The Upside Gap Two Crows pattern is a unique candlestick pattern that can appear in an established uptrend, providing a warning of a possible trend reversal. It shares similarities with the Evening Star and Engulfing patterns but has distinct characteristics that set it apart.

Understanding the Upside Gap Two Crows Pattern

The Upside Gap Two Crows pattern consists of three candlesticks and is typically observed in an uptrend. It indicates a potential shift from bullish to bearish market sentiment. This pattern is relatively rare but carries significant implications for traders.

Structure of the Upside Gap Two Crows Pattern

To identify the Upside Gap Two Crows pattern, we need to examine the characteristics of each candlestick in the formation. Here is a breakdown of the construction:

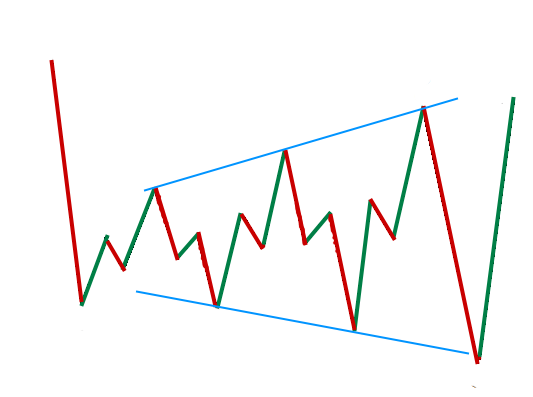

- The first candlestick is a large, bullish candlestick with a green or light-colored body. It signifies the continuation of the uptrend and demonstrates the strength of the bulls.

- The second candlestick is a smaller, bearish candlestick that opens with an upside gap above the previous candlestick’s body. It indicates a weakening of the bullish momentum.

- The third candlestick is another bearish candlestick that engulfs the previous candlestick’s body. It opens above the second candlestick but closes below its body. The third candlestick may or may not penetrate the first candlestick’s body.

Interpreting the Upside Gap Two Crows Pattern

The Upside Gap Two Crows pattern, provides valuable insights into market sentiment and potential trend reversals. Here’s what the pattern tells us:

- The first candlestick represents the prevailing uptrend, showing the strength of the bulls.

- The second candlestick signals a weakening of the bullish momentum, even though it opens with an upside gap. It indicates a shift in sentiment.

- The third candlestick confirms the bearish reversal as it engulfs the previous candlestick’s body and closes below it. The larger the body of the third candlestick, the stronger the bearish implications.

Trading Strategies with the Upside Gap Two Crows Pattern

Traders can utilize the Upside Gap Two Crows pattern to make informed trading decisions. Here are some strategies to consider:

- Short Selling: Once the third candlestick closes below the midpoint of the first candlestick’s body, traders can initiate a short position, anticipating a bearish trend reversal.

- Confirmation and Entry: To increase the probability of a successful trade, traders can wait to confirm the pattern. This confirmation can occur when a subsequent candlestick closes the window below the second candlestick. Traders can then enter a short sell order on the open of the next candlestick.

- Protective Stop-Loss and Profit Targets: As with any trade, it is essential to manage risk. Traders can place a protective stop-loss order above the high of the Upside Gap Two Crows pattern to limit potential losses. Profit targets can be set based on a defined risk/reward ratio, Fibonacci retracement levels, or other technical indicators.

Psychology of Upside Gap Two Crows Pattern

Various factors can influence the significance of the Upside Gap Two Crows pattern. Consider the following:

- Location on the Chart: The pattern’s placement in relation to trend lines, pivot points, support, and resistance levels can provide additional context and increase its significance. For example, if the pattern appears near an upper trendline or resistance level, it suggests a potential failure to break these levels, strengthening the bearish case.

- Market Conditions: Traders should consider the overall market conditions and indicators. If the pattern occurs at an all-time high, it may suggest an overbought market. Combining the Upside Gap Two Crows pattern with oscillating indicators like the RSI can provide further confirmation of a potential trend reversal.

Conclusion

The Upside Gap Two Crows pattern is a bearish reversal pattern that can occur in an established uptrend. It consists of three candlesticks and warns traders of a potential shift in market sentiment. By understanding the construction and interpreting the implications of this pattern, traders can develop effective strategies for short selling and managing risk.

However, it is crucial to consider the pattern within the broader market context and use confirmation techniques and risk management tools to increase the probability of successful trades.