Some traders try to avoid it.

Some deny it.

Some are so full of themselves to accept it.

But forex trading is about wins and losses.

For you to make money day trading, someone on the other end of the screen has to lose.

As a trader, you want to do more of the taking.

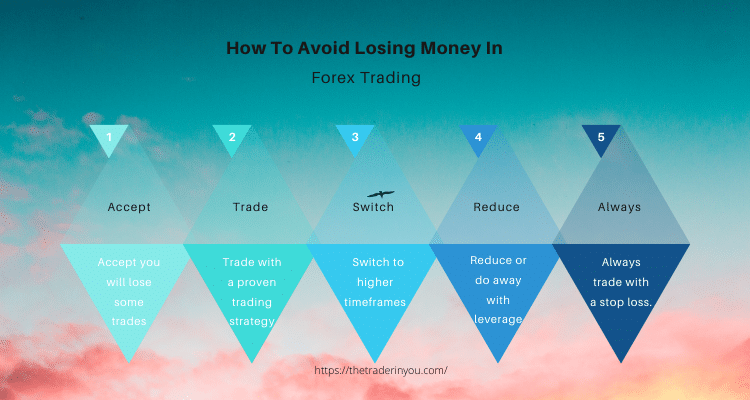

Step away from the herd that is always losing with these five practical tips you can apply to your trading that will help you avoid losing money in forex trading.

How To Avoid Losing Money In Forex Trading

- Accept you will lose some trades

- Trade with a proven trading strategy and a plan

- Switch to higher timeframes

- Reduce or do away with leverage

- Always trade with a stop loss.

1. Accept you will lose some trades.

You’ve heard the saying, what you fear most happens to you.

In forex, if you fear to lose money, you will lose all your money.

If you ground your mind to the fundamental truth that every trade you enter has an equal chance to turn a profit or a loss, then you should never struggle with taking a small loss.

Why would you let a loss run when you expected it in the first place?

The only way to avoid losing money in forex trading to other traders is to become comfortable with losing small.

When you are okay losing small, you start to trust the process confident of the big win around the corner.

2. Trade with a proven trading strategy and a plan

If you want to avoid losing money in forex trading, then you have to stop trading by the gut.

Without the rules of a tested trading strategy and a trading plan, you might as well throw your money in a pit.

A trading strategy is born from extended exposure to the markets.

If you are new to trading, you don’t need to trade for ten years to gain this exposure.

Just pull up any chart on any broker’s trading platform, and you can go ten years back in time to backtest your ideas based on historical chart patterns.

Or you can play with the demo accounts brokers give to practice and fine-tune your strategy.

As you fine-tune the strategy, you will discover the optimal conditions the strategy works best – these become the trading rules you follow.

Trading with a defined set of rules saves you from hopping in and out of the markets.

You learn to wait.

By simply waiting for your entry signals, you not only avoid exposure to trades that may turn to losers, but you also avoid losing money to spreads and commissions.

3. Switch to higher timeframes to avoid losing money in forex trading

I know it is exciting to trade the 5-minute charts.

But you are not here for excitement; you are here to make money.

Naturally, there are few trading opportunities on a higher timeframe, but when one comes, you can easily collect 100+pips.

By switching to a higher timeframe, you quickly notice:

- Your trading costs in spreads and commissions drop.

- You are disciplined and rational about your trades because

- Emotions don’t get to you.

Trading higher timeframes may be slow and boring, but like George Soros, one of the greatest traders of our times, says;

“If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.”

4. Reduce or do away with leverage to avoid losing money in forex trading

The lure of leverage is that you can grow $10 to a million dollars in one year.

Marketers make the most of this, promising new traders they can double their accounts in a day. But they are up for a surprise.

Leverage can build you a small fortune in a short time, but its evil side can plunder a trading account in seconds.

I’ve seen brokers promote leverage above 1:1000. On a standard account, someone with a $100 account can trade one standard lot.

With that trading volume, it takes 10pips on the wrong side of a trade to blow an account.

Do you want to avoid losing money in forex trading? Stay far away – far, far – very far away from leverage.

Not only does leverage magnify your losses, but it also breeds an emotional trader susceptible to making all other trading mistakes in an attempt to recover from past losses.

5. Always trade with a stop loss to avoid losing money in forex trading.

Unless you are a suicidal daredevil, you won’t go kayaking without a life jacket.

The same applies to trading. Never enter a trade without a stop loss.

If you are a student of the no stop loss doctrine – the markets will one day teach you that entering a trade without a defined amount you are willing to lose means your whole account balance is what you are ready to lose.

A stop-loss limit will always help you avoid taking heavy losses when the market goes against your trade idea. It is your life jacket in the turbulent forex market.

Last words on how to avoid losing money in forex trading

Becoming financially independent in life involves taking certain precautions, trading leveraged products requires a lot more precaution.

Trading has the potential to meet all your wildest dreams only if your account survives long enough.

You avoid trading losses by accepting small losses every now and then.

As long as you trade with a proven trading strategy with discipline, eventually, your big wins will make up for the small losses.

Do these five things, and I guarantee you will make a net profit from trading every month.

Do whatever it takes to survive today so that you can try again tomorrow.

- Why Your “Profitable Day” With Prop Firms Isn’t Always What It Seems - January 30, 2025

- Best Forex Brokers Supporting Airtel Money in Uganda - January 14, 2025

- Top Forex Brokers That Accept M-Pesa in Kenya: A Comprehensive Review - January 13, 2025