The world of trading is immensely vast, with a multitude of techniques and strategies available to traders. One of the most potent yet intriguing methods is the use of the shooting star candlestick pattern. This guide delves into this powerful trading tool, providing insights into its meaning, differences from similar patterns, reliability, and how to effectively use it in your trading strategy.

What is a Shooting Star Candlestick?

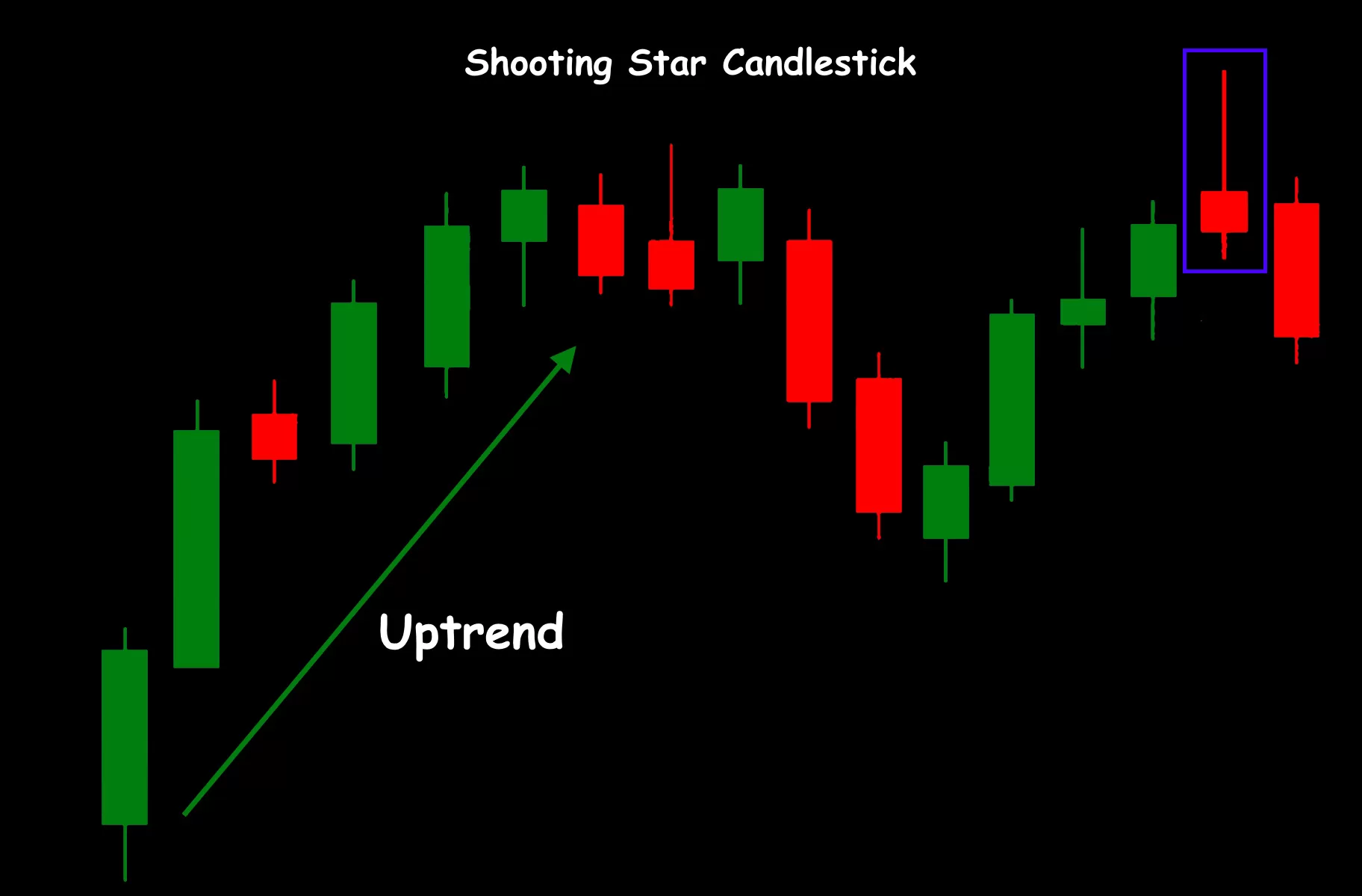

A shooting star candlestick is a single candlestick pattern predominantly found at the peak of an upward-trending market. It is a bearish reversal pattern that indicates a potential shift in market dynamics. The pattern is distinguished by a small body near the low with a long upper shadow, typically at least twice the length of the body, with little or no lower shadow.

The shooting star pattern’s formation is a dynamic process. It begins with the market opening higher and continues to climb, but eventually, the price is pushed down, closing near the opening price. The candlestick’s extended upper shadow is reminiscent of a shooting star streaking across the sky, hence its name.

Understanding the Shooting Star Candlestick Pattern

What Does the Shooting Star Candlestick Pattern Mean?

The appearance of the shooting star candlestick pattern in an uptrend is a warning signal for traders. It indicates that the upward trend may soon reverse, marking the potential end of the bullish market. The pattern suggests that the bulls may be losing control to the bears, leading to a potential downturn in prices.

The shooting star pattern’s appearance after an uptrend is significant. It indicates that despite the initial push from the bulls, the bears have overpowered them, pushing the price down again. If the next candlestick confirms this bearish bias, traders can consider this a sell signal.

Is a Shooting Star Candlestick Bullish or Bearish?

A shooting star candlestick is a bearish reversal signal. Its appearance suggests a weakening of the existing bullish sentiment and a potential shift toward a bearish market. However, it’s important to keep in mind that the shooting star pattern alone should not be the sole basis for trading decisions. It is best used in conjunction with other indicators for confirmation.

The Shooting Star vs. The Inverted Hammer

What is the Difference Between a Shooting Star and an Inverted Hammer?

Although the shooting star and the inverted hammer look similar, they signify contrasting market situations. The main difference lies in their position within the market trend.

The shooting star appears at the peak of an uptrend, signaling a potential bearish reversal. On the other hand, the inverted hammer is found at the bottom of a downtrend and indicates a possible bullish reversal. Essentially, while the shooting star is a bearish signal, the inverted hammer is a bullish signal.

Evaluating the Shooting Star Candlestick Pattern

How Reliable is Shooting Star Candlestick?

The shooting star candlestick is considered a reliable pattern for predicting potential market reversals. However, its effectiveness can be influenced by various factors, including the length of the upper shadow, the preceding trend, and the volume during the pattern’s formation.

While the shooting star pattern is a potent tool, its signals should always be confirmed with other indicators or patterns. Such cross-verification can help validate the signals generated by the shooting star, enhancing its reliability.

What Does Shooting Star Candlestick Indicate?

The shooting star candlestick indicates a potential market reversal from bullish to bearish. It signals that the market’s upward momentum is waning and the bears are gaining control. The pattern’s long upper shadow represents the failed attempt of the bulls to push prices higher, providing an opportunity for the bears to reverse the trend.

Utilizing the Shooting Star Candlestick Pattern

How to Use Shooting Star Candlestick Pattern

Trading with the shooting star candlestick pattern involves careful observation and interpretation. Here is a step-by-step guide:

- Identify the Pattern: Look for a small body with a long upper shadow and a short or non-existent lower shadow. The pattern should appear at the peak of an uptrend.

- Wait for Confirmation: The appearance of a shooting star is not an immediate sell signal. Wait for the next candlestick to confirm the bearish reversal. This could be a gap down or a long bearish candlestick.

- Set Stop Losses: Place a stop loss above the high of the shooting star pattern. This provides a safety net in case the price reverses and starts to climb again.

- Determine Take Profit Points: Use other technical indicators or tools, such as Fibonacci retracements or support and resistance levels, to determine potential take profit points.

Remember, the shooting star candlestick pattern is an indicator, not a complete trading strategy. It should be used along with other indicators and tools to make informed trading decisions.

In Conclusion

The shooting star candlestick pattern is a powerful tool in a trader’s arsenal. It provides valuable insights into potential market reversals, helping traders make informed decisions. However, like any trading tool, it should be used judiciously and in conjunction with other indicators and strategies. As always, practice and experience are key to successfully navigating the ever-changing market landscape.

Are you in need of capital for your trading account? The5ers has an instant funding program. Apply for exclusive offers.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025