Honey, I wish I could tell you, you will never lose money trading forex. I wish I could reveal to you a no loss forex strategy and secret successful traders will kill to protect. Sorry to stymie your search for that no loss forex trading trick. It doesn’t exist.

But, what I can do for you is help you deal with forex trading loss the right way.

The good thing is you are not alone in this struggle.

The pain of accepting a loss stems from investment bias – a cognitive phenomenon where the mind works hard to convince a trader they were right about the trade even when it is clear they are wrong.

So you hope and pray that the trade will come back to profit.

Even if 99% of your trades come back, the 1% that don’t have the potential to wipe clean your account.

You have to work hard to convince your mind that it is okay to lose, that loss is just the bill you got to pay to prove your edge.

To get there, we have to start at the beginning.

How did you learn about forex trading? If I may ask.

Most of us were introduced to forex trading with a promise of swimming in mula – living a life of fast cars, big houses, travel to exotic lands, and everything else that money can buy.

Barely are many of us are exposed to the reality that most forex traders swim in the deep losing end of the pool, eventually drowning in loss.

We see a few if any of such cases.

Most of us are reeled in with the promise of making millions fast, but reality tells a different story – 1% of all traders profit net of fees.

This initial introduction to forex trading, I believe is responsible for the demise of most traders.

It is a psychological trap, and certainly, it is where we have to visit if we are to solve forex trading loss problems once and for all.

So, let’s go.

Why traders lose money.

They trade with wrong expectations.

Trading courses/signals/brokers/guru/ marketers, lure most of us to forex trading with flashy images of the life they live, colorfully telling stories like how Soros made a billion dollars in a day.

So, you plunge in expecting to finally live the life of your dreams.

The pressure to make money to live to these expectations forces a trader to do dumb things. Things that result in losing money.

They over-leverage accounts

With a wrong expectation, especially on a low capitalized account – you won’t hold back on leverage.

Brokers offer crazy leverage – some of us are in countries where brokers can offer unlimited leverage. That is crazy, so with my $1000 I can trade 1, no 5, no, 10, no 20, wait, even more, lot sizes.

What would you expect to happen? That you will turn the 1k to 1M in a day?

They let emotions get the best of them

The problem with leverage is it has a sinister way of awakening the docile loss inducing demons aka emotions in you.

Greed, first. You will hear whispers, you surely can turn your 1K to 10K today.

If you don’t know what happens next, try opening a trade 10 times the volume in your trading plan. A mad rush of energy will gush into your belly enough to drive a constipated man to the toilet.

If the trade goes against you, you will break all the remaining rules in the book.

You will extend or even remove the stop loss limits because you hope the trade will come back and at least break even.

Since you know pricing is coming back, how about adding to a losing trade, that way we shall make up for the losses faster.

Eventually, if your account survives, you will want to recover from the losses fast.

If you make money, you are trapped. You will try it next time, only this time you won’t survive.

They over trade.

Trading costs and losses grow with every trade you make.

By trying to make money fast, you have to pay for spreads and commissions – these add up.

Even if you were trading with a good forex loss strategy, in a choppy market you will pile up small losses that easily drain 30% of your account.

They hop systems, brokers, strategies.

When the losses stark. A trader is tempted to try another strategy or forex broker.

They exclude themselves from the equation and throw the blame on everything else.

The thinking is there is a no loss forex strategy out there. Or, the broker is to blame. Granted, there are sad stories about scrupulous brokers, but, when it comes to most trader losses. Brokers play a very small role if any.

Every time you try a new strategy, expect to incur the cost of learning.

Because you don’t know under what trading environment a strategy works best, you will more-or-less be like a blind man playing darts.

They don’t want to be proved wrong.

If we are to sum up why traders lose money in one statement, this is it. Traders don’t want to be proven wrong.

Those who push for no stop loss trading are hoodwinked to the idea that a trade will always come back. Of course, it does, but will your account sustain thousands of pips against your trade?

This same ideology is behind traders who move or remove stop losses, average trades; naively attempting to prove to themselves and the market that they were right in the first place.

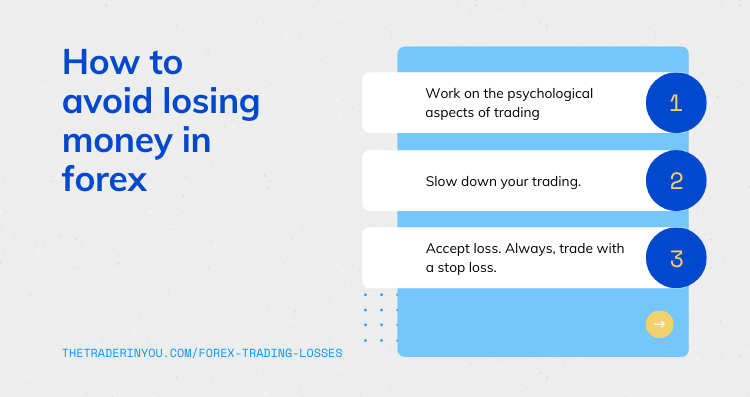

How to avoid losing money in forex

Now that you know why traders are likely losing money, let’s look at simple yet effective ways on how to reduce trading losses.

Work on the psychological aspects of trading

Trading psychology is important to trading success because most trading problems are mental.

By developing the habit of keeping a trading journal you will learn about yourself and the markets and how the variables in your trading affect your losses and profits.

You then won’t be a victim of investment bias because you are confident of the odds of your trading strategy each time you place a trade.

Every tip or strategy on how to reduce forex trading losses will only work if you know why it works.

You won’t struggle with accepting losses or let trading emotions shove you around when your mind is convinced that you don’t have to win every time to make money trading forex.

When you know that, you will stop hunting for a zero loss forex trading system and commit to executing trades when and how your trading plan dictates.

Every time you accept a loss, every time you follow your plan, you reinforce in your psyche the traits of a disciplined trader.

Over time, you will close a losing trade without qualms.

Commit to one strategy at a time.

We’ve seen how trading strategy/system hopping leads to trading loss.

To reduce your trading loss. Stick to one trading strategy at the time.

As your exposure to the market grows, you will develop strategies for any market condition. You will then know what strategy to trade in a ranging market, and what to trade on a trending market. Mix them up and you will have mixed trading results.

When you stick to a trading strategy long enough you avail yourself to the full potential of the strategy.

Slow down your trading.

When you are watching your account bleed fast, slow down. Set aside your delusions of grandeur and focus on what the charts say in realtime.

Trade on a higher timeframe.

This will dramatically fix the problems that come from trading on a lower timeframe.

Juxtapose a 5-minute chart and a 4-hour chart.

A 5-minute chart may show you tens of entries within a daily chart.

While a four-hour chart may have one or two.

10 risks vs 2 risks.

Lower timeframes may present you multiple trading opportunities, but, they bear their own risk.

By moving to a higher timeframe, instead of taking 50 trades a day, you may take only one or two – dramatically cutting your trading losses.

Start keeping a trading journal.

Planning and writing about the trade before you place order slows you down. But this is only possible when you trade setups on higher timeframes where naturally trading opportunities are few.

This will teach you to patiently wait for the best setups.

Use a checklist before entering a trade.

Your trading plan should have rules and conditions before you place a trade.

Create a checklist, and tick each item before you enter the trade. This not only slows you down but helps you curb the temptation of trading by the gut.

Download an empty forex trading checklist sheet here and add the rules you need to tick before you enter a trade.

Reduce your trading volume/size.

Dropping your trade size in proportion to your account size and trading confidence may seem like it will take forever to recover from losses, but, it is the only way to save you from more losses.

Risking small amounts of money you are prepared to lose will not trigger the emotions that brought you here in the first place.

Always, trade with a stop loss.

This should be made the golden rule of trading.

Before entering any trade make forex trading profit and loss calculations. You can use our forex risk and reward calculator.

Forex trading, like every venture in life, has risks.

That why cars have breaks and why you never touch a hot saucepan with bare hands.

Every trade eventually ends. It may end when it hits your stop loss or take profit target or when you close it or when your account is wiped. Either way, it ends. You chose how.

The reservation most traders have with stop losses is that prices will often hit their stop loss and then go back in the original direction of their trade.

That is true. Because what novice traders don’t know is that market makers know areas most traders set stop-loss limits. And so they what they do, hunt.

Create a forex stop loss strategy around major support and resistance levels, that way; your stop-loss limits are set far away from where the rest of the herd sets theirs.

Accept loss.

It may seem counter-intuitive to say accept loss as a method of how to avoid losing money in forex.

But, even after you have done everything to reduce trading losses, they eventually happen. That’s how the market works.

It may be painful, but accept the loss and close the trade.

Don’t buy into the idea of forex trading without a stop loss.

Accept a small loss now, and waiting for the next trading opportunity.

PRO TIP.

Religiously keeping a trading journal will provide you all the insights and actions you need to take to reduce forex trading losses.

Your journal will be exact on what you need to do. It will show you what currency pairs or trading instruments are losers if it is time to reduce the trading volume – lot size, or change trading sessions and trading hours if your trades need wiggle room.

If you track every aspect of your trading, you will know what causes you to lose money. Fix it then.

What to do after a loss.

Pause trading, take a walk and sweat it out.

Most traders are tempted to jump back into the markets immediately after a loss. Bad idea.

Every other trade you place immediately after a loss – especially one that leaves a huge dent on your equity – will be an emotion triggered revenge trade trying to recoup your losses.

Emotionally charged traders are ready-meal for shark traders.

After such a loss, turn off the computer and take a walk.

Go out and release the emotional charge swirling inside you.

Go for a run, lift weights, hit a punching bag, do dishes, it doesn’t matter what you do, just release the steam.

Don’t just sit there jerking off as an escape, in a moment you will enter another trade.

Any activity that will make you sweat and transport your mind away from the loss will do just fine.

Move on, don’t dwell on the past.

Like moving through the stages of grief, dealing with trading loss has to reach a point where you just have to move on.

Stop playing back and whining over how much you have lost or could have made if the trade had gone your way.

Stop it. It’s a waste of your time and energy.

Forgive yourself if you have to, and then move on.

Until then, you are not ready to learn from the past.

Learn from your mistakes.

Every trading loss or mistake is only a mistake if you don’t learn from it.

You grow as a trader when you daily learn from your wins and losses.

I will bet you a dollar; you will learn more about yourself as an individual and as a trader from losses than from wins.

So, in a sober mind, go back to the section on how to reduce loss and learn.

Quit trading.

If you are hell-bent that there is a forex trading no loss trick you don’t know, then you are in the wrong business.

Through life we are told, winners never quit. That’s not entirely true. Winners know when to quit.

It takes a lot of will power to confront the psychological aspects of trading. A lot of strength to do the simple things successful traders do. And trust me, it may take a lot of money before you cross over to the top of the pyramid where the 1% hangout.

If you don’t have the muscle for this business. Quit.

There are certainly a billion other ways to make money out there. Trading may not be your thing.

Two things should never do after blowing a forex trading account.

After a heavy loss, a loss that empties your trading account don’t:

One, deposit more money before learning why you lost.

Two, go in debt to fund a trading account.

Don’t borrow money, don’t get a loan, and don’t sell your house, car, or asset to fund another trading account.

I’ve been there, it ends one way.

If you have not learned how to trade well, especially the trading psychology on how to reduce your trading losses, you will eventually lose any new capital you inject.

If you must continue trading, start from square one – learn then practice and practice – until you can turn a profit on a demo account.

Every forex broker gives a free demo account to practice. Use it.

Tickmill and XM go further and give new traders a $30 no deposit bonus on verified live accounts to trade with – risk-free.

Wrap-up on how to deal with forex trading loss

It’s good to visualize what you can do with the money you can make from forex trading.

You shouldn’t however, let this vision cloud your judgment when you sit behind a trading station.

Losses are part of forex trading, accept it, and deal with it. If you try to escape this truth by looking for a forex trading no loss robot, the markets will wake you, rudely.

Learning about yourself and the markets prepare you for certain losses in forex trading. Cherish it, love.

What are your forex trading loss stories? Share, with us in the comments below.