The “Three Inside Up” is a powerful candlestick reversal pattern frequently observed in financial markets. This comprehensive guide aims to equip you with a thorough understanding of the pattern, its identification, and how to utilize it in trading effectively.

What is the Three Inside Up Pattern?

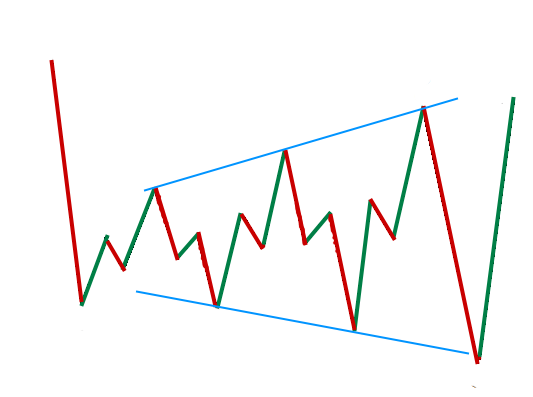

The Three Inside Up Pattern is a bullish reversal pattern found in candlestick charting. It comprises three individual candles and typically signals the end of a downtrend and the onset of an uptrend. The pattern’s appearance indicates that the market’s momentum is possibly shifting, hinting at a price increase.

Formation of the Three Inside Up Pattern

The formation of the Three Inside Up Pattern requires three specific candles to appear in a particular sequence:

- A large bearish (down) candle indicates the continuation of the current downtrend.

- A smaller bullish (up) candle that opens and closes within the body of the first candle.

- Another bullish (up) candle that closes above the second candle’s close confirms the bullish reversal.

These three candles collectively form the Three Inside Up Pattern, symbolizing a potential change in market direction.

The Three Inside Up Pattern and Trader Psychology

Understanding trader psychology is crucial when interpreting the Three Inside Up Pattern. The first candle, a significant sell-off, discourages buyers and emboldens sellers. However, the second candle’s price action, opening within the previous trading range and closing higher, raises a red flag.

Some short-term sellers might view this as an opportunity to exit. The third candle completes the bullish reversal, trapping remaining short-sellers and attracting new buyers, signaling a potential uptrend.

Trading the Three Inside Up Pattern

Trading the Three Inside Up Pattern involves strategic timing. Traders can enter a long position near the end of the day on the third candle or at the opening the following day. A stop loss can be set below the low of the first, second, or third candle, depending on the trader’s risk tolerance.

Limitations of the Three Inside Up Pattern

Despite its utility, the Three Inside Up Pattern does have limitations. It’s a short-term pattern and may not always result in significant trend changes. Furthermore, the pattern is common, making it less reliable as it can frequently result in false positives.

Enhancing the Effectiveness of the Three Inside Up Pattern

To enhance the pattern’s effectiveness, traders can use it in conjunction with the broader trend context. For instance, during an overall uptrend, traders can look for the Three Inside Up Pattern during a pullback. This could indicate that the pullback is over and the uptrend is resuming.

How to Use the Three Inside Up Pattern in Forex Trading?

The Three Inside Up Pattern can be used to signal a potential currency pair’s bullish trend reversal. Traders can enter a long position once the pattern is confirmed, set their stop loss, and take profit levels based on their risk tolerance and market analysis.

Pros and Cons of the Three Inside Up Pattern

Finally, like any other trading tool, the Three Inside Up Pattern also has its pros and cons. On the positive side, it’s easy to identify, works well with Fibonacci retracement levels, and can be used by both short and long-term traders. However, on the downside, it’s not entirely accurate on its own and may generate false signals.

Conclusion

The Three Inside Up Pattern can be a valuable tool for traders, offering insights into potential market reversals. However, it’s essential to use this pattern in conjunction with other technical analysis tools for the most effective results. Always remember that successful trading involves careful analysis, risk management, and patience.

Looking for Trading Capital? Trade up to $300,000 on a FundedNext Account and earn up to 95% of the profits.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025