Investors and traders use various tools to predict market trends. One such tool that stands out for its reliability is the Evening Star. This article will delve into the intriguing world of the Evening Star, its pattern, and candlestick representation.

What is an Evening Star?

The Evening Star is a technical analysis tool used to predict potential price reversals in the market. It is a bearish reversal candlestick pattern that consists of three candles: a large bullish candlestick, a small-bodied candle, and a bearish candle. The Evening Star pattern is usually spotted at the peak of an uptrend, hinting that the upward price movement is nearing its conclusion.

The Role of the Evening Star in Technical Analysis

Technical analysts use the Evening Star as an indicator to forecast future price movements. Despite its rarity, traders consider it a reliable technical indicator due to its strong indication of a potential downturn in price.

Interestingly, the Evening Star also has a bullish counterpart known as the Morning Star pattern. While the Evening Star signifies a bearish sentiment, the Morning Star pattern is bullish.

Structure of the Evening Star Pattern

To understand the Evening Star pattern, it’s crucial to unpack the structure of a candlestick pattern. A candlestick pattern is a way of presenting certain information about price. It reflects the open, high, low, and close prices over a certain period.

Each candlestick comprises a candle and two wicks. The length of the candle is determined by the range between the highest and lowest price during that trading day. A long candle indicates a large shift in price, while a short candle indicates a minor change in price.

With its unique three-day structure, the Evening Star pattern is considered a strong indicator of future price declines.

How the Evening Star Pattern Works

The Evening Star pattern unfolds over three trading days:

- First day: The day starts with a large green candle, indicating a continued rise in prices.

- Second day: The day sees a smaller candle, showing a modest increase in price.

- Third day: The day begins with a large red candle that opens at a price lower than the previous day’s and then closes near the middle of the first day.

Special Considerations

Spotting the Evening Star pattern amidst the constant flux of price can be challenging. Traders often use price oscillators and trendlines to identify the pattern reliably and confirm its occurrence.

Remember, despite its popularity among traders, the Evening Star pattern isn’t the only bearish indicator. Other bearish candlestick patterns include the dark cloud cover and the bearish engulfing.

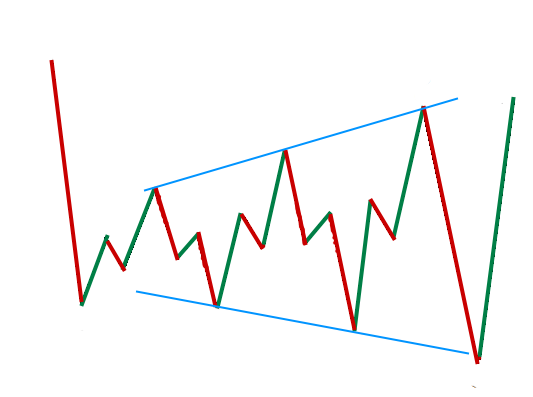

Example of Evening Star Pattern

In the chart above, the three-day pattern begins with a long green candle, indicating that prices have risen due to significant buying pressure.

The second day also shows a rise in prices, but the increase is modest compared to the previous day.

The third day shows a long red candle in which selling pressure has forced the price to around the midpoint of the first day.

These are the tell-tale signs of an Evening Star pattern.

Open, High, Low, and Close Prices

These prices monitor the value of a currency over a period. An open or opening price is the first price a forex trades at when the market opens in the morning. The closing price is the last price of the day. High and low prices track whether a price has lost or gained value during the day.

The Doji Candlestick Pattern and Evening Star

The Doji pattern occurs when the open price is the same or nearly the same as the close price. Upward movement indicates that the price may begin sinking soon. The downward movement is a sign that the price may go up.

This information can be an indicator of what will happen the next day.

Conclusion

While using various indicators to predict price movements is advisable, the Evening Star pattern can be a solid tool. It’s particularly useful in identifying downward trends, although it can be difficult to pin down. Options like trendlines and oscillators can help, and don’t overlook the value of a broker’s advice and assistance.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025