The world of trading is filled with numerous patterns and indicators, each serving a unique purpose. One such significant pattern is the Three Outside Up pattern. This guide aims to provide an in-depth understanding of the Three Outside Up pattern and its role in forecasting potential bullish reversals in the market.

What is the Three Outside Up Pattern?

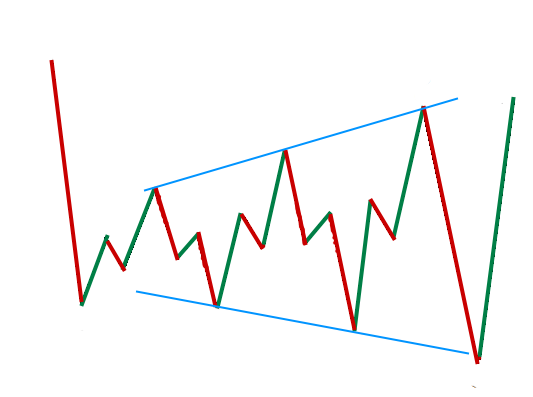

The Three Outside Up pattern is a three-candle reversal pattern mainly found in candlestick charts. This pattern often emerges at the end of a downtrend, signifying a possible bullish reversal. The formation of the Three Outside Up pattern signifies that the current bearish trend has exhausted its momentum and might be on the brink of a reversal.

The Construction of the Three Outside Up Pattern

The formation of this particular pattern requires a specific sequence of three candles. Let’s break down the construction of the Three Outside Up pattern:

- First Candle: The first candle in the sequence is a bearish one, characterized by a black or red body depending on the chart color scheme. This candle signifies a continuation of the ongoing downtrend.

- Second Candle: The second candle is a bullish one, engulfing the body of the first candle entirely. It is usually represented by a white or green body.

- Third Candle: The third and final candle in the sequence is also bullish, closing at a higher price than the second candle. This candle acts as a confirmation of the upcoming bullish reversal.

The Significance of the Three Outside Up Pattern

Traders and analysts extensively use the Three Outside Up pattern because of its potential to forecast bullish reversals. It signifies a shift in market sentiment from bearish to bullish, providing traders with a signal to possibly enter a long position.

The Psychology Behind the Three Outside Up Pattern

Understanding the psychology behind the formation of the Three Outside Up pattern can provide valuable insights into market behavior.

- First Candle Psychology: The formation of the first bearish candle continues the prevailing downtrend, indicating strong selling interest and boosting bearish confidence in the market.

- Second Candle Psychology: The second candle opens lower but reverses direction, crossing through the opening price of the first candle. This price action raises a red flag among bears, who may choose to take profits or tighten stop-loss orders due to the possibility of a market reversal.

- Third Candle Psychology: The third bullish candle confirms the potential reversal, as the security continues to post gains and closes above the range of the first candle. This increases bullish confidence and triggers buying signals, further confirmed when the security posts a new high on the third candle.

Trading with the Three Outside Up Pattern

The Three Outside Up pattern can serve as a primary buying signal for traders. However, it’s crucial to wait for confirmation before entering a trade. Confirmation can come in the form of a price breakout from the nearest resistance zone or a trend line.

How Frequently Does the Three Outside Up Pattern Occur?

While the Three Outside Up pattern is a common occurrence in the market, its frequency varies depending on the market conditions and the time frame being analyzed.

The Reliability of the Three Outside Up Pattern

The Three Outside Up pattern is considered a reliable indicator of a bullish reversal. However, it’s always recommended for traders to use this pattern in conjunction with other technical indicators or chart patterns to increase the accuracy of their predictions and minimize potential risks.

The Opposite of the Three Outside Up Pattern

The counterpart to the Three Outside Up pattern is the Three Outside Down pattern, which signals a bearish reversal. This pattern appears during an uptrend and consists of a bullish candle followed by two bearish candles.

Similar Candlestick Patterns to the Three Outside Up Pattern

The Three Inside Up pattern is quite similar to the Three Outside Up pattern. It also consists of three candles and signals a bullish reversal, but the second candle in the sequence is smaller and contained within the body of the first candle.

Conclusion

The Three Outside Up pattern is a valuable tool for traders looking to predict potential bullish reversals in the market. However, like all trading indicators, it’s essential to use it as part of a comprehensive trading strategy, incorporating other technical analysis tools and risk management techniques.

By understanding the construction, significance, and psychology behind the Three Outside Up pattern, traders can enhance their decision-making process and potentially increase their chances of successful trades.

Looking for capital for your trading account? Sign up with MyFundedFx and Manage Simulated Capital Up to $600k.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025