Candlestick patterns are essential tools in the trader’s toolbox, offering valuable insights into market trends and potential reversals. One such pattern is the Three Outside Down pattern. This article will delve into the intricacies of this bearish reversal pattern, helping traders understand its formation, interpretation, and strategic utilization.

Understanding the Basics of the Three Outside Down Pattern

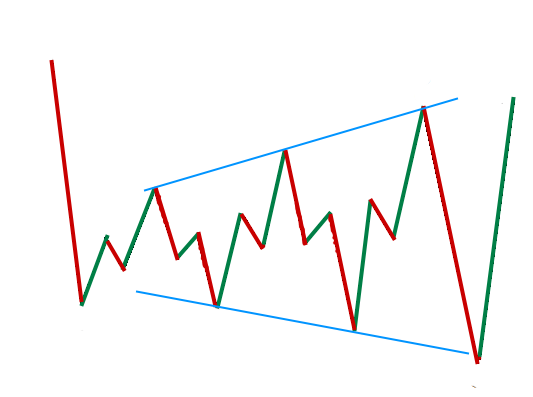

The Three Outside Down is a bearish reversal pattern that emerges on candlestick charts. This pattern, characterized by three specific candles, is indicative of a weakening existing trend and potentially a trend reversal.

Anatomy of the Three Outside Down Pattern

The formation of the Three Outside Down pattern requires the following sequence:

- First Candle: The pattern begins with a bullish candle, typical of an upward market trend.

- Second Candle: The following candle is bearish, opening higher but closing lower than the first candle, completely engulfing it.

- Third Candle: The final candle is also bearish, closing lower than the second candle, signaling an acceleration of the reversal.

Essentially, the Three Outside Down pattern is a more emphatic version of the bearish engulfing pattern, with an additional bearish candle to confirm the reversal.

Market Psychology Behind the Three Outside Down Pattern

The Three Outside Down pattern encapsulates changing market sentiment, as seen in the following stages:

First Candle

The bullish candle that marks the start of the pattern reflects continued buying interest and increased bullish confidence.

Second Candle

The second bearish candle starts higher but reverses, indicating a shift in power from bulls to bears. This shift raises a red flag for bulls, prompting them to either take profits or tighten stops in anticipation of a possible reversal.

Third Candle

The third bearish candle confirms the reversal. The security continues to register losses, dropping below the range of the first candle. This further increases bear confidence and triggers selling signals.

Importance of the Three Outside Down Pattern in Trading

The Three Outside Down pattern is a reliable indicator of a potential reversal, making it a vital tool for traders. However, it’s crucial to seek confirmation from other chart patterns or technical indicators before making any trading decisions.

When to Sell

The best time to sell is after the appearance of the third candle and once the price drops below the low of the first candle. However, traders must be cautious of false signals and should ideally wait for confirmation from other technical indicators.

Identifying the Three Outside Down Pattern

Identifying the Three Outside Down pattern involves looking for a white or bullish candle within an upward price trend, followed by a black or bearish candle that engulfs the body of the previous candle. The pattern is completed with another bearish candle with a lower close.

Strategic Tips for Trading the Three Outside Down Pattern

For successful trading with the Three Outside Down pattern, consider the following tips:

- Three Outside Down patterns that appear within a third of the yearly low tend to perform best.

- The pattern performs best when it appears as an upward retracement of the primary downtrend.

Conclusion

The Three Outside Down pattern is a powerful tool for predicting potential bearish reversals. Understanding its formation, interpretation, and strategic application can greatly enhance a trader’s ability to navigate the market.

However, it’s crucial to remember that while this pattern can provide significant insights, it should always be used in conjunction with other technical tools and indicators for the most accurate predictions and profitable trading decisions.

Have good trading Skills? Trade up to $300,000 on a FundedNext Account and earn up to 95% of the profits.

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025