The Bullish Harami pattern is a vital tool in the arsenal of traders and technical analysts. This two-candlestick pattern often signifies a possible reversal from a downward trend to an uptrend. This article will delve into the depths of the Bullish Harami pattern, shedding light on its identification, interpretation, and relevance in various trading scenarios.

What is a Bullish Harami?

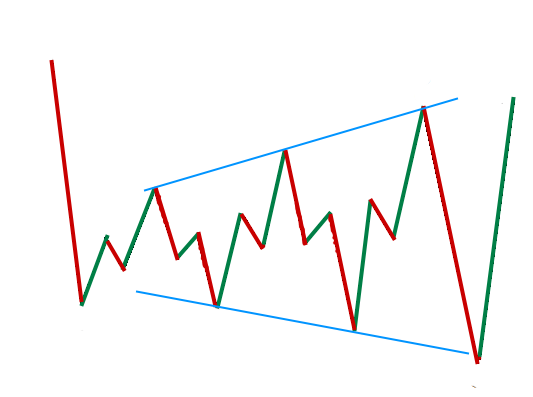

The term “Harami” is derived from the Japanese word for “pregnant.” This name is fitting as the Bullish Harami pattern consists of two candlesticks, where the second, smaller bullish candlestick is ‘nested’ within the body of the preceding larger bearish candlestick. In other words, the body of the second candlestick is ‘pregnant’ within the body of the first.

The Anatomy of a Bullish Harami Pattern

A Bullish Harami pattern emerges at the end of a downtrend and hints at a potential shift in the market sentiment. This pattern is characterized by:

- A long bearish candlestick, representing a solid downtrend.

- A smaller bullish candlestick, completely engulfed by the body of the bearish candlestick, indicates a possible shift in market momentum.

The second candlestick, which is bullish, opens at a higher level than the close of the first bearish candlestick. This ‘gapping up’ of prices is a significant aspect of the Bullish Harami pattern as it signals buying pressure in the market.

Distinguishing Between Bullish Harami and Bearish Harami

While the Bullish Harami pattern indicates a potential shift from a downtrend to an uptrend, its counterpart, the Bearish Harami, signifies the opposite. The Bearish Harami consists of a long bullish candlestick followed by a smaller bearish candlestick, suggesting that the uptrend might be losing steam and a downtrend could ensue.

The key distinguishing factor lies in the color and positioning of the two candlesticks. In a Bullish Harami, the first candlestick is bearish, and the second is bullish, whereas in a Bearish Harami, the first candlestick is bullish, and the second is bearish.

Decoding the Psychology Behind the Bullish Harami Pattern

The Bullish Harami pattern reflects a power struggle between the bulls (buyers) and bears (sellers) in the market. The appearance of a long bearish candlestick indicates the dominance of the bears. However, when a smaller bullish candlestick emerges, it suggests that the bears are losing control and the bulls might be gaining the upper hand, possibly leading to a trend reversal.

This shift in market sentiment is further underscored if the second candlestick opens with a gap up. This indicates that the buying pressure is strong enough to prevent the price from dropping to the bearish close.

Trading Strategies Based on the Bullish Harami Pattern

Trading the Bullish Harami pattern involves several crucial steps:

- Identification: Spotting the Bullish Harami pattern is the first and most crucial step. Traders must look for a strong downtrend, followed by a small bullish candlestick that opens with a gap up from the previous bearish candlestick.

- Confirmation: Once the Bullish Harami pattern is identified, traders should seek confirmation from the next candlestick or a break above a resistance level. This step is crucial to mitigate the risk of false signals and premature entries.

- Entry: After confirmation, traders can initiate a long position at the prevailing market price.

- Exit: Traders can set a take-profit level at a potential resistance level determined through trendline or Fibonacci retracement analysis.

- Stop Loss: To limit potential losses, a stop-loss order should be placed below the low of the bearish candlestick.

Real-World Application of the Bullish Harami Pattern

The Bullish Harami pattern can be a valuable tool to identify potential buying opportunities in various financial instruments such as stocks, ETFs, indices, and forex. For instance, if a trader identifies a Bullish Harami setup on a forex chart, it could indicate a potential uptrend. The trader could then execute a long position, with a stop-loss order below the low of the bearish candlestick, and a take-profit order at the next resistance level.

Pitfalls and Limitations of the Bullish Harami Pattern

Despite its usefulness, the Bullish Harami pattern is not foolproof. It is critical to remember that the reliability of this pattern, like all technical analysis patterns, depends on several factors, including price action around it, the use of supporting indicators, and its position within the trend.

Here are a few limitations of the Bullish Harami pattern:

- False Signals: The Bullish Harami pattern may sometimes produce false signals, leading to potential trading losses.

- Requires Confirmation: Trading on the Bullish Harami pattern alone can be risky. It is vital to seek confirmation from other technical indicators or price action.

- Dependent on Position in Trend: The Bullish Harami pattern must appear at the bottom of a downtrend to be considered valid. Its occurrence elsewhere in the trend does not hold the same significance.

Enhancing Trading Accuracy with Additional Technical Indicators

While the Bullish Harami pattern can be a powerful tool in predicting potential trend reversals, its accuracy can be further enhanced when used in conjunction with other technical indicators. Some popular technical indicators used by traders for confirmation include:

- Relative Strength Index (RSI): This momentum oscillator helps identify overbought or oversold conditions in the market. An RSI reading below 30 suggests oversold conditions and could provide additional confirmation for the Bullish Harami pattern.

- Stochastic Oscillator: This momentum indicator compares a particular closing price to a range of its prices over a certain period. The stochastic oscillator can signal a potential reversal when the market is oversold, further confirming the Bullish Harami pattern.

- Moving Average Convergence Divergence (MACD): This trend-following momentum indicator shows the relationship between two moving averages of a security’s price. A bullish MACD crossover can serve as additional confirmation of a Bullish Harami pattern.

Key Takeaways The Bullish Harami pattern is a two-candlestick pattern often indicating a potential reversal from a downtrend to an uptrend. The Bullish Harami pattern consists of a long bearish candlestick followed by a smaller bullish candlestick that is completely engulfed by the body of the first candlestick. Trading the Bullish Harami pattern requires identification of the pattern, confirmation, entry, exit, and stop loss. The Bullish Harami pattern is not always accurate and should be used in conjunction with other technical indicators and risk management strategies. The Bullish Harami pattern can be applied to various financial instruments, such as stocks, ETFs, indices, and forex, regardless of the timeframe.

FAQs

What is a Bullish Harami pattern?

The Bullish Harami pattern is a two-candlestick pattern often indicating a potential reversal from a downtrend to an uptrend.

How do you trade Bullish Harami?

To trade the Bullish Harami pattern, traders should identify the pattern, seek confirmation, initiate a long position, set a take-profit level, and place a stop-loss order.

Is the Bullish Harami pattern reliable?

While the Bullish Harami pattern can be a reliable indicator of potential trend reversals, it is not always accurate and should be used in conjunction with other technical indicators and risk management strategies.

Conclusion

The Bullish Harami pattern can provide valuable insights into potential market reversals. However, like all technical analysis tools, it is not infallible and should be used in conjunction with other technical indicators and risk management strategies. Traders should also be mindful of market volatility and adjust their strategies accordingly. With careful application and prudent risk management, the Bullish Harami pattern can be a powerful tool in a trader’s toolkit.

Ready to take your trading to the next level? Sign up with Funded Engineer and get a shot at managing simulated funds up to 1,500,000$!

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025