The financial market is a playground for numerous trading patterns and indicators. Among these, the Three White Soldiers Pattern stands out as a powerful bullish reversal signal. It is an indicator that suggests a strong shift from a bearish to a bullish market. This article dives deep into understanding this pattern, its significance, and how to effectively trade using it.

What is the Three White Soldiers Pattern?

The Three White Soldiers Pattern, also known as ‘Three Advancing White Soldiers,’ is a candlestick pattern used in the technical analysis of stocks, forex, commodities, and other assets. It’s a bullish pattern that consists of three consecutive long-bodied candlesticks, each closing at a price higher than the previous one.

These candlesticks ideally open within the real body of the preceding candle in the pattern and should not have very long shadows. This pattern is typically seen after a prolonged downtrend, indicating a potential shift in the market sentiment from bearish to bullish.

Recognizing the Three White Soldiers Pattern

Recognizing the Three White Soldiers Pattern involves looking for specific criteria:

- Three Consecutive Bullish Candlesticks: The pattern comprises three consecutive long-bodied candlesticks, each closing at a higher price than the previous one. These candlesticks are typically green or white, symbolizing an upward price movement.

- Opening Within the Previous Candle’s Body: Each of these candlesticks should ideally open within the real body of the preceding one. This suggests the continuation of the bullish sentiment in the market.

- Small or No Shadows: The candlesticks should not have very long shadows or wicks. This indicates that the bulls have managed to keep the price at the top of the range for the session.

The Significance of the Three White Soldiers Pattern

The Three White Soldiers Pattern is considered a reliable reversal pattern as it signals a strong change in market sentiment. It typically appears after a period of price decline, suggesting a possible reversal of the downtrend.

When the bullish candles close with small or no shadows, it indicates that the bulls have managed to maintain control over the price movement throughout the trading session. Essentially, for three consecutive sessions, the bulls take over the rally and close near the high of the day. This shift in momentum can be a strong indication of an upcoming bullish trend.

Trading with the Three White Soldiers Pattern

The Three White Soldiers Pattern, being a bullish indicator, can serve as an entry or exit point for trades. Traders who have a short position on the security may look to exit, while those waiting to take a bullish position may see the pattern as an entry opportunity.

However, it’s crucial to note that the strong upward moves indicated by this pattern could create temporary overbought conditions. Therefore, it’s recommended to confirm the signal using appropriate technical indicators such as the Relative Strength Index (RSI) or the Stochastic Oscillator. These indicators can provide additional insight into price trends and validate the bullish signals suggested by the pattern.

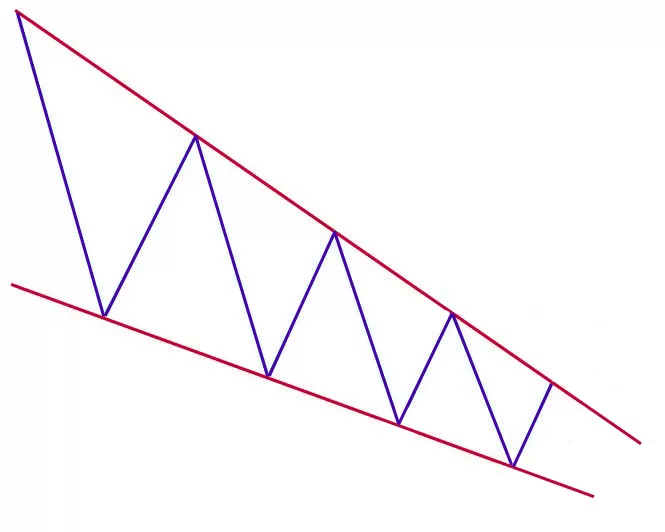

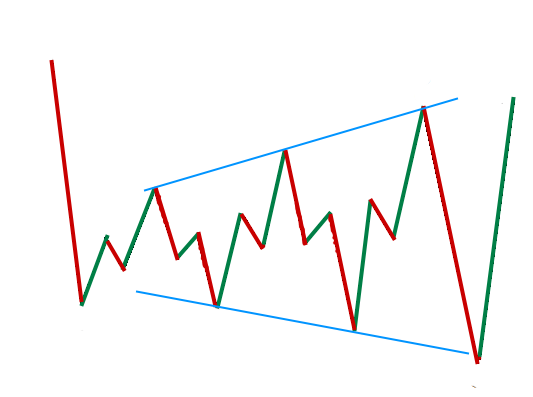

The Contrast: Three White Soldiers vs. Three Black Crows

The Three White Soldiers Pattern has an opposite counterpart known as the ‘Three Black Crows’ pattern. The Three Black Crows pattern consists of three consecutive long-bodied bearish candlesticks, each opening within the real body of the previous candle and closing lower.

While the Three White Soldiers Pattern signifies a momentum shift from bears to bulls, the Three Black Crows pattern indicates the bears taking control of the bulls. In both cases, the volume of trades and additional confirmation from other technical indicators are important considerations.

Limitations and Further Considerations

While the Three White Soldiers Pattern provides valuable insights, it’s crucial to consider its limitations. It may appear during periods of consolidation, which could lead to a continuation of the existing trend rather than a reversal. Therefore, it’s essential to look at the volume supporting the formation of the pattern and use it in conjunction with other technical indicators like trendlines, moving averages, and Bollinger bands.

Furthermore, keep in mind that the reliability of the Three White Soldiers Pattern can vary depending on the asset’s liquidity, volatility, and market conditions, as well as the timeframe used for analysis.

Conclusion

The Three White Soldiers Pattern is a valuable tool in a trader’s arsenal, serving as a strong bullish indicator that often signals a reversal in a downtrend. However, like all trading patterns, it should be used with caution and in conjunction with other technical indicators and volume data to avoid false signals. It’s not a standalone tool but can be highly effective when used as part of a comprehensive trading strategy.

Get funded with Funding Pips and receive up to 90% of the profit. Sign up and go through the different trading plans today!

- 8 Best Prop Firms USA: Real trader Reviews and Payouts - March 10, 2025

- Forex Trading in Uganda: Start With $10—An Incredible Opportunity on a Tight Budget! - February 24, 2025

- Master Forex Trading Algorithms: Your Path to Success in 2025 - February 17, 2025