The world of trading is riddled with various chart patterns that traders can utilize to predict future price movements. One such pattern is the Piercing Line Candlestick Pattern. This guide aims to provide an in-depth understanding of this pattern, detailing its creation, identification, interpretation, and effective utilization in trading strategies.

What is the Piercing Line Candlestick Pattern?

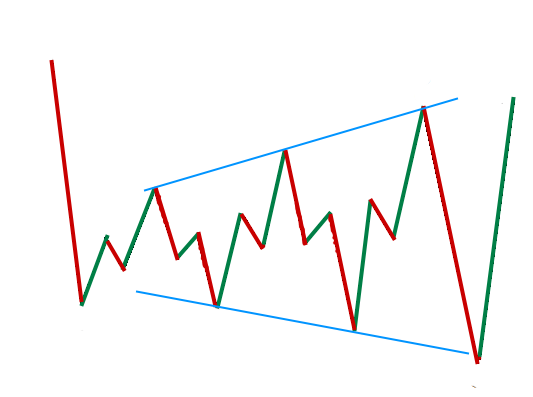

The Piercing Line Pattern is a two-candlestick formation that typically signals a potential bullish reversal in a prevailing downtrend. This pattern is seen as a bullish reversal candlestick pattern located at the bottom of a downtrend. It frequently prompts a reversal in trend as bulls enter the market and push prices higher.

This pattern involves two candlesticks, with the second bullish candlestick opening lower than the preceding bearish candle. This is followed by buyers driving prices up to close above 50% of the body of the bearish candle.

The Piercing Line is a pattern that suggests a potential bullish reversal within the forex market. This piercing pattern should not be used in isolation but rather in conjunction with other supporting technical tools to confirm the piercing pattern.

Identifying the Piercing Line Pattern

Recognizing a Piercing Line Pattern requires specific criteria:

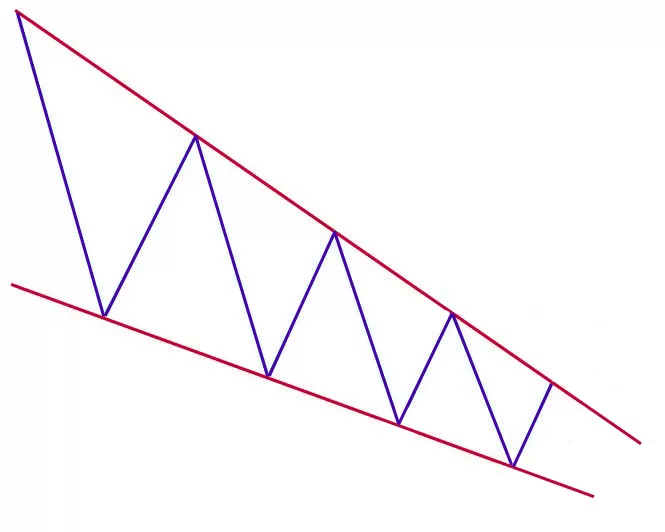

- There must be a clear and definable downtrend in progress.

- The first candlestick (which appears at the end of the downtrend) must be bearish.

- The second candlestick must be a bullish candle.

- The second candlestick must open below (gap down) the black candlestick and close above the black candlestick’s midpoint.

- If you mark a line through the vertical center of the black candlestick, the white candle must close above it.

Understanding the Piercing Line Pattern

The Piercing Line pattern emerges during a clear downtrend. The first candle is a bearish one, and the second is bullish, opening lower than the previous day’s close, but closing more than halfway into the body of the previous day’s candle.

The pattern signifies a potential shift in market sentiment, marking the beginning of a bullish trend from a bearish one. This pattern is a warning sign for sellers since a reversal to the upside might be imminent.

Trading with the Piercing Line Pattern

Here are some key points to remember when trading the Piercing Line Pattern:

- Context Matters: Always consider the broader market context. Make sure other technical indicators, like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), support your decision.

- Patience is Key: Don’t rush to trade as soon as you spot the pattern. Waiting for the next period for confirmation can help avoid false signals.

- Use Stop-Loss Orders: To manage potential risks, consider using stop-loss orders just below the pattern or the recent low.

How Reliable is the Piercing Line?

Piercing line patterns signal bullish reversals however, the reliance of this pattern alone is not recommended. Further support signals should be used in concurrence with the piercing pattern. Trading against a dominant trend can be risky so finding multiple confirmation signals is encouraged to verify the pattern.

Advantages and Limitations

Advantages

- Occurs frequently within financial markets

- Signifies bullish reversal patterns only

- Opportunity for favorable risk-reward ratios

- Piercing patterns are easy to identify for novice traders

Limitations

- Trading the piercing pattern requires the use of other technical indicators and oscillators

- Entails looking at the overall market trend and not just the candlestick pattern in isolation

Piercing Line vs Dark Cloud Cover

The Piercing Line and Dark Cloud Cover are similar patterns. The only difference is that the Dark Cloud Cover happens during a bullish trend. It happens when an asset forms a long bullish candle that is followed by a bearish candle that closes about 50% below its close.

Developing a Piercing Line Trading Strategy

When developing a trading strategy based on the Piercing Line pattern, traders first search the market for a downward trend. They watch for a small bearish candlestick to appear once a downturn has been established. Then they search for a bullish candlestick that opens below the previous bearish candlestick’s low but closes above its midpoint.

Traders that recognize this pattern open a long position at the bullish candlestick’s close and place a stop loss below the low of the preceding bearish candlestick. Traders finally take profits at a predetermined level, such as a resistance level or a Fibonacci retracement level.

Conclusion

The Piercing Line Candlestick Pattern is a powerful tool in a trader’s arsenal, providing valuable insights into potential market reversals. However, it’s essential to remember that no single pattern can guarantee success, and it’s crucial to use the Piercing Line in conjunction with other technical indicators and fundamental analysis. By understanding and effectively applying this pattern, traders can potentially enhance their trading performance and make more informed trading decisions.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025