Day traders think they can beat the market. The market has it’s ideas.

Are you thinking of starting to day trade? Don’t.

Trading and feel you are in a toaster? Stop.

If you are below the age of 40 and are to pick a career path right now.

You have a 90% chance of becoming a commercial pilot, while a day trader, your chances of breaking the glass ceiling to profit and success are lower than 25%.

A 2004 report based on data from the Taiwan stock market revealed that 20% of individual traders are successful.

If that is not bad enough, it shows a measly 0.03% of individual traders are consistently profitable.

The market does not give free cheese.

So, If the odds are stacked against you, why in your rational mind would you want to become a day trader?

If you decide to trade –like most of us have – do you have what it takes to march on to consistent profit?

Let’s get to the same page.

What is day trading?

Day trading is the purchase and sale of a trading instrument on the same day by an investor.

Who is a day trader?

A day trader then is an investor who practices day trading.

What do day traders trade?

Day traders trade leveraged products like CFDs, Stocks, Forex, Commodities, Metals, indices, Crypto, and anything else their broker supports.

Now that we are on the same page, here is why I think it is a terrible idea to become a day trader just because everyone is doing it or because you will make money fast.

Why the Odds of success are stacked against day traders?

Most traders start trading without the full knowledge and ability to balance the benefits, costs, and risks of their decisions.

They think they can make a million bucks in one day. Boy, are they wrong.

Like any career path, it takes time and money to go from novice to mastery.

You need tens of thousands of dollars and 2-3 years to complete an integrated flight training course to become a pilot.

Why would you a trader expect a million bucks day trading after two hours on YouTube?

Since most day traders don’t invest in hemming the right habits, the odds stack against them.

Eventually, this is what will happen to you in that bracket.

The Fate Of People Who Dare To Day Trade Blind

You will lose your money.

Do you ever see something like this on any broker’s website?

It is a risk disclaimer. Some brokers even include the percentage of retail traders who lose money with them.

Brokers don’t plaster disclaimers on their sites out of the goodness of their hearts. They have to oblige with regulation to keep their licenses.

I visited the websites of 104 brokers and found that, on average, 79% of retail investors lose money.

That means 2 out of 10 people who tell you that they trade forex or stock or crypto make money – the other eight lose everything they invest and more.

Just how much do individual investors lose by trading?

Too much was the astounding answer from a study of data from the Taiwan Stock Exchange two decades ago.

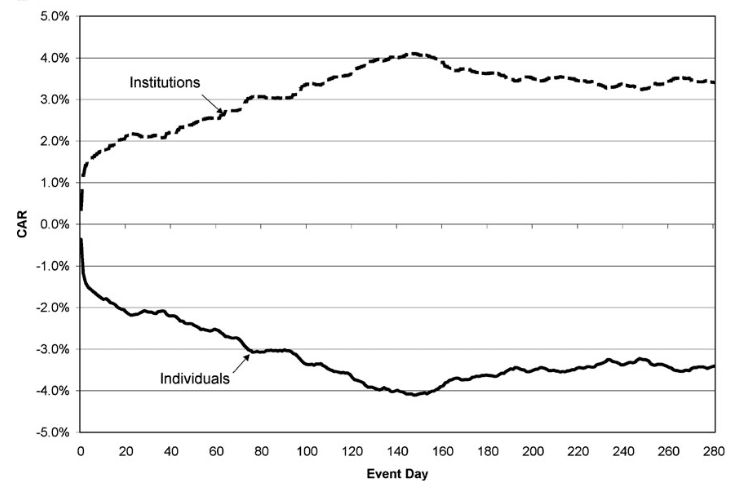

Juxtaposed, the performance of retail traders is like a mirror of institutional traders; only the retail traders are on the losing side.

It’s like the profits of institutional traders is what retail traders invest.

Dig deeper into data, and you see why the fate of anyone who attempts day trading is sealed.

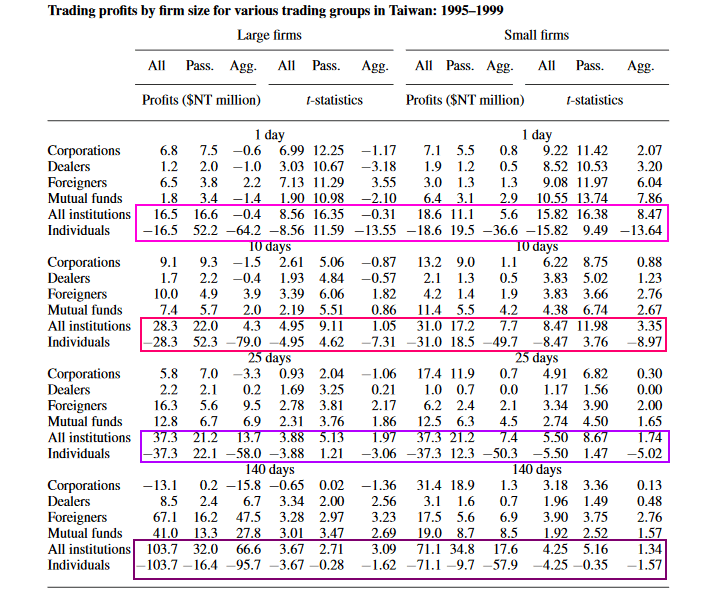

Buy and sell portfolios are constructed assuming a holding period of 1, 10, 25, and 140 trading days.

Profits are further partitioned based upon whether the order underlying the trade was aggressive or passive

Aggressive (Agg.) buy Orders are those placed where prices are above the most recent unfilled sell limit; those with prices below the most recent unfilled buy limit order are categorized as passive (Pass.).

When you look at the rows I’ve highlighted; Institutions profit by the same margin individual traders lose.

They close with a profit whether they close both passive and aggressive trades within a day or hold them for 140 days.

While for individual traders, it’s another story.

Aggressive retail traders, whichever way you look at the glass, lose.

Passive retail traders close their books with profits in the short to medium run – if they hold trades longer – they lose.

Overall, results combined, both passive traders and aggressive individual traders will lose in both the short and long run.

Institutions sustain profit in the short and long run through the provision of liquidity.

In the short run, institutions like banks and brokers bleed individual traders with Spreads and commissions.

And in the long run – they know where the price of a stock or currency should go because they know or create the underlying fundamental forces that move an instrument.

There you go again. Around the big boys, your odds of success as a day trader are next to zero.

Now it is easy to see the grim outlook of a retail trader or think the system is rigged.

Maybe it is.

But, far from it.

There is a rare breed of retail traders making a killing from day trading – the 20%.

The study, however, confirms what I mentioned earlier that most individuals dabbling in day trading don’t know what they are doing in the market.

They have no training in investments; many hold under diversified portfolios and routinely make poor trading decisions.

If you insist on day trading, I ask the question again.

Do you have what it takes to be among the 20%?

Moving on.

Day trading will make you sell your assets, borrow and lose more money than you could ever payback.

Once you get the test of the markets, there is almost no turning back until you are ruined or succeed.

After losing all your money.

You will pawn and dispose of every valuable in your names to fund another account.

When the markets suck it, you will run to family, friends, banks, loan sharks, and everyone else because you think you know why you lost the last time.

And this one time, you will earn enough to pay back the loan and the money you lost. False.

Scared money never makes money.

If you are wise, Flee, before it’s too late.

If you are wiser, don’t trade.

If you know what you are doing, tell me this.

Do you have what it takes to be among the 20%?

Day trading will mess with your mind and life in ways reserved for imagination.

Day trading doesn’t leave anyone who touches her unscathed.

It will mess with your emotions, mind, and money.

If you hold on to the idea of day trading – without what it takes to join the 20% long enough to rundown your capital (yours + loans) – you will wish the sky falls on you.

The sky will not fall on you, but Fear, Shame, Depression, Anger, Stress, Regret, and their cousins will.

If you are in a relationship, at this point, your partner will most likely ditch you.

If you were dumb to sell/mortgage your house or assets or quit your job to trade.

You will go from a state of euphoria to destitute.

At this point , if you don’t reign over your life you may resort to substance abuse and more self sabotaging copying antics.

And when you can’t take it anymore, some traders resort to suicide or disappearing.

Too sad.

But this is the somber story of 80% retail traders.

Forget the lifestyle “successful” traders depict on Instagram.

Do you have what it takes to be among the 20%?

Why will day trading continue to thrive even with the bad press?

Do you expect someone reading a warning that they risk losing all their capital to heed?

Ask cigarette smokers or drunken drivers.

Back in 1966, Tobacco companies were forced to plaster the warning that cigarette smoking is harmful to your health on their labels.

Hoping that that would scare smokers, on the contrary, tobacco companies grew.

Then, another genius was like a picture is worth a thousand words – so they plaster a chimney-dark rotten lung in cigarette labels.

No dent to the industry. Cigarette smoking continued to soar.

Regulation steps in with higher taxes, gazetting smoke zones.

The pressure is felt as several tobacco factories to the closed shop; in response, there was a wave of mergers and consolidation of the tobacco industry.

Now the worldwide population of cigarette smokers is expected to grow to 1.6bn by 2025.

That’s about 20% of the people in the world in 2025.

Cigarettes may be demerit goods, but they have an inelastic price demand.

An increase in price – an effect of regulation – causes a smaller percentage change in demand because smokers are addicts.

And so are most traders.

What lures most people to day trading is the grandiose ideas of the life that trading will afford them.

What keeps them is addiction.

That’s why no labels or even my attempt to paint a picture of the worst that could happen will hamper the growth of day trading.

Neither forcing brokers to declare how many investors lose money nor will the negative press stop people from trying their luck with day trading just as the Harvard business review confirms, warning labels on consumer goods barely impact their consumption.

Conclusion.

I know almost everyone enticing you to trade will water-down the fact that you will most likely lose your money.

Suppose you do open up a trading account after reading this. There’s no one else to blame but yourself.

If my attempts to dissuade you from trading only firms your resolve, then brace yourself.

The glass ceiling you have to break to dine with the top 20% ain’t a feat for the lax, weak and forgetful.

Work hard at it, and you may tell a story like how Michael Marcus turned $30,000 to $80 Million after losing his initial investment.

Get the right training, practice the proper trading habits, then, and only then can you reap the rewards of day trading.

Join the company of traders. Follow us on Twitter and Facebook.

Sign up to my mailing list. Unsubscribe at any time