Trend lines are one of the foundational tools for anyone interested in technical analysis. They help traders and analysts understand and visualize the direction, strength, and momentum of a price movement. Whether you’re a novice trader or a seasoned professional, mastering the art of drawing accurate trend lines can greatly enhance your market analysis.

What is a Trend Line?

A trend line is a straight line drawn on a price chart that connects multiple price points. Typically, this line is drawn to connect lows (in an uptrend) or highs (in a downtrend) or in ranging/sideways markets over a certain period, showcasing the general price trajectory. The main idea is that prices tend to move in trends, and these lines help in identifying and confirming these trends.

There are three main types:

- Uptrend Line: Another term for the bullish trend line, the uptrend line showcases a market where every successive peak and trough is higher than the ones found earlier. It represents a prolonged period where buyers outnumber sellers, pushing prices higher over time.

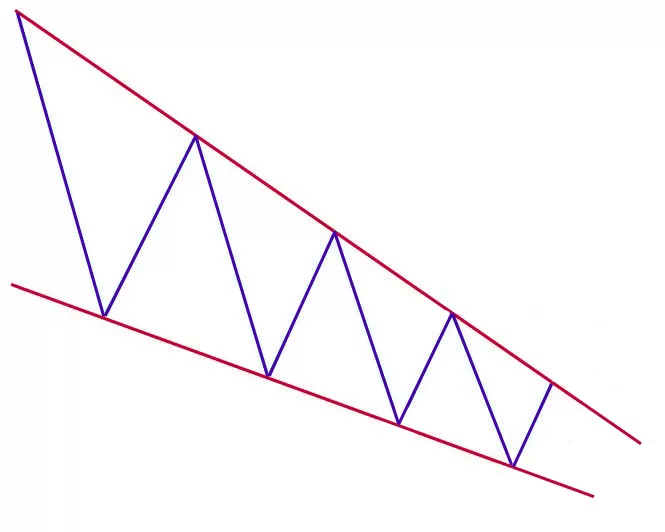

- Downtrend Line: Synonymous with the bearish trend line, a downtrend line reveals a market in which each subsequent peak and trough is lower than the previous ones. This is indicative of a phase where sellers dominate the market, causing prices to drop consistently.

- Sideways Trend Line: Unlike the bullish/bearish or uptrend/downtrend lines, a horizontal trend line doesn’t indicate an upward or downward direction. Instead, it represents a state of equilibrium between buyers and sellers, leading to a range-bound or sideways market.

This type of trend line can be drawn connecting multiple highs (forming resistance) or lows (forming support) at approximately the same price level. A breach above or below a significant horizontal trend line can often lead to a strong directional move, as it indicates a shift in the balance between buying and selling forces.

How to Draw Trend lines

Drawing trend lines might seem straightforward, but it requires a keen eye and understanding of the market dynamics. Here’s a step-by-step guide:

- Select Your Chart Type: Start with a clean candlestick or bar chart.

- Identify Significant Highs and Lows: These are the peaks and troughs where the price has clearly reversed.

- Connect the Dots: For an uptrend, connect the successive higher lows. For a downtrend, connect the successive lower highs. Ensure you have at least two touching points for a valid trend line.

- Extend the Line: This will allow you to see potential future areas of support or resistance.

- Adjust Regularly: Markets evolve, and so do their trends. Regularly revisit and adjust your trend lines to accommodate new data.

How Not to Draw Trend Lines?

Drawing trend lines might seem like a simple task, but even seasoned traders sometimes make mistakes in their approach. Properly drawn trend lines can offer valuable insights into market dynamics, but inaccuracies can lead to misguided conclusions and poor trading decisions. Here’s a breakdown of what not to do when drawing trend lines:

Common Mistakes

- Ignoring the Most Relevant Points: Some traders make the mistake of connecting random highs and lows without considering the significance of those price points. It’s crucial to prioritize major swing highs or lows rather than minor fluctuations.

- Drawing Over Short Timeframes: Especially for longer-term investors, drawing trend lines over very short timeframes (like a few minutes or hours) can be misleading. It’s often more beneficial to capture the broader trend over days, weeks, or even months.

- Relying on Too Few Touch Points: A valid trend line should have at least two touch points, but the more the better. Relying on a trend line drawn from only two closely spaced points can be precarious.

Overfitting

Overfitting refers to a situation where a trader forces a trend line to fit the price data, even if it doesn’t naturally align with significant highs or lows. This can arise from:

- Bias Confirmation: Traders might sometimes have a preconceived notion about where the market is headed. They might draw trend lines that confirm their biases rather than truly reflecting market behavior.

- Ignoring Data Breaches: If prices frequently breach a trend line, it’s likely not a valid representation of the trend. However, some traders might ignore these breaches, insisting that their trend line is accurate.

Too Steep or Too Flat

- Excessively Steep Trend Lines: While steep trend lines might indicate strong momentum, if they’re too steep, they may not be sustainable. Prices moving vertically might signal an overextended market, which can reverse abruptly.

- Overly Flat Trend Lines: Trend lines that are almost horizontal might not provide much insight into the prevailing trend, especially if the market is in a consolidation phase. They might simply be echoing what horizontal support and resistance levels already show.

How To Trade Different Types of Trend Lines

Trend lines are pivotal in determining potential trading opportunities. However, recognizing these opportunities requires understanding the behavior associated with different types of trend lines and their associated patterns. Here’s how traders typically approach various trend line scenarios:

Breakout and Breakdown

- Breakout (Above the Trend Line):

- Bullish Breakout: When the price breaks above a bearish trend line (or downtrend line), it signifies potential bullish momentum. Traders may consider entering a long position upon a confirmed breakout, especially if it’s accompanied by high trading volume.

- Bearish Breakout: A price breakout below a horizontal support trend line can be seen as a bearish signal, hinting at further price decline.

- Breakdown (Below the Trend Line):

- Bearish Breakdown: If the price falls below a bullish trend line (or uptrend line), it could be a sign of emerging bearish momentum. Traders might consider short selling or exiting existing long positions.

- Bullish Breakdown: A price breakdown above a horizontal resistance trend line suggests a potential bullish momentum.

Reversal Patterns

These patterns indicate a potential change in the prevailing trend:

- Head and Shoulders: This is typically a bearish reversal pattern that appears after an uptrend. The pattern consists of three peaks: the left shoulder, the head (the highest peak), and the right shoulder. A trend line (neckline) is drawn at the bottoms of the left and right shoulders. A break below the neckline signals a potential bearish reversal.

- Inverse Head and Shoulders: Opposite to the Head and Shoulders pattern, this one appears after a downtrend and signals a bullish reversal. A break above the neckline (drawn at the peaks of the shoulders) can be a buying opportunity.

- Double Top: This bearish reversal pattern forms after an uptrend, appearing as two peaks at roughly the same price level. A break below the support level (valley between the peaks) confirms the pattern.

- Double Bottom: A bullish counterpart to the Double Top, it forms after a downtrend and looks like a ‘W’. A break above the resistance level (peak between the two bottoms) validates the pattern.

Continuation Patterns

These patterns suggest that the prevailing trend is likely to continue:

- Triangles (Ascending, Descending, and Symmetrical): These are formed by converging trend lines. The direction of the breakout (above or below the triangle) can hint at the continuation direction.

- Flags and Pennants: These patterns appear as small consolidation ranges after a strong price movement (the flagpole). The breakout direction from the flag or pennant usually aligns with the previous trend, indicating its continuation.

- Wedges: Rising wedges (formed in uptrends) and falling wedges (formed in downtrends) can break either way, but they often result in a reversal. However, the direction of the breakout should be monitored for trading confirmation.

How Effective is Trendline Trading?

Trendline trading is a popular method among technical analysts and traders. Its effectiveness can be assessed by examining its reliability, probability, and the associated risk-reward dynamics:

Reliability

- Historical Significance: Trend lines are drawn by connecting significant highs or lows. If a trend line has been tested multiple times without being broken, it gains more validity and is deemed more reliable.

- Duration: The longer a trend line has been intact, the more reliable it becomes. For instance, a trend line spanning several months or years is generally considered more reliable than one drawn over a few days or weeks.

- Confluence with Other Indicators: If a trend line coincides with other technical indicators, such as moving averages, Fibonacci retracement levels, or support/resistance zones, its reliability is enhanced.

Probability

- Number of Touch Points: A trend line that has been touched or tested numerous times without being broken increases the probability of the trend continuing.

- Breakout Confirmation: A trend line breakout (or breakdown) accompanied by high volume or backed by other technical or fundamental factors can increase the probability of a sustained move in the breakout direction.

- False Breakouts: It’s essential to be cautious as markets sometimes show false breakouts only to revert to the prevailing trend. Waiting for confirmation, like a candlestick close beyond the trend line or supportive volume, can improve the probability of a genuine breakout.

Risk and Reward

- Clear Stop-Loss Points: One of the advantages of trendline trading is that it provides clear levels for setting stop-loss orders. For instance, if trading a bullish breakout above a downtrend line, a trader can set a stop-loss just below the trend line.

- Objective Target Setting: Trend lines, especially when combined with chart patterns, can provide objective price targets. For instance, the height of a triangle pattern can be projected from the breakout point to estimate a potential target.

- Risk Management: The defined boundaries of trend lines help traders manage their risk by determining position sizes based on the distance to their stop-loss levels.

Trendlines vs. Channels

Both trendlines and channels are foundational tools in technical analysis, helping traders identify and understand prevailing market trends and potential future price movements. However, they serve slightly different purposes and have distinct characteristics. Let’s dive into their differences and the concepts of parallel lines, bounces, breaks, and range trading associated with them.

1. Parallel Lines

- Trendlines: A trendline is a straight line that connects a series of higher lows in an uptrend or lower highs in a downtrend. It represents the trajectory of a trend and can act as support in an uptrend or resistance in a downtrend.

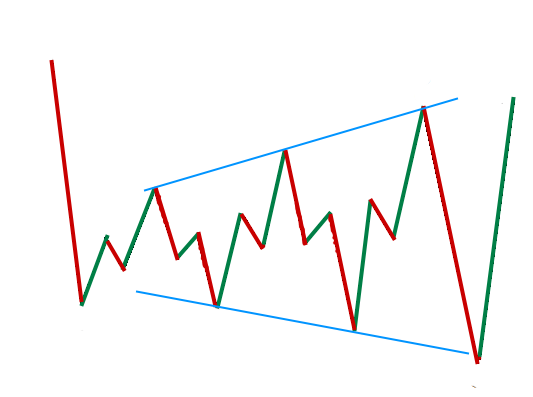

- Channels: Channels consist of two parallel trendlines. The upper trendline connects the highs, and the lower one connects the lows. Together, they encapsulate the price range within which the asset is trading. The space between these lines is the ‘channel’, which can be ascending, descending, or horizontal(side ways/ ranging)

2. Bounces and Breaks

- Trendlines: When prices approach a trendline, two scenarios can occur: a ‘bounce’ or a ‘break’. A bounce off a trendline reaffirms its validity as a support or resistance level. Conversely, a break through a trendline may signify a potential trend reversal or weakening of the current trend.

- Channels: With channels, traders look for bounces between the two parallel lines. A bounce off the upper line (in a descending channel) or the lower line (in an ascending channel) can provide trading opportunities. A break outside the channel, especially if confirmed with volume or other indicators, can suggest the beginning of a new trend or a significant trend continuation.

3. Range Trading

- Trendlines: While trendlines primarily help identify the direction of a trend, they can also aid in range trading when the market is moving sideways, and no clear trend is established. In such cases, a horizontal trendline can be drawn at support and resistance levels, forming a “range”.

- Channels: Channels are particularly beneficial for range traders. When prices move within a well-defined channel, traders can buy at or near the channel’s lower boundary (support) and sell at or near its upper boundary (resistance). This strategy is commonly referred to as “channel trading” or “range trading”.

Points to Note:

1. Importance of Practice

- Hands-On Experience: Like any skill, mastering the art of drawing and interpreting trendlines and channels comes with practice. Reading about them is one thing, but applying them on real charts, in real-time scenarios, solidifies understanding.

- Mistakes are Instructors: As beginners, traders might occasionally misinterpret signals or draw inaccurate trendlines. These mistakes, when reflected upon, offer invaluable lessons that textbooks and guides can’t.

2. Combining Tools

- Holistic Analysis: Relying solely on trendlines or channels can be limiting. The financial markets are influenced by myriad factors, and no single tool can capture all its nuances.

- Synergy of Indicators: Combining trendlines with other technical indicators, such as moving averages, RSI, MACD, or volume, can provide more robust signals. For instance, a breakout from a channel confirmed by a surge in volume or an RSI moving into overbought/oversold territory can increase the confidence in that signal.

3. Continuous Learning

- Ever-Evolving Markets: Financial markets are dynamic. New patterns emerge, old ones evolve, and sometimes, established paradigms shift. A successful trader remains adaptable and open to learning.

- Stay Updated: As technology and trading methodologies advance, there are always new tools, indicators, and strategies emerging. Engaging in webinars, courses, seminars, and reading new literature can help traders stay ahead of the curve.

Want to perfect your skills in drawing Trend Lines on a demo/real account? Sign up with HotForex.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025