The Downside Gap Three Methods is a candlestick pattern that is known for its potential to signal a bearish continuation in the market. This pattern consists of three candles and typically occurs during a downtrend. It is characterized by a gap between the first two candles, with the third candle closing within the range of the first candle.

What is the Downside Gap Three Methods Pattern?

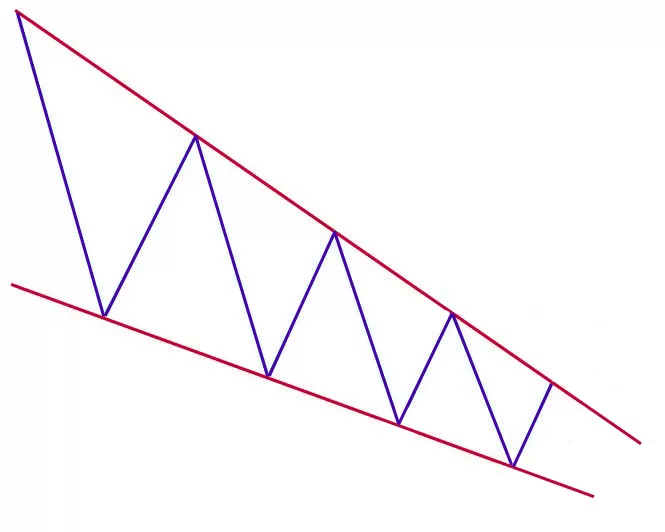

The Downside Gap Three Methods pattern starts with a long black candle, representing a decrease in price during a downtrend. The second candle also decreases in price and opens below the low of the previous candle, creating a noticeable gap between the two. This gap is an important characteristic of the pattern.

The third candle in the pattern is where the reversal potential comes into play. This candle starts increasing in price and closes within the body of the first candle, effectively closing the gap. The bullish momentum demonstrated by the third candle suggests that the bulls are taking control and could potentially initiate a new uptrend.

Identifying the Downside Gap Three Methods Pattern

To identify the Downside Gap Three Methods pattern, traders should look for the following characteristics:

- Number of Candle Lines: The pattern consists of three candle lines.

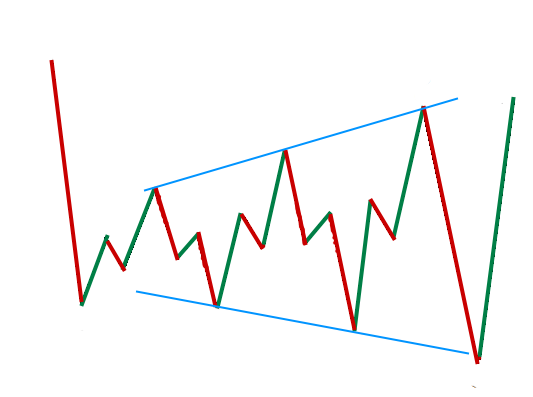

- Price Trend Leading to the Pattern: The pattern typically occurs during a downtrend.

- Configuration: The first two candles should be long red candles, with the second candle opening below the low of the first candle, creating a gap. The third candle should be a long green candle that opens within the body of the second candle and closes within the body of the first candle, closing the gap.

The Performance of the Downside Gap Three Methods Pattern

The Downside Gap Three Methods pattern demonstrates interesting performance statistics. While it is theoretically considered a bearish continuation pattern, testing shows that it acts as a bullish reversal pattern 62% of the time. This discrepancy between theory and reality highlights the importance of backtesting and analyzing patterns in real market conditions.

The overall performance rank of the Downside Gap Three Methods pattern is 26, which is quite respectable. However, it is important to note that this pattern is relatively rare, with a frequency rank of 84 out of 103 candlestick patterns. Traders should be cautious and not solely rely on this pattern for trading decisions.

Trading Strategies and Tips for the Downside Gap Three Methods Pattern

Here are some trading strategies and tips to consider when using the Downside Gap Three Methods pattern:

- Reversal Signal: The Downside Gap Three Methods pattern is primarily seen as a bearish continuation signal during a downtrend. Traders should look for confirmation of the reversal by observing subsequent price action.

- Breakout Direction: The pattern often tends to break out upward, especially in a bull market. Traders should be cautious when the pattern appears after an upward breakout, particularly in a bear market.

- Timing: The pattern is more likely to be a reversal signal when it appears near the end of an inverted and ascending scallop pattern. Timing can play a crucial role in identifying the pattern’s potential effectiveness.

Conclusion

The Downside Gap Three Methods pattern is a fascinating candlestick pattern that has the potential to signal a bullish reversal in the market. Although it is theoretically considered a bearish continuation pattern, testing shows that it often behaves as a bullish reversal pattern. Traders should, however, be cautious due to the pattern’s rarity and the need for confirmation through subsequent price action.

As with any trading strategy, it is crucial to conduct thorough research, backtesting, and analysis before making any trading decisions. The Downside Gap Three Methods pattern can be a valuable tool in a trader’s arsenal, but it should be used in conjunction with other indicators and techniques to increase the probability of successful trades.

Remember, the financial markets are inherently unpredictable, and no trading strategy guarantees profits. Always exercise caution, manage risk effectively, and stay informed about market conditions to make informed trading decisions.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025