Traders often interpret chart patterns as signs of potential market indecision or instability. Expanding triangles indicate increased volatility in the market and uncertainty among traders. Let’s get more into it.

What is an Expanding Triangle?

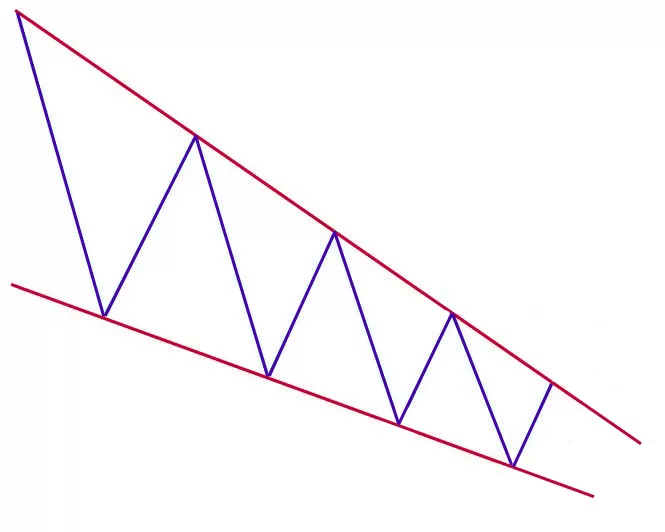

An expanding triangle is a unique triangle pattern that differs from other triangle patterns, such as symmetrical, ascending, and descending. While the other triangle patterns have converging lines, the expanding triangle has diverging lines. This divergence leads to wider price swings, higher highs, and lower lows, ultimately resulting in increased volatility.

The expanding triangle can be either bullish or bearish, giving rise to the bullish expanding triangle or the bearish expanding triangle. It is important to note that the bearish version is more commonly observed in stock markets due to the faster decrease of prices during market crashes.

Expanding Triangle Psychology

When observing an expanding triangle, it becomes clear that there is a significant level of uncertainty in the market. Bulls and bears are engaged in a constant battle for control, leading to larger and larger price swings. This increasing uncertainty signals the potential for a trend reversal.

The expanding triangle is classified as a reversal pattern because the widening swings indicate a higher level of uncertainty, which increases the likelihood of the prior trend reversing. Market players often hesitate to commit fully to a position until there is more clarity regarding the direction of the trend.

Expanding Triangle Trading Strategies

There are three main trading strategies associated with expanding triangles: range trading, breakout trading, and reversal trading. Each strategy offers a unique approach to capitalize on the price movements within the expanding triangle pattern.

Range Trading

Range trading involves taking advantage of the wide swings within the expanding triangle pattern. Like trading a rectangle pattern, traders aim to enter near the support levels and exit near the resistance levels. However, in the case of an expanding triangle, the support and resistance levels are represented by the diverging lines of the pattern.

To execute this strategy, traders would look to enter positions near the lines of the expanding triangle while using wider stop-loss levels to account for the pattern’s high volatility. As the lines of the pattern diverge and the swings become wider, the risk-to-reward ratio for each trade improves. Traders should be mindful of managing their positions as prices move within the expanding triangle, as the pattern will eventually lead to a breakout.

Breakout Trading

In the breakout trading strategy, traders treat the expanding triangle as a continuation rather than a reversal pattern. This means traders look for a breakout in the same direction as the prior trend. However, it is important to note that the probability of a reversal is higher due to the uncertainty of the expanding triangle pattern.

To implement this strategy, traders wait for prices to break above or below the lines of the expanding triangle. It is crucial to identify a strong breakout, characterized by prices shooting past the line and then pulling back to form a stable base. Traders can enter near this stable base as it acts as a launchpad for the next leg of movement in the direction of the breakout.

Reversal Trading

The reversal trading strategy focuses on identifying a breakout in the opposite direction of the prevailing trend, indicating a potential trend reversal. Instead of looking for a traditional breakout, traders search for a low-risk entry point for their first position. This approach is similar to the range trading strategy, where traders enter near the extreme swing of the expanding triangle.

To execute this strategy, traders can initiate a low-risk position near the upper or lower bound of the range, depending on the direction of the desired reversal. As prices form lower highs and lower lows (in a bearish reversal) or higher highs and higher lows (in a bullish reversal), traders can add to their positions. This strategy is most effective when the prior trend is weak and in a relatively late stage and when the expanding triangle is larger in height and duration.

Expanding Triangle Trading Strategy: Range Trading

The range trading strategy for expanding triangles involves capitalizing on the wide swings between the range of the pattern. Traders aim to take positions near the extremes of the swings, similar to trading a rectangle pattern. However, in this case, the support and resistance levels are represented by the diverging lines of the expanding triangle.

To implement this strategy, traders look for instances where prices bounce off the lines of the expanding triangle. Potential buying and selling opportunities can be identified by highlighting the areas where prices interact with the lines.

When executing trades, it is crucial to enter near the lines of the expanding triangle and use wider stop-loss levels due to the pattern’s high volatility. As the lines of the pattern diverge and the swings become wider, the reward-to-risk ratio improves. Traders should remain vigilant and manage their positions as prices move within the expanding triangle, as a breakout is inevitable.

Expanding Triangle Trading Strategy: Breakout Trading

The breakout trading strategy treats the expanding triangle as a continuation rather than a reversal pattern. Traders aim to identify breakouts in the same direction as the prior trend, although the probability of a reversal is higher due to the uncertainty associated with the expanding triangle pattern.

To implement this strategy, traders wait for prices to break above or below the lines of the expanding triangle. A strong breakout is characterized by prices shooting past the line and then pulling back to form a stable base. Traders can enter near this stable base, as it serves as a launchpad for the next leg of movement in the direction of the breakout.

It is important to note that this strategy is considered riskier than other strategies, as breakouts in expanding triangles can be challenging to identify and confirm. Traders must exercise caution and employ proper risk management techniques when executing trades based on this strategy.

Expanding Triangle Trading Strategy: Reversal Trading

In the reversal trading strategy, traders aim to identify breakouts in the opposite direction of the prevailing trend, signaling a potential trend reversal. Instead of focusing solely on breakouts, traders look for low-risk entry points for their initial positions. This approach aligns with the range trading strategy, where traders enter near the extreme swings of the expanding triangle.

To execute this strategy, traders can initiate a low-risk position near the upper or lower bound of the range, depending on the desired direction of the reversal. As prices form lower highs and lower lows (in a bearish reversal) or higher highs and higher lows (in a bullish reversal), traders can add to their positions.

This strategy is particularly effective when the prior trend is weak and in a relatively late stage. Additionally, the success rate of this strategy tends to be higher when the expanding triangle is larger in height and duration. Traders must exercise caution and employ proper risk management techniques when executing trades based on this strategy.

Profit Target for Expanding Triangles

Once an expanding triangle pattern is completed, traders can use it to estimate a minimum profit target for their trades. This can be achieved by taking the maximum height of the triangle and projecting that distance from the breakout point.

To determine the profit target, traders identify the maximum height of the expanding triangle and mark it on the chart. This height is then used as a price projection from the breakout point. The resulting price level is the minimum profit target for the expanding triangle pattern breakout.

It is important to note that the price projection technique should be used with other methods, such as support and resistance levels, to provide additional confirmation. By combining multiple analysis techniques, traders can increase their confidence in the projected profit targets.

Conclusion

Expanding triangles are intriguing chart patterns that offer unique trading opportunities. By understanding the psychology behind these patterns and implementing appropriate trading strategies, traders can effectively capitalize on the price movements within expanding triangles.

Range trading, breakout trading, and reversal trading strategies provide different approaches to trading expanding triangles. Each strategy has advantages and considerations, and traders should choose the strategy that aligns with their trading style and risk tolerance.

Remember to employ proper risk management techniques and use additional technical analysis tools to confirm trading signals. With careful analysis and execution, expanding triangles can become valuable tools in a trader’s arsenal.