Keeping a forex trading journal should not be dreary. In this article, I will show how to keep one and importantly how to use a trading journal to make you a better trader.

To get started, you will need a journaling tool.

You can use a spreadsheet like Excel (there’s a free Excel forex trading journal template a few sections below) or a trade journal software like Edgewonk or Trademetria.

Download a PDF version of this article and read it however you like. I will also send you the journaling tools mentioned – an Excel trading journal template and a $20 discount coupon for Edgewonk journaling software..

What is a forex trading journal?

A trading journal is a tool traders use to record and track their trades. With it, traders can analyze their trades identifying actionable areas affecting their performance.

Most traders struggle with the idea and practice of keeping a trading journal because they don’t like the feedback the journal spits in their faces.

We would rather bury our heads in candlestick and chart gazing than acknowledge the underlying reasons behind losses or wins.

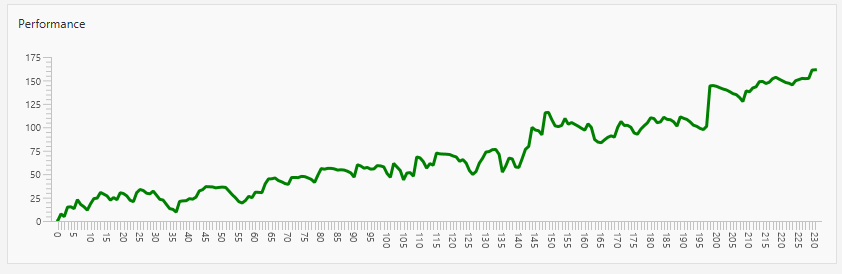

Yet we hold on to the juvenile trader’s dream of consistently making money – a steadily rising equity curve.

How do you get to consistency when you hop in hop out of trades counting on luck to win every time?

Like a production assembly line, a trader needs a system that consistently makes them money.

You may call this your edge.

Only a trading journal can serve you a trading edge on a silver platter.

Because, if you don’t know what makes you lose or what is responsible for your wins, you will enter the next trade hoping to win.

Hope is an emotional scapegoat for laziness in trading.

It won’t always work in your favor based on the randomness of trade results.

A trading journal brings clarity and certainty to every trade – it crunches what would look like random variables in your trading, and points to you with pinpoint accuracy the issues bleeding your account or areas working for your good.

What should be included in a trading journal?

Knowing the purpose of a trading journal, it is safe to say, you should include all the information you consider when making a trade.

This information varies from trader to trader.

But if we consider a typical trading cycle.

Study charts for a trading opportunity, enter, manage, and close the trade.

Then, a trading journal should touch on the decisions you make at each one of these stages.

Planning for trades.

What instrument do you intend to trade, is it stock, what stock is it? Is it forex, what currency pair is it?

How much do you intend to risk and expect to gain from a trade in dollar or unit figures?

Screenshots charts with interest areas for your trading opportunities.

When you are in a trade, you can note on the chart, when you entered, where you set targets and when you exited and your reasoning behind them.

The idea of annotating a chart is even better suited for a scalper.

You may not be able to enter trades in your journal before you place new trades for the risk of missing trading opportunities, but, if you make notes on the chart as you trade, you can capture a screenshot, which you attach to your trading journal when you import or input your trade entries.

Traders trading longer timeframes entering one to ten trades a week or even a day should have screenshots of before and after trades attached to each trade.

Entering a trade

- The entry price.

- Initial stop loss and take profit targets

- The volume or lot size of the trade.

- Comments on why did you took the trade. Was your entry signal triggered or you are revenge trading or you followed a tip from a trading forum

- What trading strategy did you use? Fundamental, Breakout, news, or none.

- The emotion you felt when you entered the trade. Happy, excited, bored, anxious?

Managing a trade.

Once you entered a trade, what did you do?

Did you set and forget?

Or did you tinker with the trade? Did you move the stop loss and take profit targets or did you remove them altogether?

If you did, why did you do it? Could it have been that you were expecting news and tightened or widened your targets, or your stop target was about to be hit and you decided to remove it? Be honest.

Exiting a trade.

What was the closing price?

Was it a profit or a loss.

Did you manually close the trade or your take profit target was hit?

You get the idea. Question every motive behind every trading action because any one of these actions makes or loses you money.

A good trading journal software or tool should have an option for you to add custom comments or triggers for your trading. One trader may want to know the impact of trading during high impact news, while another, cares to know the impact a family dispute has on their trading. Those little things we often ignore silently affect trading performance.

What I track in my trading journals has rhymed with my evolution as a trader.

When I struggled with accepting loss. The trading journal was there to help me know how many times I never accepted the loss and what impact it had on my account.

By convincing myself – yes, you may have to convince yourself – to track the impact of accepting loss had on my account, I learned what the best traders know, by refusing to accept a loss, you lose.

Like a spoiled brat, I gave up journaling several times, because I never wanted to accept the truth.

The addiction to random wins and blatant self-denial and refusal to deal with the deep-rooted issues in affecting my trading somehow let me skip journaling.

In the beginning, there will be a war and somehow your mind will convince you it’s okay to ditch journaling altogether.

But, if you find your way back like I did countless times, eventually, the trading journal will hone your trading strategy. Knowing exactly, what instruments to trade, on which days of the week to trade them, the emotional pressure your trading buckles to.

I learned for instance, when I scalp, I make most of my money two hours leading to the London open.

What is important for you to take away is that a trading journal helps remove randomness from your trading. It will give you the reason to become a disciplined trader.

To summarize it all, here are

5 key elements every forex trading journal should have.

- The instruments or currency pair you are trading

- The trading strategy you used on the trade

- The entry times along with the initial targets for both profit and loss in both currency figures and price.

- The exit time and the trade result whether it was a profit or a loss

- Notes on thoughts, feelings, and emotions before, during, and after the trade.

How to create a trading journal?

Any way you choose will yield results.

With a hard paper notebook and your computer.

You don’t need fancy software to jot down your trading thoughts and activities. A simple notebook or paper that you can safely file will do.

Earlier, I mentioned how you can take screenshots and comment on your charts.

You can have a folder on your computer to save the screenshots or upload them to the cloud.

Use a spreadsheet

An upgrade from the hard paper is a spreadsheet like Microsoft Excel.

This is way better, because of the analytical power you can get with spreadsheets.

Now, many of you may be wondering how to create a forex trading journal in excel.

Keep it simple.

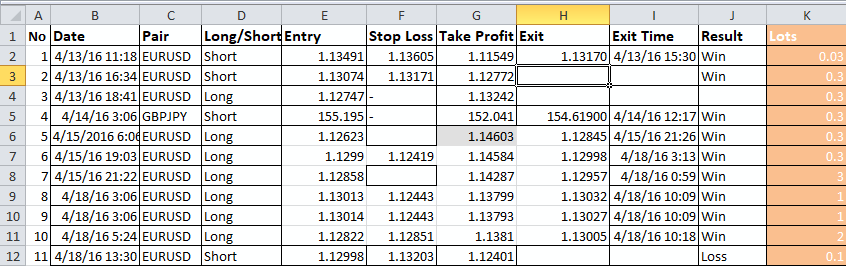

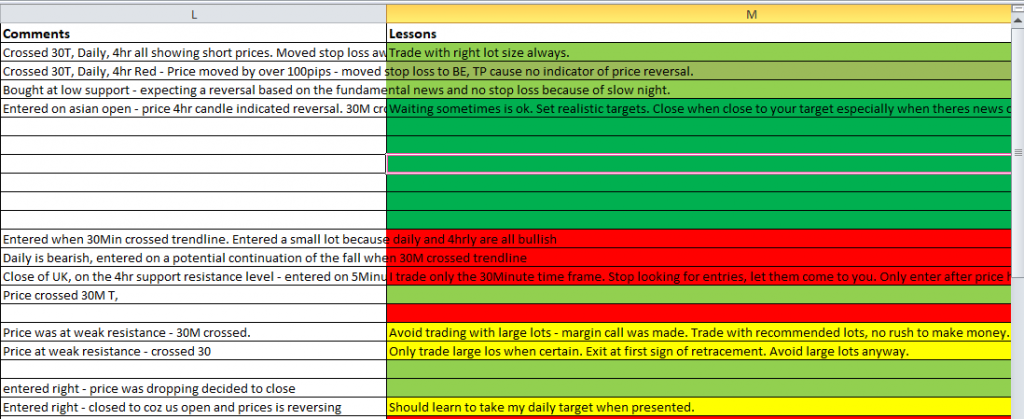

When I used an excel trading journal in 2016. I had something like this.

But the most important sections were the comments and thoughts about each trade.

I tracked each trade with comments on how I entered, and the lessons I learned. My lessons had color codes to reflect how critical the lesson was to my success as a trader.

In your worksheet, list the areas in your trading cycle that you want to track.

If you want a trading journal example, here is a forex trading journal excel template download you can modify to suit your journaling needs.

Use dedicated forex trading journal software

Excel is great, but your time is better spent planning and executing trades than in manual administrative data entry work or tweaking a formula to show you exactly the gaping issues in your trading.

Dedicated trade journal software is built to make journaling a breeze.

It does all the heavy lifting of data analysis, and if you wish, data entry, so you can focus on trading.

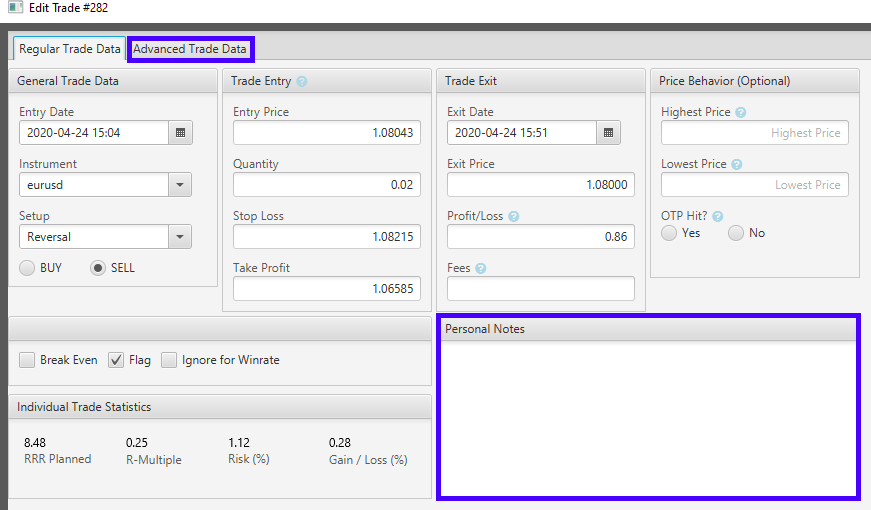

On long term trades, I use the trade planner to plan trades.

When I scalp, I import trades to the software from the broker’s statement every hour or less so I can enter my comments around trade entry, exit, and management while my memory is still fresh.

All the data about the trade are automatically added. All I do is enter information about the trade in the personal notes.

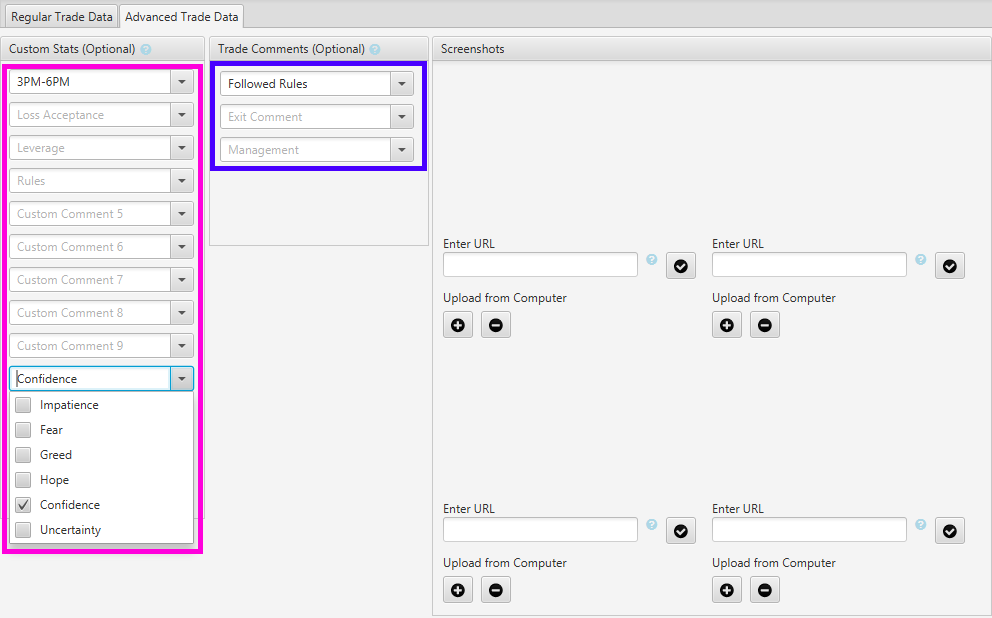

Then, I go to the advanced trade data to attach the different issues I want to track to the trade.

Every trade is tagged with my emotional state, the time I entered the trade, whether I broker rules or not, the entry, exit, and trade management comments.

All these parameters are defined once in the settings area of the software.

Once the data is in, the software does its work.

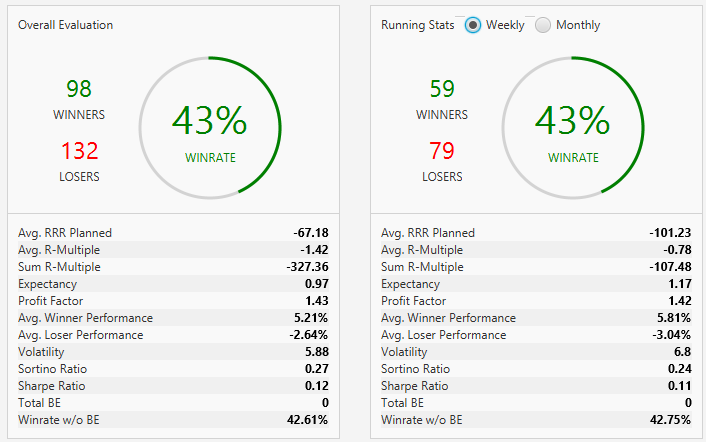

Every time I launch my trading software, the first thing I see is the overall health of my trading account.

Then I have a birdseye view of my weekly and monthly performance.

I can then dig deep into the trade analysis features of the software to know what I need to work on or what I need to keep up in my trading.

For a small cost, trading journal software will elevate your trading.

Most ship with the basic data points you need to track, but you can also create your custom data points depending on your trading needs.

I use Edgewonk, and so far it is the best trading journal for any trader committed to achieving their dream.

Edgewonk trading journal works for Forex, Futures, Stocks, CFD, Spread betting, and Crypto-currencies traders.

Edgewonk charges a one-time fee of $187.00 for only the journal.

You can start with the free trial.

When you are ready to buy, use the $25 off Edgewonk discount coupon I send my readers.

Another dedicated trading journal software you can use is Trademetria.

Unlike Edgewonk, it is a cloud or online based trading journal.

It is a free online trading journal for up to 30 orders a month. This is perfect for low volume traders any one testing the waters of journaling.

Once your trade numbers go up you can subscribe to a monthly package starting at $11.9 a month.

When and how to review a trading journal?

When and how to review a trading journal depends on a trader.

Some prefer to pore through their last trades before they enter new trades, while others prefer to accumulate the trades and only review them at the end of a trading day or once a week.

Whatever works, go for it. Just make sure you review your trading journal.

If a trading journal is to add the promised value to your trading, reviewing it should show you in a glimpse your trading performance.

Reviewing a trading journal comes to sitting down and exploring the data you have collected during a trading session.

Those using dedicated journaling software should look through the trade analytics section of the software.

What you want to know is what strategy or the custom parameters you set to make money and why they work.

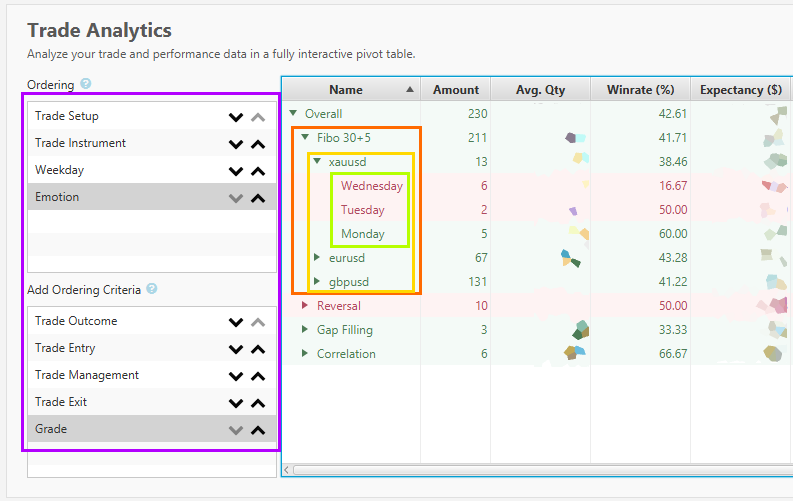

In the chart above, on my short term scalping account, I trade four strategies. One, based on currency correlation, the second on Gap filling, the third on reversals, and the fourth based on the Fibonacci pivot levels entering trades in the 5-minute timeframe in the direction of the 30-minute chart.

In my trade analytics, I am curious to know what currency pair works for me and on which days I make the most losses.

My trade analysis report shows me my trading performance based on the trading strategy, the currency pair, the trading days, emotions, and everything else I track.

When you have a general idea of your trade performance, you should go to the individual trades, and review the thoughts and comments behind every trade.

In my reversal strategy, for instance, I notice most of my trades are based on an idea my gut is telling me that price is about to reverse – I am trying to pick the top or bottom.

I could now either drop the strategy all together or tweak it.

At the end of a review session, you should have actionable areas in your trading to improve or drop.

There is no need for trading all 80+ instruments your broker offers when your journal shows only 2 instruments make you the most money.

If your journal reveals that, you enter trades too soon, you will need to adjust your entry signal or work out something that will stop you from jumping too soon.

Some traders go to the extremes when their journals reveal meddling with trades is costly. Instead of leaving the trade to play out as planned, they move targets, close wins too soon – such traders, learned that that single habit limits the potential of their system, so what they do after placing the trades? They close their trading workstations – only checking at defined times.

Of course, this may not work for a scalper who has to be in the market through the trading day.

But what you can learn from the journal is the trading session that makes you money and in which sessions you give back profits or what currency pair is most profitable.

Actionable Intel.

The importance of a forex trading journal to a trader.

If you have read to this part of the article or if you skipped to it, why add yourself more work of noting trades when trading statements from your brokers have all your trading results – Information that would seem duplicate if we tried to recreate it.

Well, here are 5 reasons why successful traders hold dear the habit of keeping a trading journal.

Helps hone and prove your trading strategy

The only way you will test and prove a trading strategy is by testing it on historical data and a live account.

But, it is not just blind testing.

A journal will identify areas in the chart and the trading conditions around the trade times where you make the most or lose the most money.

With thousands or even hundreds of data entries, a predictable pattern will pop out. There, you will know your strategy.

It makes you a disciplined trader.

Once you are confident that your trading strategy has proven itself, there is no way you will make the stupid mistakes most traders make.

It takes discipline and commitment to take screenshots and jot down your trade ideas.

This discipline easily trickles down to your trade directly, since you have to write your plan before placing a trade or indirectly, by tapping into the psychological power of the mind, where improving in one area sprawls to other areas.

A useful accountability tool

Individual day traders don’t have the luxury of the rigged oversight institutional traders have.

You are on your own. You make the rules as you please. And break them when you feel them strangling.

That is the detriment of most retail traders.

A trading journal forces you to account for each win and loss. It forces you to ask why and how.

It is a beacon, keeping you away from making the same trade mistakes

When your trading strategy ushers you to the disciplined traders’ arena certain mistakes will naturally fade away like the morning sun disappears the night.

Because you are alone are responsible for a rising equity curve, you won’t trade a large lot size in a trading time when your system has warned you.

Neither will you cut remove the stop loss because you feel the pain of loss in bearable.

Because your trading journal will show you that you always make money even after taking 10 losses in raw.

Journaling is therapeutic

Hollywood, in her movies, depicts traders as alter ego males who get off the high and stress of trading with a puff of a joint, a snort of cocaine, and a shoot a of heroin in wild orgies.

You don’t need to trust me, you know it, trading can be stressful that it is clear why many traders resort to substance abuse to level their minds.

By scribbling your thoughts to paper or screen you comb through your mind releasing pressure from within you. The pressure that we all know quickly snowballs into bad trading decisions.

That is when you understand the therapeutic power of journaling.

Parting thoughts on and tools for keeping a trading journal

We can’t underscore the importance of keeping a trading journal.

Numbers don’t lie; it’s why a thriving business is keen on good record keeping.

I am sure you have heard the saying, “data is the new gold” and thus the data mining trend.

Good traders know that. And that’s why many advise you treat your trading as a business.

A trading journal is a reliable tool that assesses your trading decisions, trading strategy, and overall account performance.

You don’t need to complicate the process.

Pick any one of these tools and start

- Get a book and track your thoughts.

- Download my Forex trading journal excel template and customize it.

- Use dedicated trade journaling software. You can use a cloud or online trading journal like Trademetria or a desktop trading journal like Edgewonk.

- Subscribe to my newsletter and I will send you a $20 discount coupon for Edgewonk .

Eventually, the information your journal shows will keep you focused when the sustained losing streaks hit.

- Essential Guide to Forex Market Analysis Techniques for Traders - January 30, 2026

- Complete Guide to Selecting Trustworthy Forex Brokers and Platforms - January 28, 2026

- Ultimate Guide to Advanced Trading Strategies for Forex Success - January 26, 2026