Tweezer Bottoms, a term often heard in the trading realm, is a technical indicator signaling a bullish reversal pattern. This article will guide you through the understanding of this market pattern, its significance, and ways to effectively leverage it in your trading strategy.

What are Tweezer Bottoms?

Tweezer Bottoms is a type of candlestick pattern that typically appears at the end of a bearish trend, indicating a possible reversal toward a bullish movement. They are named so due to their resemblance to a pair of tweezers, with two candles having matching lows.

Spotting Tweezer Bottoms

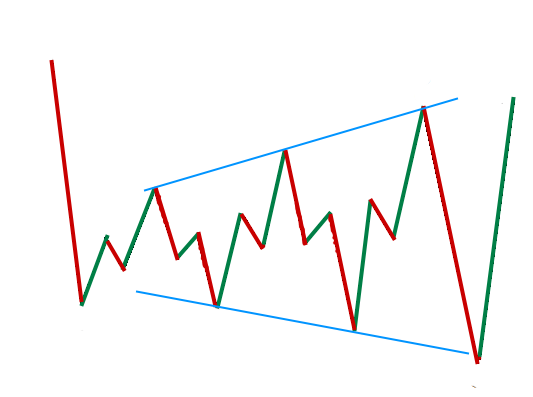

To identify Tweezer Bottoms, you must observe a clear downtrend, followed by two consecutive candles with the same low point. The color and shape of the candles are not as important as the matching lows, which indicate a strong support level. This is where the sellers are unwilling to push the price any lower, resulting in the bulls taking control and pushing the price up.

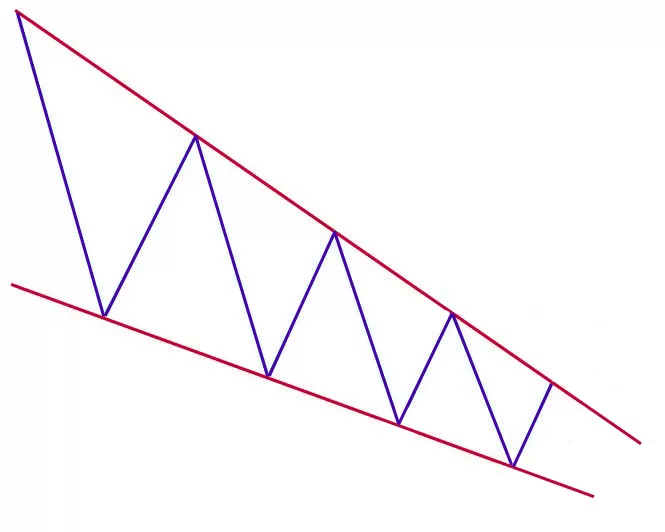

The Structure of Tweezer Bottoms Pattern

The structure of the Tweezer Bottoms pattern is quite simple. It usually consists of two candles – the first one being bearish (red) and the second one being bullish (green). Both these candles should have the same or nearly the same low points.

Understanding the Tweezer Bottoms Pattern

The Tweezer Bottoms pattern holds crucial insights into market dynamics. It signifies that the market, which was previously driven by a bearish sentiment, is now likely to switch to a bullish trend.

The Significance of Tweezer Bottoms

When the Tweezer Bottoms pattern appears at the end of a downtrend, it indicates that the sellers have lost their grip on the market and the buyers are now in control. This pattern is a strong signal for traders to potentially initiate a long position as a bullish reversal is on the horizon.

The Reliability of Tweezer Bottoms Pattern

The reliability of the Tweezer Bottoms pattern increases if it appears at the market lows or if it is followed by another bullish reversal pattern. For instance, if the Tweezer Bottoms pattern is followed by a Bullish Engulfing or Piercing Line pattern, it further enhances the reliability of this bullish reversal signal.

How to Identify Tweezer Bottoms Candlestick Patterns

Identifying Tweezer Bottoms involves careful observation of candlestick patterns. Here are the steps:

- Observe a clear downtrend in the market.

- Look for two consecutive candles (of any color) with the same low point.

- Ensure the first candle is a bearish (red) one, followed by a bullish (green) candle.

- Both candles should have the same or nearly the same low points.

Tweezer Bottoms in Trading Strategy

Tweezer Bottoms can play a significant role in devising an effective trading strategy. When you spot a Tweezer Bottoms pattern, it may be a good time to consider opening a long position.

Preparing for Trade Entry

Once you’ve identified a potential Tweezer Bottoms pattern, you can prepare for a trade entry. This can be done manually or by setting up a pending order.

Setting Stop Loss

A stop loss should ideally be placed 2 pips below the low of the Tweezer Bottoms. This can be adjusted based on your risk tolerance.

Setting Take Profit

Your take-profit point should be set at the nearest market structure or resistance level.

Caution: While the Tweezer Bottoms pattern is a reliable indicator of a bullish reversal, it’s not always foolproof. It’s always advisable to confirm the formation of this pattern with other indicators or technical analysis tools.

The Tweezer Bottoms pattern can be an extremely useful tool for traders. It provides a reliable signal of a potential bullish reversal, helping traders make informed decisions. However, like any trading tool, it should be used with other indicators and analysis methods for the best results.

Final Thoughts

Understanding and effectively leveraging Tweezer Bottoms can significantly enhance your trading strategy. However, it’s vital to remember that no single indicator can guarantee success. Consider multiple indicators and employ sound risk management practices to ensure trading success. Happy trading!

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025