Investing and trading involve a host of complex strategies and tools, one of which is the Dark Cloud Cover Candlestick Pattern. This pattern is a crucial element in the realm of technical analysis and can be a powerful tool for predicting potential market downturns.

What is a Dark Cloud Cover?

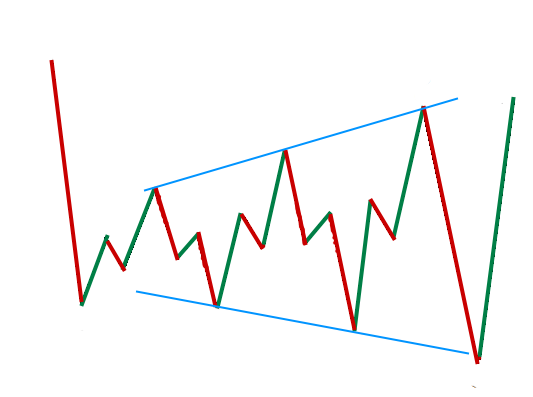

A Dark Cloud Cover is a bearish reversal candlestick pattern that is used to predict a potential downturn in an otherwise bullish market. It is characterized by a candlestick that opens above the close of the previous candle but then closes below its midpoint. This pattern signals a shift in market momentum from the bulls to the bears, indicating that a bearish reversal may be on the horizon.

Structure of Dark Cloud Cover

The Dark Cloud Cover pattern comprises two candles—an up candle followed by a down candle. The up candle, usually colored white or green, signifies an upward trend. The down candle, typically black or red, opens above the close of the up candle and then closes below its midpoint, symbolizing a shift in momentum to the downside.

The occurrence of the Dark Cloud Cover pattern is significant as it represents a potential change in the market direction, from a rising trend to a falling one.

Key Components of the Dark Cloud Cover Pattern

1. Preceding Uptrend

The Dark Cloud Cover pattern does not occur in isolation but is usually preceded by an uptrend or an overall rise in the price of a security. This bullish uptrend sets the stage for the appearance of the Dark Cloud Cover pattern.

2. Two-Candle Formation

The pattern is created by two candles—an up candle and a down candle. The up candle represents a continuation of the bullish trend, while the down candle represents a potential shift to a bearish trend.

3. Gap Up

Following the up candle, the down candle opens with a gap up. This signifies a temporary continuation of the bullish trend before a potential reversal.

4. Downward Close

The down candle then closes below the midpoint of the up candle, signaling a potential bearish reversal.

5. Confirmation

The pattern is confirmed when the price continues to decline in the following trading session. This continued decline confirms the bearish reversal indicated by the Dark Cloud Cover pattern.

Identifying the Dark Cloud Cover Pattern

Recognizing the Dark Cloud Cover pattern involves looking for its characteristic two-candle formation during an uptrend. The first candle is an up (bullish) candle, while the second is a down (bearish) candle that opens above the close of the previous candle and then closes below its midpoint.

The Dark Cloud Cover pattern is further characterized by the significant size of both the up and down candles. These large candles suggest strong market participation and a decisive shift in price movement.

Confirming the Dark Cloud Cover Pattern

Confirmation of the Dark Cloud Cover pattern is crucial for its effective use in trading strategies. This confirmation usually takes the form of a continued price decline following the appearance of the pattern.

Traders may also use other forms of technical analysis in conjunction with the Dark Cloud Cover pattern. For instance, an overbought relative strength index (RSI) or a breakdown from a key support level can further confirm the bearish reversal signaled by the Dark Cloud Cover pattern.

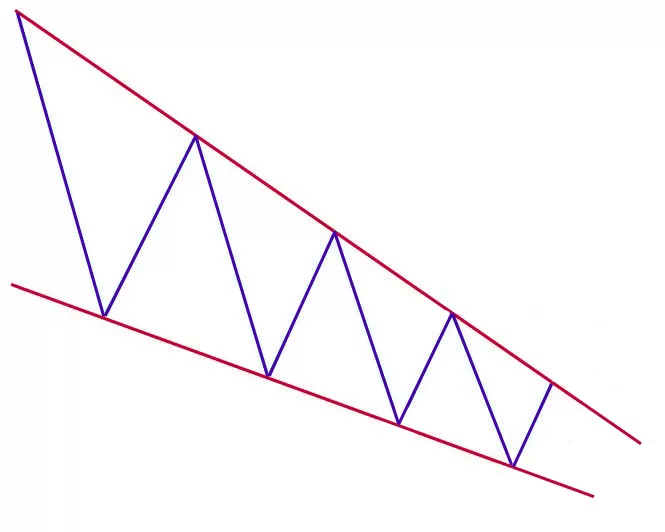

The Dark Cloud Cover Pattern vs. Other Similar Patterns

The Dark Cloud Cover pattern is similar to some other candlestick patterns, particularly the Bearish Engulfing Pattern. However, while the Bearish Engulfing Pattern is a more bearish formation that completely rejects the gains of the preceding candle and usually closes below its lows, the Dark Cloud Cover pattern only requires the down candle to close below the midpoint of the up candle.

Also, the Piercing Pattern can be considered as the bullish equivalent of the Dark Cloud Cover Pattern.

Conclusion

The Dark Cloud Cover candlestick pattern is a powerful tool in technical analysis, providing traders with a potential signal of a bearish market reversal. However, like all trading tools and strategies, it should be used in conjunction with other forms of analysis and should always be confirmed before making any trading decisions. It’s crucial to remember that while the Dark Cloud Cover pattern can be a strong indicator of a potential trend reversal, it does not guarantee that a reversal will occur.

As always in the realm of investing and trading, due diligence, thorough analysis, and prudent risk management are key to success.

Get funded with FundedNext and receive a 90% profit share of the Capital. Trade up to a $300k account.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025