The world of trading is filled with intricate and fascinating patterns that can provide critical insights into the market’s future movements. One such intriguing model is the Abandoned Baby. This rare but potent pattern, derived from Japanese candlestick trading techniques, can signal a potential reversal in trading trends.

In this comprehensive guide, we’ll delve into the specifics of the Abandoned Baby Pattern, its types, how to identify it, and how traders can leverage this pattern for successful trading outcomes.

What is the Abandoned Baby Pattern?

The Abandoned Baby is a distinctive three-candle reversal pattern that appears in candlestick charts. The formation of this pattern requires a specific set of price movements, making it relatively rare yet exceptionally reliable when it does occur.

The pattern is named so due to the presence of a single ‘doji’ candlestick, which appears isolated from the rest of the trend, akin to an ‘abandoned baby’. This doji is flanked by two candles with bodies on either side, each separated by a gap.

Types of Abandoned Baby Patterns

The Abandoned Baby pattern is primarily classified into two types:

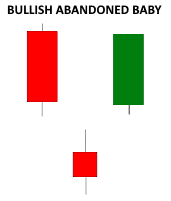

- Bullish Abandoned Baby: This pattern signals a possible upward reversal following a downtrend. It consists of a large, red candlestick (representing a fall in prices), followed by a doji that gaps below the first candle’s closing price. The third candle, green or white, opens above the doji, signaling a bullish reversal.

- Bearish Abandoned Baby: This pattern indicates a potential downward reversal after an uptrend. It is characterized by a large, green or white candlestick (indicating a rise in prices), followed by a doji that gaps above the first candle’s closing price. The final candle, red or black, opens below the doji, signaling a bearish reversal.

Identifying the Abandoned Baby Pattern

Identifying the Abandoned Baby Pattern requires a keen eye and an understanding of specific criteria. Let’s break down the identification process for both types of Abandoned Baby Patterns:

Bullish Abandoned Baby

- Look for a large red or black candlestick in a downtrend.

- The first candle should be followed by a doji that gaps below its close.

- The last candle in this three-candlestick pattern should be green or white and open above the doji.

Bearish Abandoned Baby

- Identify a large green or white candlestick in an uptrend.

- The first candle should be followed by a doji that gaps above its close.

- The final candle in the pattern should be red or black and open below the doji.

It’s crucial to note that in both types, there should be clear gaps between the first and second candles and between the second and third candles. If the neighboring candles overlap, the pattern is not an Abandoned Baby but likely a Morning Star or Evening Star pattern.

The Implications of the Abandoned Baby Pattern

The Abandoned Baby pattern is essentially a reversal pattern. After a significant uptrend or downtrend, the appearance of a doji depicts a moment of uncertainty in the market. This pause is followed by a sudden shift in momentum, signaling a strong reversal.

If the market was in an uptrend, the bears take control post the doji, pushing the price downward. Conversely, following a downtrend, the bulls seize the reins and drive the price upwards.

The larger the gaps before and after the doji, the more significant the reversal tends to be. Therefore, the appearance of this pattern often alerts traders to potential opportunities for profit or the need to brace for potential losses.

Trading the Abandoned Baby Pattern

The rarity and reliability of the Abandoned Baby pattern make it a valuable tool for traders. Its appearance on the chart can be a signal to enter a trade quickly, as the pattern itself often confirms the signal. However, like any trading pattern, it’s not foolproof and doesn’t guarantee a win every time.

Stop-Loss Orders

Always protect your trade with a stop-loss order when trading with the Abandoned Baby pattern. Your stop should be placed at or below the middle candle of the formation, depending on the direction of your trade. You can also adjust the stop as tight as possible to reduce potential losses.

Profit Targets

You can use a moving average or an oscillator to exit a trade. Alternatively, rely on basic price action rules to close your profitable position. As with any trading strategy, you must practice sound money management when trading the Abandoned Baby pattern.

Wrapping Up

With its unique formation and reliable reversal signal, the Abandoned Baby pattern is a valuable tool in a trader’s arsenal. Despite its rarity, its appearance can provide crucial insights into potential market reversals, helping traders make informed decisions and capitalize on market opportunities.

While this pattern offers a relatively high success rate, it’s essential to remember that no trading pattern is infallible. Always use stop-loss orders when trading with the Abandoned Baby pattern to protect your investments.

Finally, practice makes perfect. As you gain confidence and experience, you’ll be better equipped to leverage this intriguing pattern for successful trades.

Happy trading!

Looking for trading capital? Join Funding Pips and trade up to $100k while receiving 90% of the profit.