Price action, a popular trading methodology, is the study of price movement over time. Traders across the spectrum, from retail traders to institutional traders and hedge fund managers, use price action strategies to predict the future direction of a security or market.

What is Price Action?

Price action is the behavior of price changes, which is most easily observed in markets with high liquidity and volatility. However, it applies to any product that is bought or sold in a free market. It’s a form of technical analysis that focuses on a market’s current price in relation to its past or recent prices, as opposed to ‘second-hand’ values that are derived from that price history.

In essence, price action trading does not concern itself with the fundamental factors that influence a market’s movement. Instead, it focuses predominantly on the market’s price history, i.e., its price movement across a period of time.

What are the Rules of Price Action Trading?

Price action trading relies on understanding and interpreting raw price data without the heavy reliance on indicators. Well, there isn’t a strict set of universally accepted “rules” for price action trading, but there are several guiding principles and best practices that traders often follow:

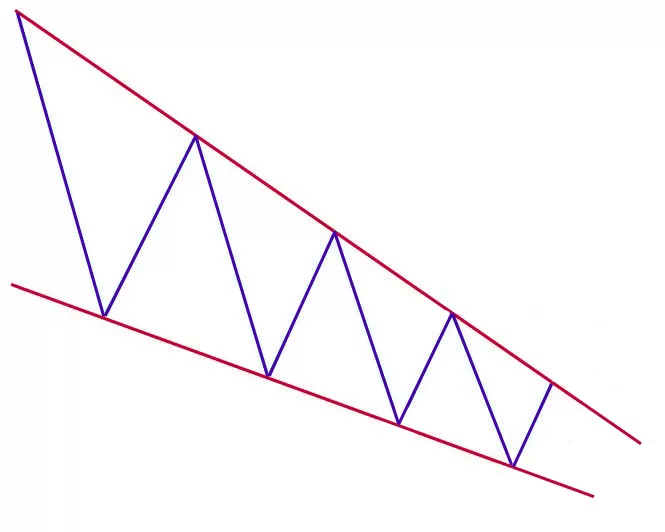

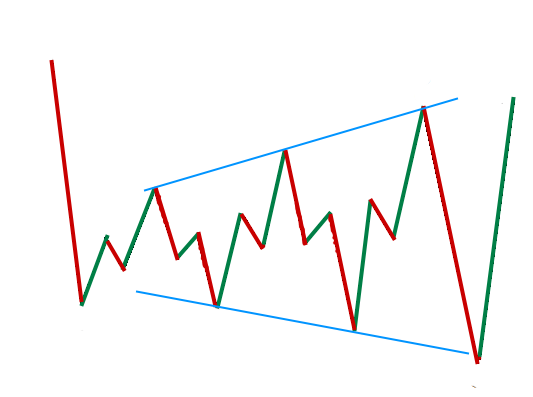

- Understand the Market Structure: Before trading, understand if the market is trending or ranging. This can be done by identifying higher highs and higher lows for uptrends or lower highs and lower lows for downtrends.

- Support and Resistance Levels are Key: Always identify major support and resistance levels. They act as barriers for price movement and can serve as entry or exit points.

- Prioritize Recent Data: While historical price data is essential, recent price action is usually more relevant. The market’s reaction to recent levels, trends, and patterns often provides clearer signals.

- Wait for Confirmation: Instead of preemptively acting on a setup, wait for the market to confirm your analysis. This could be in the form of a particular candlestick pattern completion, a breakout, or a bounce from a support/resistance level.

- Keep it Simple: Don’t overcomplicate charts with too many lines, patterns, or annotations. A cluttered chart can lead to analysis paralysis.

- Risk Management is Essential: Always use stop losses and take profits. Determine in advance the amount or percentage of your portfolio you’re willing to risk on a single trade.

- Stay Consistent with Timeframes: If analyzing on a daily timeframe, make your trading decisions based on that. Jumping between timeframes can lead to confusion and mixed signals.

- Avoid Overtrading: Just because you see a pattern doesn’t mean you should trade it. Quality over quantity is a good rule of thumb. Look for high-probability setups.

- Educate and Practice: Continually educate yourself about new price action patterns and strategies. Use demo accounts to practice without risking real money.

- Stay Objective and Disciplined: It’s easy to become emotionally attached to a trade, especially if you’ve done extensive analysis. However, the market doesn’t always move as expected. Stick to your strategy, and if the trade goes against you, have the discipline to exit.

- Review and Learn from Trades: After each trade, review what went right and what went wrong. This post-analysis can be a powerful learning tool.

- Understand that Every Trade Won’t Be a Winner: Even the most experienced price action traders face losses. It’s part of the trading journey. What’s crucial is to have a strategy that ensures wins outweigh losses over time.

Note that many traders overwhelm themselves by inundating their charts with a plethora of technical indicators, leading to over-analysis. This style of trading is often dubbed as ‘pristine chart trading‘, ‘bare chart trading‘, or ‘unadulterated trading‘, emphasizing the reliance solely on price movements.

In the pure, minimalist world of Price Action Trading, traders operate without indicators on their charts, and external news or economic events don’t influence their trading choices.

TheTraderinYou

Price Action Patterns: Strategies for Price Action Trading

Price action patterns are specific formations or sequences of candlesticks (or bars) on a price chart that traders use to predict potential future price movements. These patterns reflect the collective psychology of market participants at any given time. By recognizing and understanding these patterns, traders can make more informed decisions about entries, exits, and potential market direction. Here are some of the most commonly observed price action patterns:

- Pin Bar

- A candle with a small body and a long tail or wick. The long wick indicates a rejection of prices at that level.

- When it appears at the bottom of a downtrend, it’s called a ‘Hammer’ and indicates a potential bullish reversal.

- When it appears at the top of an uptrend, it’s called a ‘Shooting Star’ and suggests a possible bearish reversal.

2. Inside Bar:

- A candle that is completely contained within the range of the preceding candle.

- It indicates a period of consolidation and can be a sign of a continuation or reversal.

3. Engulfing Pattern:

- Consists of two candles. The second candle “engulfs” the body of the first.

- A bullish engulfing occurs after a downtrend and indicates a potential reversal upwards.

- A bearish engulfing appears after an uptrend and indicates a potential reversal downwards.

4. Double Top and Double Bottom:

- Double Top: After an uptrend, the price reaches a peak twice and fails to break higher, signaling a potential bearish reversal.

- Double Bottom: After a downtrend, the price reaches a low point twice and fails to break lower, signaling a potential bullish reversal.

5. Head and Shoulders & Inverse Head and Shoulders:

- Head and Shoulders: After an uptrend, the pattern forms three peaks — the middle one (head) being the highest and the two others (shoulders) being roughly equal. It signals a potential bearish reversal.

- Inverse Head and Shoulders: It’s the opposite of the regular pattern and indicates a bullish reversal after a downtrend.

Is Price Action Better than Indicators?

The debate between relying on Price Action versus Indicators in trading is longstanding and varies among traders based on their preferences, strategies, and trading styles. Both approaches have their strengths and weaknesses.

PRICE ACTION

Advantages

- Simplicity: Price action provides a “clean” view of the market, without the clutter of numerous indicators. This can make it easier for some traders to analyze and interpret real-time market sentiment.

- Relevance: Since price action is based directly on price data, it’s always relevant. Patterns like support and resistance levels, candlestick formations, and trendlines are directly derived from market activity.

- Flexibility: Price action can be applied across various timeframes and markets.

Disadvantages

- Subjectivity: Interpretation of price action can be more subjective than using standardized indicators. Two traders might interpret the same price pattern differently.

- Requires More Experience: To trade effectively using price action, a trader often needs significant experience and skill to recognize and act on patterns reliably.

Vs

INDICATORS

Advantages

- Standardization: Indicators provide standardized calculations, which means that, given the same input and settings, an indicator will provide the same output for all traders.

- Diversity: There are numerous indicators available, each designed to interpret different facets of the market, such as trend strength (e.g., ADX), momentum (e.g., RSI), and volume (e.g., OBV).

- Objective Signals: Many indicators can provide objective buy or sell signals based on predefined criteria.

Disadvantages

- Lag: Most indicators are lagging, meaning they’re based on past price data. This can lead to late entry or exit signals in fast-moving markets.

- Potential for Over-reliance: Some traders might rely too heavily on indicators and overlook the underlying price action.

- False Signals: No indicator is perfect. They can and do produce false signals, leading to potential losses.

Many successful traders combine both methods. For example, they might use price action to identify key support and resistance levels and then use indicators to confirm entry or exit signals.

It’s essential for traders to experiment with both methods and determine which (or a combination of both) aligns best with their personal comfort and yields the best results in their hands.

Conclusion

Price action or rather Price Action trading is like deciphering the market’s heartbeat, where each trend and pattern narrates the collective psyche of its participants. It’s akin to choosing an acoustic guitar over a synthesizer; both can create melodies, but one offers an unfiltered connection. This approach is not just a method but an art, allowing traders to synchronize with the market’s rhythm.

Beyond potential profits, it offers a profound understanding of market dynamics. Amidst the allure of modern tools, the raw simplicity of price action remains unmatched, giving traders a direct line to the market’s whispers and roars.

FAQs

What is the best price action indicator?

While “price action” by definition involves the study of raw price movement without the reliance on traditional indicators, many traders use tools and indicators that can help highlight or complement their price action analysis. When we talk about a “price action indicator,” we’re typically referring to a tool that doesn’t override or replace price action but works in tandem with it.

Here are some popular tools and indicators that traders often use alongside price action:

- Moving Averages: One of the simplest and most widely used indicators. It smoothens price data to create a single flowing line, which can help traders identify the direction of the trend. The two most common types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). Moving averages can also act as dynamic support or resistance levels.

- Volume: Not an indicator per se, but an essential tool. Analyzing volume can give insights into the strength or weakness of a price move. For instance, a breakout on high volume is generally seen as more robust than one on low volume.

- Pivot Points: Used to determine potential support and resistance levels based on the high, low, and close prices of the previous period.

- Fibonacci Retracement Levels: Based on the Fibonacci sequence, these levels can indicate potential support or resistance areas after a significant price movement.

- Trendlines: While they’re drawn manually by the trader and not a traditional “indicator,” trendlines connect lows or highs to highlight a trend or potential areas of support and resistance.

- Candlestick Patterns Recognition Tools: Some software offers tools that automatically highlight common candlestick patterns on charts, assisting traders in identifying them.

For someone practicing price action trading, the “best” indicator is often the one that:

- Complements their trading style without adding confusion or noise.

- Enhances their ability to make informed decisions based on the raw price data.

- It has been tested and proven effective in their hands through backtesting and live trading.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025