping and lets traders enter and exit positions quickly.

Brief holding periods also help scalpers avoid exposure to negative market events.

Successful forex scalping needs specific trader qualities.

Scalpers must be disciplined and know how to make quick decisions.

They need sharp focus and must stay concentrated for long periods.

This strategy works well for traders who want active market involvement and quick results instead of holding long-term positions.

Notwithstanding that, scalpers need substantial starting capital to handle the leverage that makes small trades profitable.

ECN forex accounts are vital for scalping because they give traders better execution speeds and let them post orders at any price.

Traders can act more like market makers by buying at bid prices and selling at offer prices.

Essential Tools for Scalping Success

The right tools make all the difference in forex scalping strategy. Let’s explore everything you need to build strong scalping operations.

Trading platform requirements

A reliable trading platform is the life-blood of successful scalping.

MetaTrader 4 and MetaTrader 5 platforms have become the standard in the industry.

They execute trades at speeds of around 30ms.

cTrader has become prominent among scalpers because it offers specialized high-frequency trading features.

Your platform should have:

- One-click trading capability

- Drag-and-modify stop-loss functionality

- Quick position closing options

- Immediate price streaming

- Advanced charting tools

Must-have indicators

Technical analysis tools drive successful scalping.

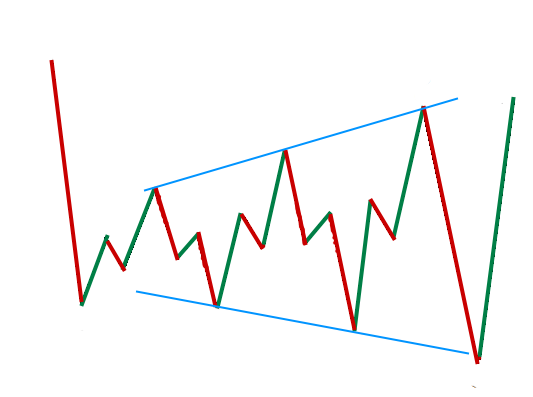

The 5-3-3 Stochastics combined with a 13-bar, 3-standard deviation Bollinger Band work best.

These tools show excellent results on two-minute charts for active currency pairs.

The Exponential Moving Average (EMA) is a vital tool.

We used different lengths to spot potential trading opportunities.

A bullish trend appears when the fast EMA crosses above the slow EMA.

The market turns bearish when the fast EMA crosses below.

Internet and hardware setup

Your technical infrastructure can make or break your scalping success.

You just need 40 Mbps internet speed at minimum, though 100 Mbps gives the best results.

The ping rate should stay under fifty milliseconds to ensure quick data transmission.

Wired Ethernet connections are nowhere near as unstable as wireless options.

This setup reduces latency issues and keeps you connected during important trades.

Your hardware setup needs careful planning.

A trading computer should process data quick and run multiple monitors without lag.

Without doubt, a backup internet source like a high-quality mobile hotspot gives you the redundancy you need for non-stop trading.

Regular internet speed tests and updated hardware components help avoid technical problems.

A mix of resilient hardware, stable internet, and the right trading platform creates perfect conditions for successful scalping.

Choosing the Right Currency Pairs

Choosing the right currency pairs is the foundation of a winning forex scalping strategy.

Your choice of pairs will affect your potential profits and trading costs.

Most profitable pairs for scalping

Major currency pairs are your best bet for scalping because they have the highest liquidity and tightest spreads.

EUR/USD tops the list and makes up over 20% of all forex transactions each day.

USD/JPY and GBP/USD are also top picks for scalpers.

You’ll get the best results by focusing on these currency categories:

- Major pairs (EUR/USD, GBP/USD, USD/JPY)

- Minor pairs (EUR/JPY, GBP/JPY, EUR/GBP)

- Cross pairs (EUR/GBP, EUR/JPY)

Yes, it is true that major pairs give you steady trading conditions throughout market hours.

These pairs keep stable spreads whatever the market volatility, which makes them perfect for scalping operations.

Understanding spread impact

The spread between buy and sell prices can really affect your scalping profits.

Each currency pair has either a wide or narrow spread, and the most traded pairs usually give you tighter spreads.

Your trade becomes profitable only when price moves more than the spread size.

This is why scalpers should pick pairs with the smallest spreads to boost profit potential.

Take EUR/USD with a 3-pip spread – you’ll need at least a 3-pip favorable move before you see any profits.

Spread costs add up faster in scalping operations.

Even tiny spreads can be a big deal as they affect your profits when you make lots of trades.

Wider spreads need bigger price moves just to break even, which might cut down your chances of successful trades.

Market conditions shape how spreads behave.

We noticed that during high-volatility periods, spreads often widen as market makers adjust to higher risks.

Trading during peak market hours helps you get better spreads thanks to increased liquidity.

The spread percentage shows you how efficient your trading costs are – just divide the spread by the daily average range.

Lower percentages mean lower costs and possibly higher profits.

This number helps a lot when you’re comparing different currency pairs for scalping.

Best Times to Scalp Forex

Timing is a vital part of a successful forex scalping strategy.

The 24-hour forex market cycle has specific periods that work better for scalpers.

Peak trading hours

The market reaches peak activity between 8:00 AM and 12:00 PM EST.

Major financial centers operate at the same time during this window.

The New York session brings substantial market movement, representing about 17% of the total daily forex trading volume.

Prime Trading Windows:

- 7:00-8:00 AM EST: European markets show choppy conditions

- 8:00-11:00 AM EST: Highest liquidity and volatility

- 3:00-5:00 PM EST: Moderate activity as US banks close

We noticed that Tuesdays, Wednesdays, and Thursdays show the highest market activity and liquidity.

These days give you the best conditions to apply scalping strategies.

Market overlap periods

Trading volume peaks at the time major trading sessions overlap.

The London-New York overlap happens from 8:00 AM to 12:00 PM EST and makes up about 50% of the daily forex trading volume.

Scalpers benefit from the tightest spreads and highest liquidity during this time.

Key market overlaps include:

- Tokyo-London: 3:00 AM to 4:00 AM EST

- London-New York: 8:00 AM to 12:00 PM EST

- Tokyo-Sydney: 12:00 AM to 7:00 AM UTC

The European-North American overlap is the best time to scalp forex.

Major currency pairs like EUR/USD, GBP/USD, and USD/CHF see increased trading during this period.

The Asian-European overlap from 12:00 Midnight to 3:00 AM EST works well for trading Japanese Yen pairs.

Scalpers who focus on JPY crosses find great opportunities in this window.

Market overlaps ended up creating micro-trends with quick directional swings.

These conditions are perfect for scalping because they provide:

- Quick position entry and exit through increased liquidity

- Lower transaction costs from tighter spreads

- More profit chances with higher volatility

- Better price action from increased market participation

The market is quietest between 5:00 PM and 7:00 PM EST.

Some scalpers prefer these calm, directionless markets to profit from small price movements.

Your scalping strategy should line up with these peak trading hours and overlap periods.

You’ll have better chances of quick profits while keeping risks under control during these active market times.

Simple Scalping Strategy Steps

Becoming skilled at forex scalping requires understanding three basic components: precise entry rules, disciplined exit strategies, and proper position sizing.

Let’s break down each element step by step.

Entry rules

A reliable scalping system combines multiple technical indicators to get accurate trade signals.

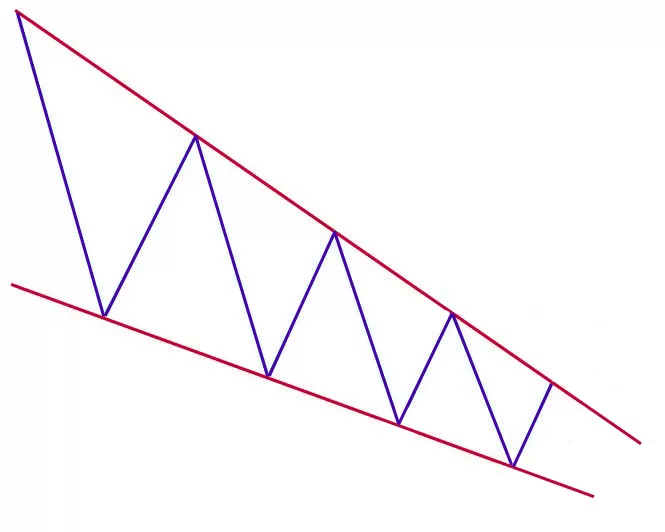

We used the 5-8-13 simple moving average (SMA) combination on two-minute charts to identify strong trends that you can trade on counter swings.

The strategy works right away when these moving averages arrange in the same direction, pointing higher or lower, with prices staying close to the 5- or 8-bar SMA.

To find optimal entry points:

- Watch for ribbon alignment (5-8-13 SMA)

- Confirm with 5-3-3 Stochastics from oversold/overbought levels

- Monitor 13-bar Bollinger Bands for price interaction

- Enter when Stochastics turns higher from oversold or lower from overbought

Exit rules

Successful scalping needs swift and precise exit strategies.

Scalpers want to capture 5-15 pips per trade. The exit strategy relies on two key components:

Take-Profit Guidelines: A profitable scalp trade usually targets 8-12 pips from the entry price.

Traders should exit when prices penetrate Bollinger Bands as they signal potential trend slowdown or reversal.

Stop-Loss Management: Manual scalping operations require careful stop-loss placement.

Stop-loss placement takes precious seconds and causes price changes of several pips.

Trading without stops makes your risk exposure much higher.

Position sizing guidelines

Position sizing plays a vital role in scalping risk management.

You can calculate position size based on your account balance and risk tolerance.

For instance, with a USD 10,000 account risking 0.5% per trade (USD 50), and a 4-pip stop loss, you can safely trade 1.25 standard lots.

Calculate optimal position size with these parameters:

- Risk percentage: 0.5-1.5% of account balance per trade

- Maximum loss limit: Based on the largest stop-loss from backtesting

- Account leverage: Think over 10:1 leverage for safer scalping operations

Professional scalpers follow strict position sizing rules and trade smaller positions during volatile markets.

They focus on quantity over individual trade size and execute hundreds of trades daily while keeping positions relatively small.

You can control risk by using this formula: Account Balance × Risk Percentage ÷ (Stop Loss in Pips × Pip Value).

After setting your position size, keep it consistent across trades unless market conditions suggest adjustment.

Note that ECN forex accounts give you better execution speeds and order placement flexibility.

These accounts help you act more like market makers and improve your entry and exit capabilities for scalping operations.

Managing Risk in Scalp Trading

Risk management is the lifeblood of a successful forex scalping strategy.

Knowing how to implement good risk control measures can make all the difference between steady profits and crushing losses.

Stop loss placement

Your scalping operations need precise stop-loss placement.

You should set stop-loss levels based on your risk tolerance and how volatile your currency pair is.

Place your stop-losses about two or three pips below the last low point of a swing.

You need to think over several factors to set the right stop-loss orders:

- Market volatility and recent price action

- Technical support and resistance levels

- Account risk tolerance

- Position size correlation

Trading without stop-loss orders risks your account from unexpected market swings that could wipe out your funds.

Of course, setting stop-loss orders takes precious seconds when prices might change by several pips, but the protection they give you is worth the slight delay.

Maximum loss limits

Maximum loss limits shield your trading capital from big drawdowns.

Smart traders usually stick to a daily loss limit of 3% or less of their account balance.

They stop all trading for the day once they hit this limit.

Many successful traders live by the one-percent rule, which keeps risk exposure to 1% of total funds per trade.

This approach works even better in scalping, where frequent trading could put large chunks of capital at risk.

Here are daily risk parameters to follow:

- Set a fixed percentage limit (0.5% to 3% of account)

- Establish a maximum dollar amount loss

- Implement a “loss from top” threshold

- Track cumulative daily exposure

A “loss from top” threshold protects your profits by applying the same risk limit to the day’s highest profit point.

This means you won’t give back too much if you’ve had a profitable start to your day.

Recovery techniques

You need a systematic approach, not emotional reactions, to bounce back from losses.

Accept that losses are part of trading and look objectively at what went wrong.

Then review your trade setup, context, and exit decisions to spot areas for improvement.

Stay away from these common mistakes when facing losses:

- Taking bigger positions to recover losses

- Straying from your trading plan

- Trading outside your set market hours

- Ignoring daily loss limits

Try these recovery strategies instead:

- Review your trading journal to spot patterns

- Look at trade setups objectively

- Think about smaller position sizes for now

- Take short breaks to stay emotionally balanced

Getting back on track means staying disciplined with position sizing and risk management rules.

Sometimes, you might need a few days away from trading to clear your head.

This break helps you find your strategy’s flaws or return to effective trading patterns.

Managing your stops actively helps protect profits and minimize losses.

Move your stop-loss levels up as trades go your way.

This trailing stop method locks in gains while protecting you from sudden market turns.

Professional scalpers know that commission costs and spreads can eat into profits substantially.

Pick a broker with competitive high-frequency trading rates so transaction costs don’t kill your potential profits.

Your emotional intelligence plays a vital role in trading psychology.

Learn to spot your emotional states and how they affect your trading decisions.

Stay objective, even during tough times.

Note that quick reactions to market changes often result in bad decisions and bigger risks.

Conclusion

Forex scalping works best when you combine smart strategy, the right tools, and disciplined execution.

You can spot profitable trades using technical indicators like the 5-8-13 SMA setup with Stochastics.

Major currency pairs during peak market hours will give you the best returns with lower risks.

Your trading capital stays protected by following strict risk management through proper stop-loss placement and position sizing.

A systematic approach to losses and emotional discipline helps you survive longer in the markets.

FAQs

What is the most effective forex scalping strategy for beginners?

A simple yet effective strategy for beginners is the one-minute scalping technique. It involves opening a position, gaining a few pips, and quickly closing the position. This approach is widely regarded by professional traders as one of the best and easiest strategies to master.

Which currency pairs are best suited for scalping?

Major currency pairs like EUR/USD, GBP/USD, and USD/JPY are ideal for scalping due to their high liquidity and tight spreads. These pairs offer consistent trading conditions throughout market hours, making them perfect for quick, frequent trades.

What are the optimal times for forex scalping?

The best time for scalping is during market overlaps, particularly the London-New York overlap from 8:00 AM to 12:00 PM EST. This period offers the highest liquidity and tightest spreads, creating ideal conditions for scalping operations.

How should risk be managed in forex scalping?

Effective risk management in scalping involves setting strict stop-loss orders, typically 2-3 pips below the last low point of a swing. It’s also crucial to implement a daily loss limit of 3% or less of your account balance and adhere to the one-percent rule, risking no more than 1% of your capital per trade.

What technical indicators are most useful for scalping?

A combination of indicators often works best for scalping. The 5-8-13 simple moving average (SMA) setup on two-minute charts, along with the 5-3-3 Stochastics and 13-bar Bollinger Bands, can be highly effective for identifying strong trends and potential entry points in scalping operations.

Want to try this strategy? Open a demo account and start scalping now!

Small, frequent gains build up over time, making forex scalping work well for focused and disciplined traders. Success comes when you stick to your trading plan and respect risk limits. Of course, it takes patience, practice, and steadfast dedication to your trading rules.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025