The Evening Doji Star pattern occupies a unique and prominent place. It is a powerful tool in the hands of seasoned traders, offering insightful cues about possible market reversals. This article sheds light on this intriguing pattern, its construction, and how it can be effectively utilized in trading.

What is the Evening Doji Star Pattern?

The Evening Doji Star is a bearish reversal pattern that signifies a potential shift in momentum from an uptrend to a downtrend. This pattern is highly revered due to its reliability and rarity, and its appearance often piques the interest of market observers.

Primary Components of an Evening Doji Star

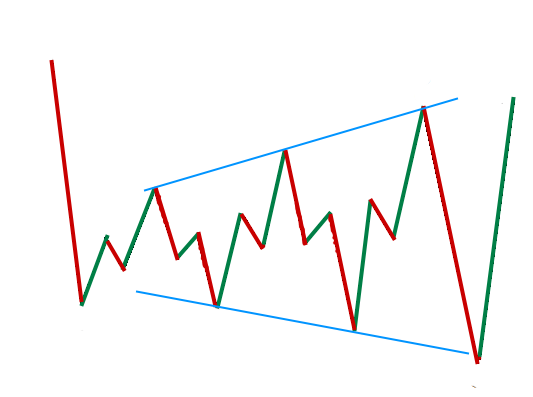

There are three primary candles that make up the Evening Doji Star pattern:

- First Candle: This is a bullish, or green, candle that appears during an uptrend. It symbolizes strong buying pressure.

- Second Candle: This is a doji candle that is characterized by a small or non-existent body, indicating market indecision. It is usually positioned above the first candle’s body, often signified by a gap.

- Third Candle: This is a bearish, or red, candle that signals selling pressure. It typically opens below the doji’s body and closes below the midpoint of the first candle’s body.

Significance of the Evening Doji Star Pattern

The Evening Doji Star pattern clearly indicates a shift in market sentiment. The indecisive doji on the second day challenges the bullish momentum of the first day. This indecision sets the stage for an influx of sellers on the third day, effectively flipping the market trend. This pattern can serve as a significant signal to traders to exit long positions or even consider potentially entering short positions.

However, it’s crucial to remember that this pattern doesn’t operate in isolation. It’s advisable to consider other technical indicators and market data to confirm its signal.

Identifying the Evening Doji Star Pattern in Trading Charts

The appearance of the Evening Doji Star pattern on a trading chart can alert traders to a potential trading opportunity. However, correctly identifying this pattern requires some familiarity with chart analysis.

Key Steps to Spot the Evening Doji Star Pattern

- Spot the Uptrend: The first step is to identify a solid uptrend in the market, characterized by rising peaks and troughs.

- Look for the Doji: The second step involves spotting a doji candle that signals market indecision, following a long bullish candle.

- Identify the Downtrend: The third step is to look for a strong, bearish candle that closes below the midpoint of the first bullish candle. This is a signal that sellers are starting to control the market.

Trading with the Evening Doji Star Pattern

Once the Evening Doji Star pattern is identified and confirmed, traders might consider entering a short position. They typically place a stop-loss order above the highest point of the pattern to manage risks and determine a take-profit target based on the closest support area or demand zone.

However, it’s crucial to monitor the trade and adjust stop-loss and take-profit levels based on market conditions.

Distinguishing the Evening Doji Star Pattern from Other Patterns

It’s essential to differentiate the Evening Doji Star pattern from other candlestick formations to make informed trading decisions.

Evening Star vs. Evening Doji Star

Although both the Evening Star and the Evening Doji Star patterns indicate a potential trend reversal from an uptrend to a downtrend, they differ slightly in their structure. The Evening Star pattern comprises a long bullish candle, a small-bodied candle (rising or falling), and a long bearish candle. On the other hand, the Evening Doji Star pattern replaces the small-bodied candle with a doji, signaling greater market indecision.

Morning Doji Star vs. Evening Doji Star

While the Morning Doji Star and the Evening Doji Star patterns feature a doji, they signal trend reversals in opposite directions. The Morning Doji Star indicates a shift from a downtrend to an uptrend, whereas the Evening Doji Star signals a reversal from an uptrend to a downtrend.

Final Thoughts on the Evening Doji Star Pattern

While the Evening Doji Star pattern can serve as a reliable indicator to spot potential trend reversals, it’s important not to rely solely on it for trading decisions. Incorporating other technical indicators and risk management strategies can help mitigate potential losses and enhance trading performance. Above all, remember that practice and experience are key to mastering the art of trading with the Evening Doji Star pattern.