Candlestick patterns play a pivotal role in Trading. They serve as the crux of technical analysis, providing traders with a graphical representation of price movements. The Stick Sandwich Candlestick Pattern is one of these patterns that offer traders key insights into potential market trends.

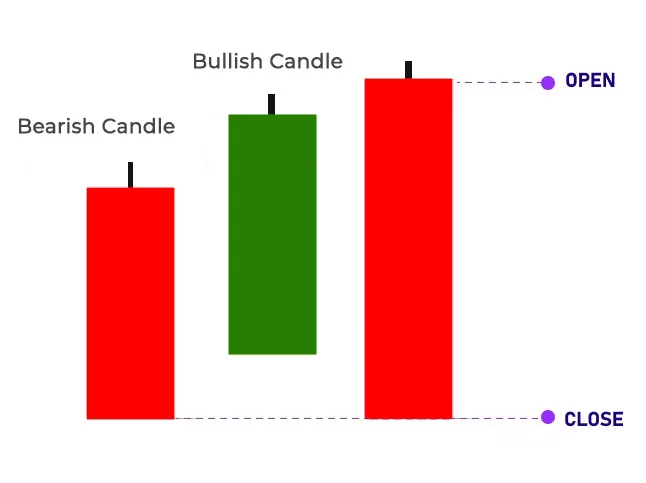

This pattern is a three-candlestick formation that appears to form a ‘sandwich’ on the trading chart. It is aptly named ‘Stick Sandwich’ due to its visual resemblance to a sandwich, with the middle candlestick being ‘sandwiched’ between two larger candlesticks on either side.

Characteristics of the Stick Sandwich Pattern

The Stick Sandwich Pattern is characterized by a specific arrangement of three candlesticks. The middle candlestick is of a different color than the two flanking candlesticks, which are the same color. The flanking candlesticks also have a larger trading range than the middle one.

The pattern can manifest in a bullish Stick Sandwich and a bearish Stick Sandwich.

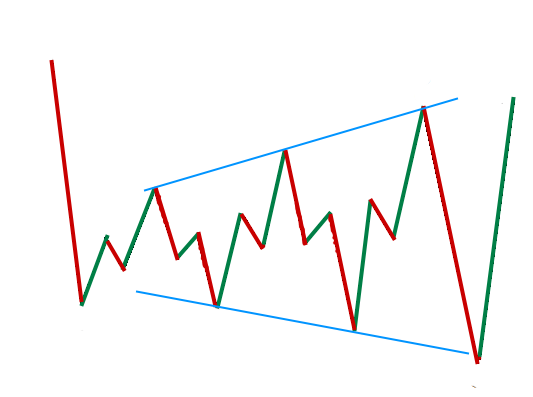

Bullish Stick Sandwich Pattern

A bullish Stick Sandwich pattern emerges during a downtrend. It consists of three candles, the first and third of which are red (or black), denoting a price drop, while the middle candle is green (or white), signifying a price increase. This pattern indicates the possibility of an impending bullish reversal.

Bearish Stick Sandwich Pattern

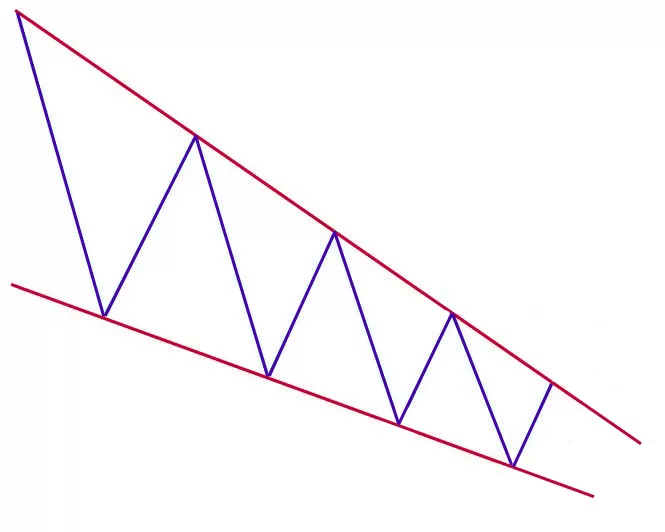

Conversely, a bearish Stick Sandwich pattern appears during an uptrend. In this pattern, the first and third candles are green (or white), representing a rise in prices, while the middle candle is red (or black), indicating a price decline. This pattern signals a potential bearish reversal.

Interpreting the Stick Sandwich Pattern

Understanding the Stick Sandwich Pattern requires traders to pay close attention to the colors of the candlesticks. The color of the middle candlestick is the opposite of the two surrounding candles.

In a bullish market, the bulls control the market until the formation of the second candle. This candle indicates that the buying pressure might be diminishing. Conversely, in a bearish market, the scenario is reversed.

The pattern’s significance is heightened by the two flanking candles close at the same level, establishing a strong support level. This hints at a high probability of a reversal.

Identifying the Stick Sandwich Pattern

To identify a Stick Sandwich pattern, traders need to look out for the following criteria:

- The presence of three consecutive candles

- The middle candle is of the opposite color to the flanking candles

- The flanking candles have a larger trading range than the middle candle

- The bullish Stick Sandwich pattern occurs during a downtrend, while the bearish pattern appears during an uptrend

Significance of the Stick Sandwich Pattern

The Stick Sandwich Pattern holds significant importance in trading as it can signal a potential reversal in market trends. The pattern provides a clear demarcation of support and resistance levels. If the following candle crosses above or below these levels, it confirms the pattern.

Moreover, the pattern’s reliability has been tested over time and has proven useful for both short-term and long-term trading opportunities.

Trading Strategies Based on the Stick Sandwich Pattern

Traders often use the Stick Sandwich Pattern as part of their trading strategies. In a bullish pattern, traders may consider entering the market at the closing price of the candle that confirms the pattern, with the stop loss being the support line. Conversely, in a bearish pattern, traders may consider entering the market at the closing price of the confirming candle, with the stop loss being the resistance line.

Limitations of the Stick Sandwich Pattern

While the Stick Sandwich Pattern can be a powerful tool in predicting potential market reversals, it is not without its limitations. The pattern’s effectiveness can decrease over time, especially if it is widely recognized and used by traders. Additionally, the pattern only provides information about possible price movements and does not guarantee a specific outcome.

Further Reading

Consider exploring additional resources to deepen your understanding of the Stick Sandwich Pattern and other candlestick patterns. Books such as “Japanese Candlestick Charting Techniques” by Steve Nison and “Candlestick Charting For Dummies” by Russell Rhoads offer in-depth insights into the world of candlestick trading.

Conclusion

Understanding the Stick Sandwich Candlestick Pattern can equip traders with valuable insights into potential market trends. However, it should not be used in isolation like all trading patterns. Traders should corroborate findings from this pattern with other technical analysis tools to ensure a more comprehensive and accurate trading strategy.

Remember, the key to successful trading lies in continuous learning and staying abreast of the latest market trends and patterns. Happy trading!

Optimize Your Trading with FundedNext: Unlock the potential to trade up to a $300,000 account and gain a share of up to 95% in profits.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025