Candlestick patterns play a crucial role in identifying potential market reversals. One such pattern that traders often look out for is the Three Black Crows. This bearish reversal pattern consists of three consecutive bearish candlesticks that form within an uptrend. In this article, we will delve into the details of the Three Black Crows pattern, learn how to identify it and explore different strategies to trade it effectively.

What is the Three Black Crows Pattern?

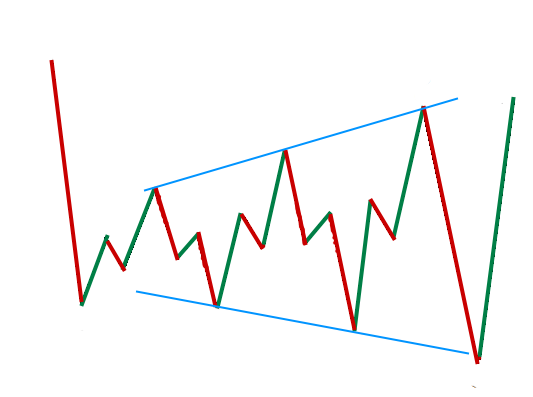

The Three Black Crows pattern is a visual formation that signals a potential reversal in an uptrend. It is characterized by three consecutive bearish candlesticks, each opening lower than the previous candle’s open.

These candles typically have long bodies and may have short or nonexistent upper shadows. The pattern suggests that the bears have taken control and are pushing the price downward, indicating a possible trend reversal.

How to Identify the Three Black Crows Pattern?

Identifying the Three Black Crows pattern is relatively straightforward. Here are the key criteria to look for:

- Uptrend: The pattern should appear within an established uptrend.

- Three Consecutive Bearish Candlesticks: Look for three consecutive bearish candlesticks with long bodies.

- Lower Openings: Each candlestick should open lower than the previous candle’s open.

- Short or Nonexistent Upper Shadows: The candles should have short or no upper shadows, indicating a strong bearish sentiment.

- Lower Closings: The closing price of each candlestick should be in the lower quadrant, suggesting sustained bearish pressure.

By carefully observing these criteria, traders can effectively identify the Three Black Crows pattern and use it as a potential trading signal.

How to Trade Forex Using the Three Black Crows Pattern?

Trading the Three Black Crows pattern requires a well-defined strategy. Here are the steps to trade this pattern effectively:

- Market Entry: Once you have identified the Three Black Crows pattern within an uptrend, enter a sell order beneath the low of the third candlestick. This ensures that you enter the market at a favorable price level.

- Stop Loss: Set your stop loss either above the high of the first candlestick or immediately above the high of the third candlestick. This helps limit potential losses if the market unexpectedly reverses.

- Profit Targets: Determine your profit targets based on your risk-reward ratio. Common ratios used in forex trading are 1:1, 1:2, 1:3, and 1:4. Consider taking profits as the price reaches predetermined levels to secure your gains.

It’s important to note that the Three Black Crows pattern is a reversal indicator. Therefore, it’s crucial to incorporate proper risk management techniques and use additional confirmation tools to increase the probability of successful trades.

Three Black Crows vs. Three White Soldiers

It’s important to differentiate the Three Black Crows pattern from its counterpart, the Three White Soldiers pattern. While both patterns indicate trend reversals, they occur in different market conditions.

- Three Black Crows: This pattern appears within an uptrend and signals a potential reversal to the downside. It consists of three consecutive bearish candlesticks.

- Three White Soldiers: In contrast, the Three White Soldiers pattern occurs within a downtrend and suggests a potential reversal to the upside. It consists of three consecutive bullish candlesticks.

Understanding the distinction between these patterns is crucial for traders to accurately interpret market signals and make informed trading decisions.

Pros and Cons of the Three Black Crows Pattern

Like any other trading pattern, the Three Black Crows pattern has its advantages and limitations. Here are some pros and cons to consider:

Pros:

- Easy to identify and trade due to its distinctive visual formation.

- Occurs frequently in various markets, including forex, commodities, and stocks.

- Suitable for trading reversals and entering new trends.

Cons:

- May produce false signals in consolidating market conditions.

- Trading on daily, weekly, and monthly timeframes can be costly.

- Late market entry may occur, leading to missed opportunities.

Given these pros and cons, it’s important for traders to exercise caution and employ additional indicators or analysis to validate the Three Black Crows pattern.

Conclusion

The Three Black Crows pattern is a powerful tool in a trader’s arsenal for identifying potential trend reversals in forex trading. By understanding how to identify and trade this pattern effectively, traders can enhance their decision-making process and capitalize on market opportunities. Remember to incorporate proper risk management techniques and use additional confirmation tools to increase the probability of successful trades.